Are you thinking about buying gold? Before you invest, it might be smart to take a look at the correlation coefficients between gold and several other variables. A correlation coefficient is a mathematical formula that shows the positive or inverse relationship between two variables. A strong correlation coefficient would approach 1.0 (or 100 percent) while a weak correlation coefficient would approach -1.0 (completely opposite movement).

You instinctively know that you will become a better and more successful gold investor if you have more compelling information about the future price of gold. So how can studying gold’s correlation coefficients help you predict the future price of the precious metal? By watching the highly correlated variables closely, you can see when they start to move, often just before the price of gold will move. By looking at the change in variables that have an inverse relationship with gold, you can also get a signal about the direction that gold is likely to take.

Gold’s Positive Relationships

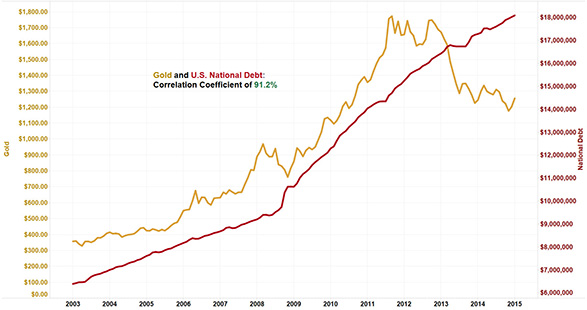

Gold has a strong correlation coefficient with U.S. national debt, silver, and the real U.S. money supply. Gold’s correlation coefficient with the national debt is 91.2 percent. A rising national debt may not be very good for the economy, but it is bullish for the price of gold.

Gold has a strong 89.2 correlation coefficient with silver. While there are times when the two precious metals will move in opposite directions, for the most part, they move in unison. At times when the ratio of gold to silver prices is historically low, it is an indication that gold may move up at a higher rate than silver to reestablish the historical norm.

The correlation coefficient between gold and the real U.S. money supply is 88.6 percent. After adding to the money supply with its quantitative easing programs over the last five years, the Federal Reserve is dropping hints that they will start to tighten supply (increase interest rates). When the money supply starts to go down, it is likely going to put downward pressure on gold prices.

At an almost perfect positive correlation coefficient of 94.7 percent, the ratio of gold to European Central Bank total assets is a key indicator for the price movement of the precious metal. The extremely strong relationship between gold and the ECB’s assets on its balance sheet could be indicative of signs of inflation, currency exchange rates, or even the accumulation of gold by the central bank.

Gold’s Inverse Relationships

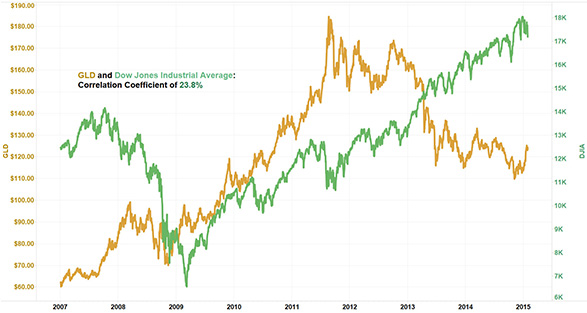

Ever notice that when the stock market goes up, the price of gold goes down? That is because gold has a very low 23.8 percent correlation coefficient with the Dow Jones Industrial Average. One of the most commonly cited inverse relationships with gold is the U.S. dollar. When the dollar is strong, it hurts the price of gold.

While none of these correlation coefficients can predict with certainty the future price of gold, they allow you to make a better educated guess on the precious metal’s future price movement. Check the regularly updated gold charts online to see if gold will likely go down, stay steady, or be positioned for an upswing.