When gold mining activity increases and more gold is extracted from beneath the earth’s surface you might think that the added supply would drive down gold prices. Actually, it is more likely that prices will go up. As a gold investor, you need to pay attention to both the supply and demand for the precious metal.

When gold mining activity increases and more gold is extracted from beneath the earth’s surface you might think that the added supply would drive down gold prices. Actually, it is more likely that prices will go up. As a gold investor, you need to pay attention to both the supply and demand for the precious metal.

Gold known to exist above the ground

If you could gather up all of the gold known to exist above the ground on earth and mold it into one solid cube, it would measure 20 meters long, 20 meters wide, and 20 meters tall. According to the World Gold Council (WGC), at the end of 2012, the known supply of gold totaled 174,400 tons. That figure includes gold in all forms including gold bars, gold coins and gold jewelry. It includes gold held by the world’s central banks, by investors, collectors, speculators, and ordinary individuals.

Adding to the supply

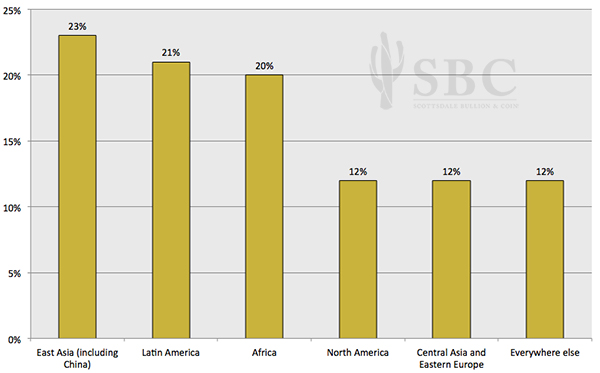

Gold is mined in most parts of the world. China is the leading producer of new gold, accounting for about 13 percent of all mined gold in the world. The WGC breaks down new production (added supply) by region.

In 2014, the US Geological Survey reported that the world’s newly mined gold in 2013 totaled 2,770 tons. China led the way with 420 tons of mined gold and the United States accounted for 227 tons of the new supply of gold.

Mining activity increases when the price of gold is high

While the cost to extract an ounce of gold from the earth can vary tremendously, there is general consensus that the industry average is $1,100-$1,200 per troy ounce. When gold was selling north of $1,700 a few years back, exploration and mining was going full-force. More recently, when spot gold dipped below $1,200, those same companies slowed their operations.

Gold mining companies make projections about future demand and use those projections to estimate the price of gold in the future. They also make cost-benefit decisions. Is it worth investing millions today if your return on investment is only two percent?

If you see a strong uptick in activity by all of the big mining companies, you can usually take it as a strong signal that the people who know gold the best believe the price of gold is going up. They are not going to mine gold, put it on the market, and accept lower prices. New supply of gold only happens when demand far exceeds current supply.

Creating demand is easier than adding supply

The reason that gold is considered a “store of wealth” or a “hedge against inflation” is that it is limited in supply. You can print all of the dollars you want, but you can’t mine all of the gold you want. Historically, people have tried to extract gold from seawater. Alchemists tried to turn lead or mercury into gold. There are companies today that want to harvest the gold in meteorites. Current technology makes all of those methods extremely expensive and, at least for now, those efforts have had no measurable effect on the supply of gold.

Investors can get an early clue on when gold prices are likely to move to higher sustained levels by keeping an eye on mining activity. If you notice a big percentage increase in world gold production, you may do well to stock-up on some gold bullion.