“…the collectables market in general is on fire…”— stated Rick Harrison, owner of the Gold & Silver Pawn Shop and personality on History Channel’s hit reality TV show “Pawn Stars”, during a recent Kitco interview.

A rusty, old Vespa sold for ~$15,282.38 on June 9th, setting a new world record.[1] One day prior, bidding on a 1933 Saint-Gaudens Double Eagle soared to $18,872,250 before the Sotheby’s auctioneer brought down the gavel.[2] Minutes later, two historic stamps fetched $8,307,000 and $4,860,000.[2][3] All the while, sports cards enthusiasts across the country are being priced out of their treasured hobby as the paper visages of everyone from LeBron James to the Pokémon Charizard trade for small fortunes.[4][5]

What is behind the surge in the collectibles market? The new trend of “collecting as investing”—of purchasing fine art and classic cars and rare coins not only for the pure enjoyment of owning such items but also the prospect of financial returns and portfolio diversification.[6]

Given today’s inflationary environment, investors are looking for new avenues for protecting their wealth, but is this approach right for you? Take a closer look at the dynamics of one of the largest collectible markets, rare coins, to help you decide.

Investor Secret? The Lucrative Rare Coin Market

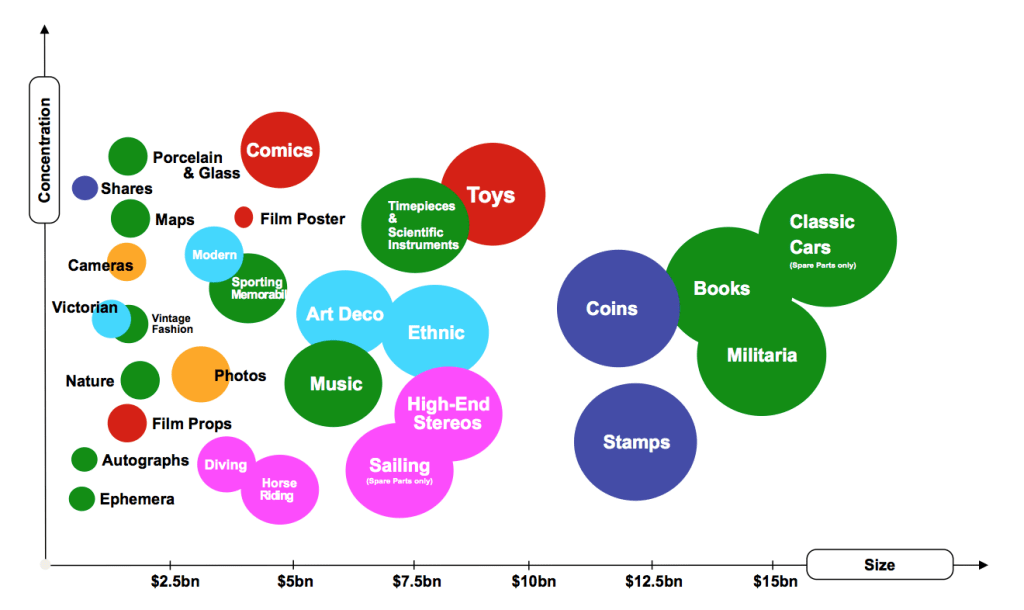

Rare coins, also called “numismatic” or “investment grade coins,” boast the most impressive returns of any precious metals investment. However, you wouldn’t know it because novice investors often rush to gold and silver bullion whenever the metals rally. It’s a phenomenon that might have you think numismatic coins are the experienced investor’s best kept secret—if they didn’t account for such a significant portion of the collectibles market.

Rare Coins’ Share of Global Collectibles Market

Source: https://askwonder.com/research/global-collectibles-industry-h8v6hbunq

To what can we attribute the popularity of rare coins among the world’s collectors? Their unparalleled beauty? Their remarkable history? Their rarity? All of these contribute to the allure of numismatic coins, but as more individuals straddle the line between collector and investor, one factor is especially salient: performance.

