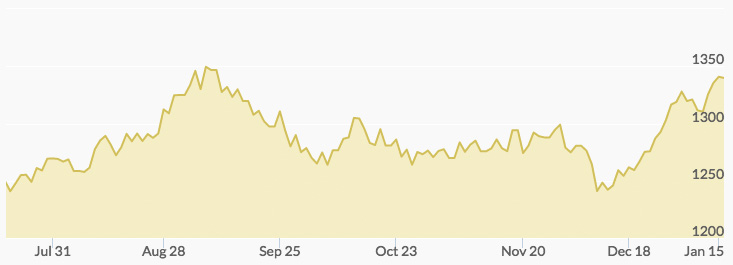

Gold continued its strong bull run this week, indicated the gold spot price history chart. Monday opened off slightly at $1,318.84 but then rallied to close the day at $1,320.04. Tuesday’s open saw the price of gold slip to $1,314.57 and continued to pullback to close the day at $1,313.80. The yellow metal then rallied in afterhours trading to open Wednesday at $1,322.65, after which the rally cooled to close at a more modest $1,317.98. Thursday’s opening surged again to $1,319.78 and then the market pushed higher to close at $1,321.82. In what seems to be a pattern for the past five weeks, Friday opened with gold prices way up at $1,332.33 and then surged further to close out at $1,337.64 for a gain of 1.37 percent on the week.

Monday’s news was dominated by U.S. payroll numbers, which were weaker than expected. 1 The market noted the dollar weakening on the news, causing gold and the precious complex to rally. The afterhours rally on Tuesday was led by news that U.S. oil inventories had been drawn down to levels not seen at this time of year since 1999. 2

On Wednesday, a report by Bloomberg Intelligence showed that gold is beating all other investment assets since the Fed rate hike in December, including Bitcoin and other cryptocurrencies. 3 The report helped to put to rest the myth that gold always falls on rate hikes, which has not held whatsoever since the 2008 global financial crisis.

The end of the week was dominated by more bad news for Bitcoin. On Thursday, the South Korean justice minister renewed his proposal to ban cryptocurrency exchanges in the country, which happens to be one of the world’s most active cryptocurrency markets. 4 On Friday, concerns of a more hands-on approach from the Chinese government led Chinese public companies to distance themselves from links to cryptocurrencies, which previously they had been highlighting. The news from Asia was compounded by word from Russia that the country’s central bank was digging in its heels to prevent cryptocurrency trading on official exchanges. 5 6 Bitcoin was down nearly 20 percent on the week as a result. 7 For all intents and purposes, the Bitcoin crash is lasting longer than some predicted and the idea that the cryptocurrency could replace gold as the new investment safe haven now appears to be over.