The global economic environment is increasingly volatile as a reserve currency war heats up between major economic powers. The US dollar still reigns supreme as the linchpin of the world economy, but increasing economic challenges, US debt, and the rise of competitive currencies have rattled its hegemony. The resulting reserve currency war has a number of casualties, and some investors fear the US dollar will be among the losses.

The global economic environment is increasingly volatile as a reserve currency war heats up between major economic powers. The US dollar still reigns supreme as the linchpin of the world economy, but increasing economic challenges, US debt, and the rise of competitive currencies have rattled its hegemony. The resulting reserve currency war has a number of casualties, and some investors fear the US dollar will be among the losses.

What is a reserve currency war?

A reserve currency war is a competition between powerful economies to promote their currencies’ status, value, and usage. The turf is the global economic system, and the objective is to establish a position as the world reserve currency. Battling nations will use a number of policies to devalue a foreign currency while stimulating their domestic money. While it’s common for currency ratios to ebb and flow, a currency war exists when two or more nations engage in repeated and concerted efforts to harm another country’s monetary system or currency.

Reserve Currency War vs Currency War

Despite being nearly identical terms, there’s a crucial distinction between a reserve currency war and a currency war. As mentioned before, the former involves countries competing to have their currencies achieve reserve status. On the other hand, a currency war involves strategic devaluations where nations attempt to gain an economic edge by making their exports more affordable. Economic dominance is the end goal of both, but the strategies are disparate. While currency wars occur routinely between several countries, a reserve currency war is much more challenging to start given the dollar’s entrenched dominance.

Threats to the Dollar’s Reserve Status

The US dollar has enjoyed an unrivaled position as a reserve currency since America took a leading position on the world stage following WWII. In the past few years alone, that dominance has unraveled with increasing speed. There are a number of domestic and international battles driving the reserve currency war forward against the dollar.

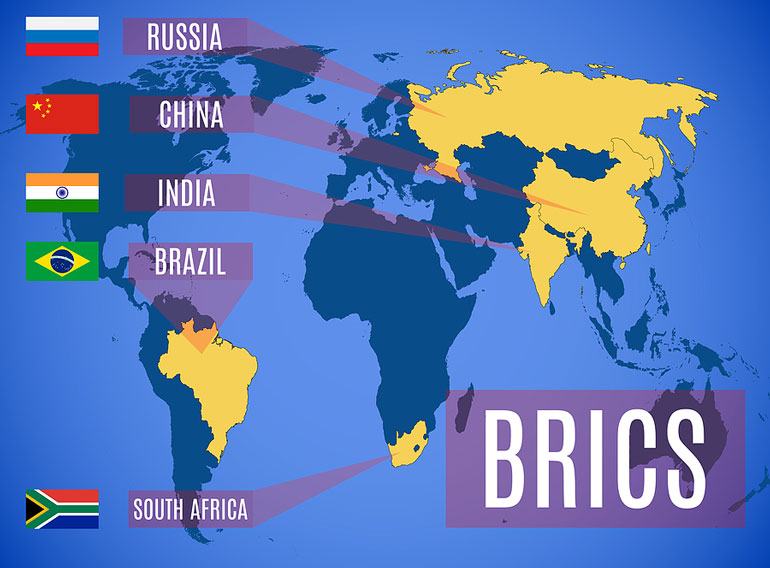

The rise of the BRICS currency

Brazil, Russia, India, China, and South Africa, collectively known as the BRICS nations, are openly considering the development of an inter-country currency to settle transactions and conduct trade. A BRICS currency alone wouldn’t be enough to threaten the dollar, but the economic block has voiced interest in backing the new currency with gold. Having a currency tied to physical gold reserves could offer more stability, security, and predictability than the US dollar. Over 40 countries have already voiced interest in taking part.

The Petrodollar: A Retrospective

How To Prepare For The Impending Dollar Failure

Get Report – It’s Free!China’s desire for global influence

China has always made its desire to supplant America’s hegemony unapologetically clear. That’s precisely what makes our government’s feckless foreign policy so frustrating. While the Biden administration takes a back seat on the world stage, Xi Ji Ping is out brokering historic peace deals in the Middle East, expanding the massive Belt and Road Initiative, and encouraging oil-producing nations to consider accepting Yuan for petro-trading. This rise in geopolitical prominence makes China a more desirable strategic partner to other countries.

The demise of the petrodollar system

OPEC warming up to the use of other currencies isn’t just a foreign policy threat to the US. It’s also an existential threat to the US dollar. Ever since the gold standard was abandoned in the 70s, the greenback has been propped by the petrodollar. Saudi Arabia, along with other oil giants, agreed to trade oil exclusively in USD which ensured international dependence on the dollar. With the rise of the petroyuan, there’s no telling how much longer the final pillar of dollar hegemony will last.

The weaponization of the dollar

The dollar’s supremacy has made economic sanctions a convenient and highly effective tool when pursuing US interests abroad. However, these stringent measures have driven countries to seek independence from the dollar. Russia and China, two of the most frequent recipients of these sanctions, have been stockpiling gold to bolster their economies while simultaneously working to build a BRICS currency. The weaponization of the dollar has backfired by encouraging countries to find workarounds to the greenback which harms its influence.

What happens if the US loses reserve currency status?

The dollar’s fall from grace as the world reserve currency would have numerous and severe knock-on effects. The currency would inevitably lose significant value as countries, institutions, and individuals around the world seek alternatives. Every day Americans would suffer a tremendous loss in spending power and an unbelievable dilution of their investment. On the geopolitical landscape, the US would be relegated to a junior position with little to no influence.

👉 Related read: How the Dollar Became the World Reserve Currency?

What will replace USD as the reserve currency?

There’s no way to predict which currency would replace the US dollar in the aftermath of a successful reserve currency war. There are a few possibilities, however. China has been artfully plotting to topple USD for decades to replace it with the yuan, and the CCP certainly has the patience and due diligence to pull it off. The BRICS alliance is also generating a lot of interest in international markets, and the creation of an inter-country currency would provide the economic powerhouse with a possible replacement for the dollar. In today’s globalized world, there’s no guarantee a country will win the reserve currency war. The International Monetary Fund has raised the potential of their Special Drawing Right, a self-proclaimed reserve asset, as a replacement for the dollar.

Gold Is The Only True Reserve Asset

It’s impossible to know the result of this reserve currency war from the outset. However, investors can learn something about the reliability and security of paper-backed money. Fiat currencies might dominate the current global economy, but they’ve proven to be poor stores of value with volatile price performance.

Throughout the centuries, gold has remained the only true reserve asset. Even in a world dominated by paper assets, central banks are binging on gold at record rates. You can escape the pitfalls of the paper money system by diversifying with physical precious metals. Grab a copy of our FREE gold and silver investing guide to learn more.