“[De-dollarization] is happening, and it’s happening in real time, right in front of us.”– Eric Sepanek, Scottsdale Bullion & Coin Founder

The process of de-dollarization is no longer a looming threat. It’s a harsh reality that’s unraveling right before our eyes. To keep our clients as informed as possible, we’ve put together a Petrodollar Timeline Report covering the entire lead-up to the dollar’s demise.

Watch this week’s Gold Spot to hear Scottsdale Bullion & Coin Precious Metals Advisor John Karow & Founder Eric Sepanek explain the purpose behind this new timeline report, how it can inform your investment decisions, and why de-dollarization is accelerating.

The NEW Petrodollar Timeline

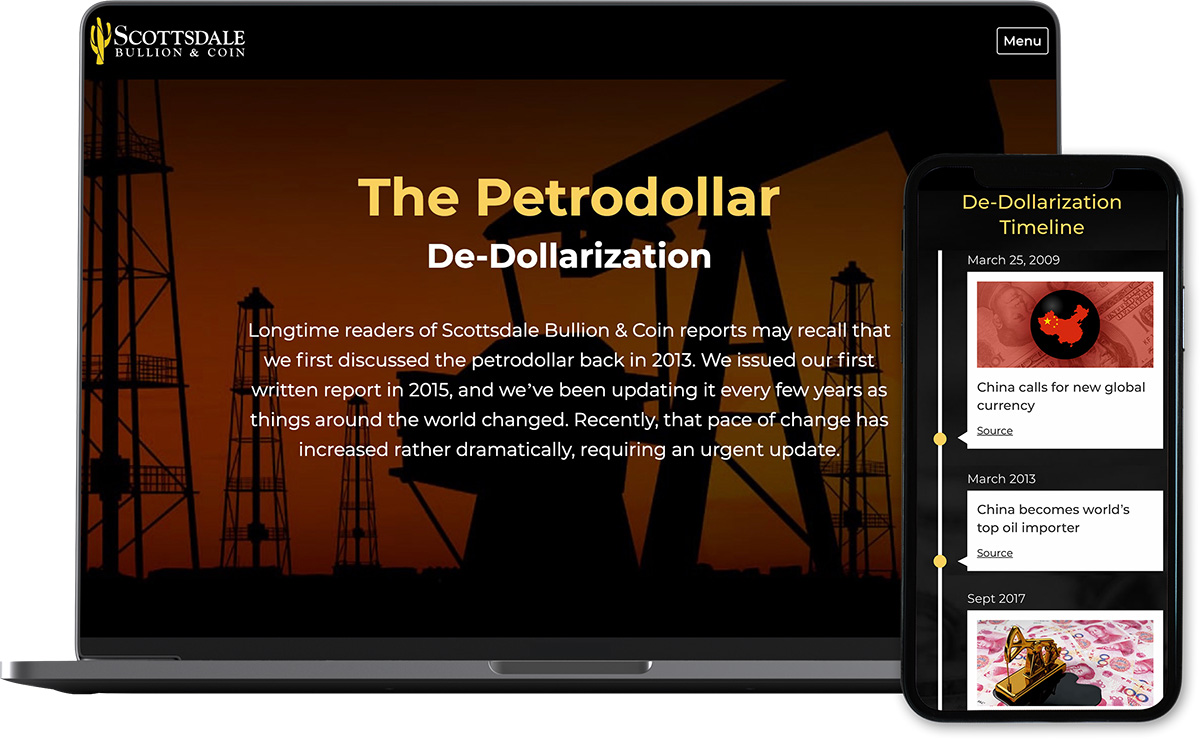

Scottsdale Bullion & Coin has been actively sounding the de-dollarization alarm bells for years. Since 2013, we’ve closely monitored the situation to keep investors engaged and updated. Recently, one of our clients requested an additional report reflecting the most recent changes in the downfall of the dollar. And, due to an acceleration in countries around the globe seeming to reduce their dependence on the dollar, that’s when we decided to put together a complete De-dollarization Timeline. A timeline that can be updated as news comes.

This comprehensive timeline charts key events in a clear and digestible format. It includes everything from the Gold Confiscation Act of 1933 and the Bretton Woods Agreement to the most recent developments with the Petroyuan and China’s presence in the Middle East, and around the world. Everything is clearly sourced so you can research beyond the wealth of info provided if you desire.

Evidence of De-Dollarization

It seems like every day the US dollar suffers another blow as foreign countries abandon the greenback in droves. Just this week, Elon Musk voiced concerns about the stability of the global economy on Tucker Carlson’s show. As the crash of 2008 painfully proved, an economic fallout in the United States isn’t confined to our borders.

“We’re not isolated anymore. We’re not a finite or discrete economy that can rely on itself and nobody else. Everybody’s interconnected.”– Precious Metals Advisor John Karow

Investors got a bitter taste of that reality in the wake of the Silicon Valley Bank collapse. The US isn’t an isolated economy separate from the rest of the world. The Fed’s mismanagement at home has ripple effects globally. Countries have evidently had enough of our government’s misguided policies as they seek independence from US influence by decoupling from the dollar.

Central Banks Choose Gold (Over the Dollar)

The global shift away from the dollar begs a crucial question: Where are countries investing? Well, central banks have answered that question loud and clear with record-setting purchases of gold. Unsurprisingly, China and Russia have been leading the charge into gold, but other countries aren’t far behind.

“The bigger central banks…and nations…are buying a ton of gold. Take a page out of their book.”– Eric Sepanek

One of the hallmarks of smart investing is to copy what those with more insight, resources, and money are doing. Smart money investors are taking a play out of the book of central banks by moving their wealth away from solely paper-backed assets and into a diversified precious metals portfolio.

Stay Informed to Safeguard Your Wealth

You don’t have to suffer the consequences of our government’s misguided policies. Staying up to date on crucial developments protects your wealth by informing your investment decisions. Our De-Dollarization Timeline Report makes it easy to understand the current process of de-dollarization from the earliest stages to the present day.

Check it out here for free and please contact us if you have any questions.