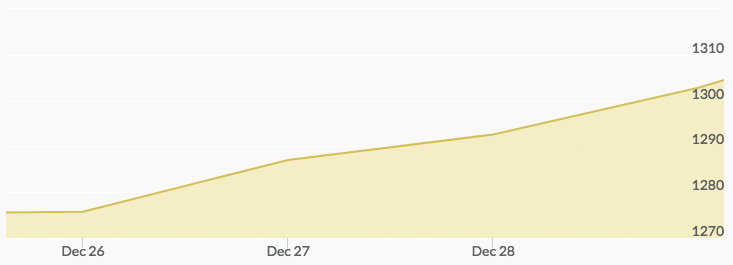

Gold had one of its best weeks of the year, indicated the gold spot price history chart. Markets were closed Monday for the Christmas holiday, but the yellow metal opened up nearly $4.00 on Tuesday at $1,278.80 then kept climbing to close the day at $1,283.07. Wednesday opened up slightly at $1,283.74, then the rally continued to close at $1,288.00. Afterhours trading stayed the course, and Thursday opened up above the $1,290 level for the first time in December, starting the day at $1,292.25 and closing at $1,294.62. For the third Friday in a row, however, the yellow metal took off in the last day of trading, opening at $1,296.74 and rocketing to close the week at $1,302.80. A banner week for gold, by any measure, here’s a summary of the milestones achieved by gold this week:

- Friday’s closing price marked a 2.18 percent gain over the previous Friday’s close.

- It was the first time since October 16 that gold broke the $1,300/ounce barrier.

- In the last trading week of 2017, gold also marked a gain of 11 percent for the full trading year.

Given that most market participants were on vacation for the holidays, it was a slow week news-wise. After last week’s addition of five prominent Russian oligarchs to the list of U.S.-sanctioned individuals targeted under the Magnitsky Act, on Monday Vladimir Putin announced plans to lure back approximately $1 trillion in overseas assets held by wealthy Russians outside their home country via tax incentives and legal amnesty. 1 The targeting of such a staggering amount of wealth is bullish for gold, as a significant portion of the newly sanctioned funds will likely be changed into gold for privacy reasons, even if it gets repatriated.

Later in the week, the news broke that the world’s richest people added $1 trillion in wealth in 2017, according to the Bloomberg Billionaires Index, a daily ranking of the world’s richest 500 people. Such a vast expansion of wealth at the top certainly means more demand for alternative investments and financial safe havens, of which gold is king. Additionally, the fact that Asia now has more billionaires for the first time than the U.S. should mean a big increase in demand for gold, as Asian investors are widely reputed to have a higher-than-average appetite for gold.