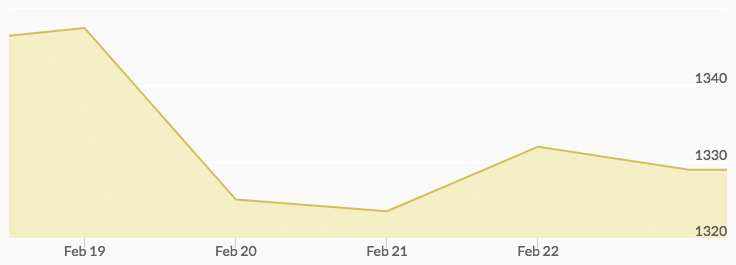

Markets were closed Monday for the President’s Day holiday. The price of gold opened on Tuesday amid a pullback at $1,339.39 but rallied in the first couple of hours of trading, then pulled back to close at $1,330.62. Wednesday’s open saw gold prices slip slightly to $1,328.00 and to $1,324.29 by the close. Thursday opened with the price of gold just slightly down at $1,323.69 before a major rally throughout the trading day brought the close to $1,331.40. Friday’s open slipped to $1,330.49, and then the market traded in a tight range during the day before closing the week at $1,328.66.

The week started with some dour warnings out of Goldman Sachs on the future of the economy. In the report, Goldman economist Alec Philips openly worried about U.S. government net interest costs rising to levels seen in the 1980s and early 1990s and debt-to-GDP ratios moving over 100 percent, ‘putting the US in a worse fiscal position than the experience of the 1940s or 1990s.’ 1 Crucially, Goldman’s market strategist team also recently raised the year-end 2018 estimate for the 10-year Treasury to 3.25 percent, above the 3 percent widely viewed as the level at which interest rates will become a major source of risk for equities. 2

Oil pushed to a two-week high last week, sending Brent to $67.27 and WTI to $63.54 by the end of the week. 3 A lower-than-expected U.S. inventories report was held partly responsible, driven in large part by the backwardation in the current oil price curve, which makes it less economical to buy and hold oil for sale in the future. 4 As a sector leader in the commodities complex, high oil prices generally pull precious metals up with them eventually, even if the short-term trading results differ.

The week ended with markets eagerly anticipating the Saturday release of Warren Buffett’s annual letter to Berkshire Hathaway shareholders, widely considered to be one of the most common-sense analyses on Wall Street, investing, and the economy available. 5 This year’s version did not disappoint, with something for everyone, but one key point caught was especially interesting to investors. The “Oracle of Omaha” and his team have amassed a war chest of $116 billion, but are waiting for prices to fall to put it to work. Clearly, even one of the world’s leading investors is anticipating a major market correction.