Take the 1933 Saint-Gaudens Double Eagle gold coin for example. Often considered the “most famous coin on the planet,” the eponymous, numismatic masterpiece “has been hunted by the United States Secret Service… [and] the subject of innumerable ‘tribute copies,’ thrillers, history books, documentaries, and primetime tv crime shows.”2 If this all sounds like the profile for the most expensive coin in the world, that’s because it is: renowned shoe designer Stuart Weitzman purchased the coin at auction in 2002 for $7,590,020. He sold it for $18,872,250 in 2021.2

High-Performing Rare Coins within Reach

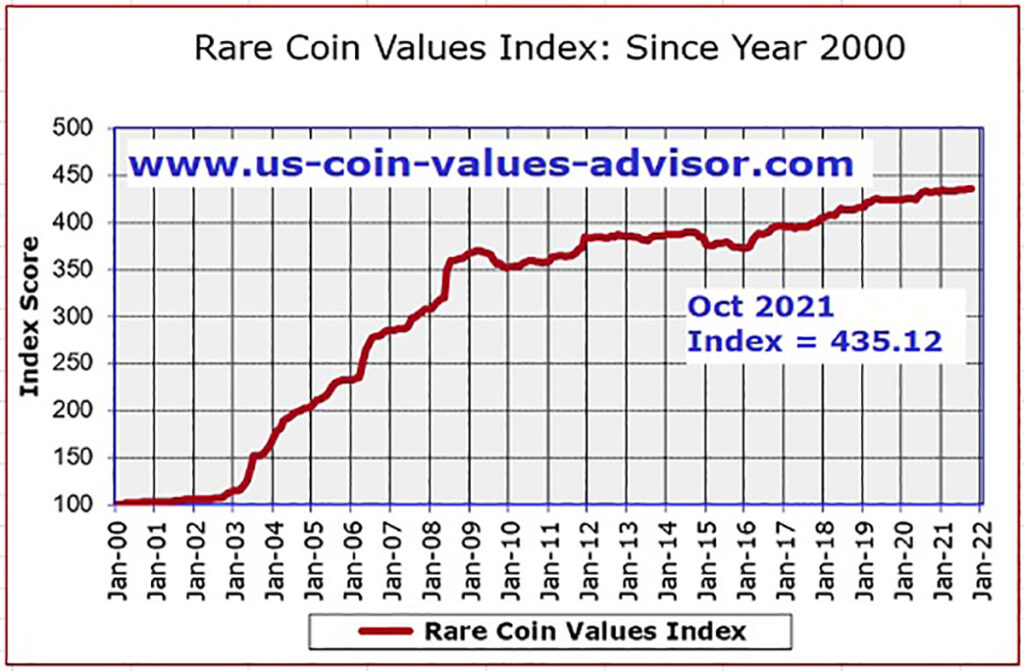

The 149% return on investment Weitzman saw on the 1933 Saint-Gaudens Double Eagle is not uncommon in the rare coin marketplace. Investors who bought the MS-63 1799 Draped Bust Dollar for approximately $20,000 in the early 2000s, for instance, could likely sell the coin today for about $65,000 for a 225% return on investment. This timeframe marks a general uptrend in prices across the investment grade coin market.

Rare Coin Price Uptrend

The Dual Role of Inflation in the Collectibles Market Rally

Inflation is driving both demand and prices for collectibles. On the one hand, investors are diversifying their portfolios with rare coins, art, and antiques because such items have historically exhibited a ‘low correlation with traditional asset classes,’ making them a choice hedge against market downturn and inflation.6 In fact, many financial advisors recommend allocating between 5% and 10% of your portfolio to collectibles for the purpose of diversification.

On the other hand, inflation is sending the price of these collectibles higher, along with gold, silver, housing, and an array of other assets—as the old axiom goes, “a rising tide lifts all boats.” Nowhere is this more apparent than in the realm of digital art, where a non-fungible token (NFT) of obscure artist Beeple’s collage Everydays: The First 5000 Days recently sold for $69 million at Christie’s.[7]

Finally, the spike in demand for collectibles is compounding the effects of inflation on their price.

Collectibles Offer Performance, Protection & Privacy

While inflation may be the culprit behind the record-breaking, headline-grabbing prices across the industry, collectibles have been a promising investment market for some time. Since 2003, the Economist Valuables Index of Art and Other Collectibles grew 64% faster than the MSCI World Index, reported Deloitte in 2014.[8]

Beyond performance and protection, however, collectibles can offer privacy. Investment grade coins, for example, do not require 1099 tax form reporting nor are they attached to a Social Security number. They are immune to government seizure. The nearly $19 million Saint-Gaudens Double Eagle that escaped the U.S. Mint’s melting vats following President Roosevelt’s gold confiscation in 1933 cannot be taken today.

For all of the benefits they offer, collectibles can be daunting for new investors because success can be contingent on understanding the nuances and complexities of the market. If you would like a comprehensive introduction to investing in rare coins, please request our free Investment Grade Coin Report.