With the unprecedented election of Donald Trump to the presidency of the United States, many other potential realities previously thought to be outside the realm of possibility are being opened for consideration. While no one has it at the top of any immediate action, the idea of returning to the gold standard is again at least a subject of discussion.

Gold Standard History and U.S. Debt

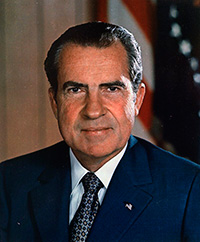

Then-President Richard Nixon took the U.S. off the gold standard in 1971. There are many controversies around the leadership of Nixon, but few are as contentious as this action. There are many contemporary academics and economists who praise that decision, and others who point to it as the root of many of today’s economic woes. 1

👉 Related reading: The Gold Standard: Everything You Need to Know

As the world entered the 1970s, the U.S., Britain and France had their central banks operating on what was called a 40 percent cover. 2 As explained by Jeffery Wilson, that meant that the countries could only have total money in circulation (including government debt) that was covered by at least 40 of that value in gold reserves.

If the gold standard were in effect today, the current national debt of almost $20 trillion dollars alone would be roughly 40 times the estimated gold reserves held by the United States. Of course, that doesn’t address the additional trillions in real and digital currency outstanding.

The Unsustainability of Fiat Currency

It provides a real contrast to compare that limitation with the concept of paper currency issued and backed only by the “full faith and credit” of the government. The reality is that there are no real controls on what governments can do with fiat currency, and the end result is the world is now awash with massive annual deficit spending by most governments.

That freedom to spend has the same consequences one would encounter by giving a teenager an unlimited spending allowance. If you told that teenager they would have to repay all the debt whenever they got a job, but “don’t worry about it now,” you would have the attitude of today’s politicians.

These elected officials can spend as they please to help their chances of reelection, and pretend the debt will be repaid sometime in the future. The result is unsustainable levels of debt worldwide, backed only by governmental “good intentions.”

How a Gold Standard Could Make Sense in Today’s Economy

Economists who support this ability to spend point to the expanding economies and jobs it creates, but they ignore the future consequences of servicing that debt. These same purveyors of the fiat experiment ignore past history, and they poo-pah the idea of returning to the gold standard. 3 They claim there is not enough gold in the world to support “modern economies,” and it is impossible to consider returning to such a basis for value.

However, markets historically laugh at experts who ignore them for too long, and many people who believe in the gold standard as a requirement for core fiscal responsibility point to one fallacy of the fiat crowd.

That reality is that if gold were allowed to again serve as the world’s economic balance point, there would be plenty available—if the gold price were high enough. In other words, gold at $40,000 an ounce, according to one analyst, would serve as an adequate reserve for any expanding economy. They argue further that price could go higher if needed—just let the market, not artificial fiat philosophies, determine the real value of money.

Additional Sources

2 – http://openmarkets.cmegroup.com/4510/what-would-a-return-to-the-gold-standard-mean

3 – http://www.cnbc.com/2015/10/29/is-it-really-time-for-a-return-of-the-gold-standard.html