China has built a wall of secrecy surrounding its gold strategy, with experts long predicting that the country’s reserves and buying habits far exceed official reports. Tellingly, the rise of Beijing’s global “gold corridor” is facilitating a parallel, dollar-free economy.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors John Karow and Joe Elkjer peek behind the curtain in front of China’s gold holdings, explain how BRICS nations benefit from these immense reserves, and predict what impact these developments could have on the US dollar.

China’s Quiet Gold Accumulation Strategy

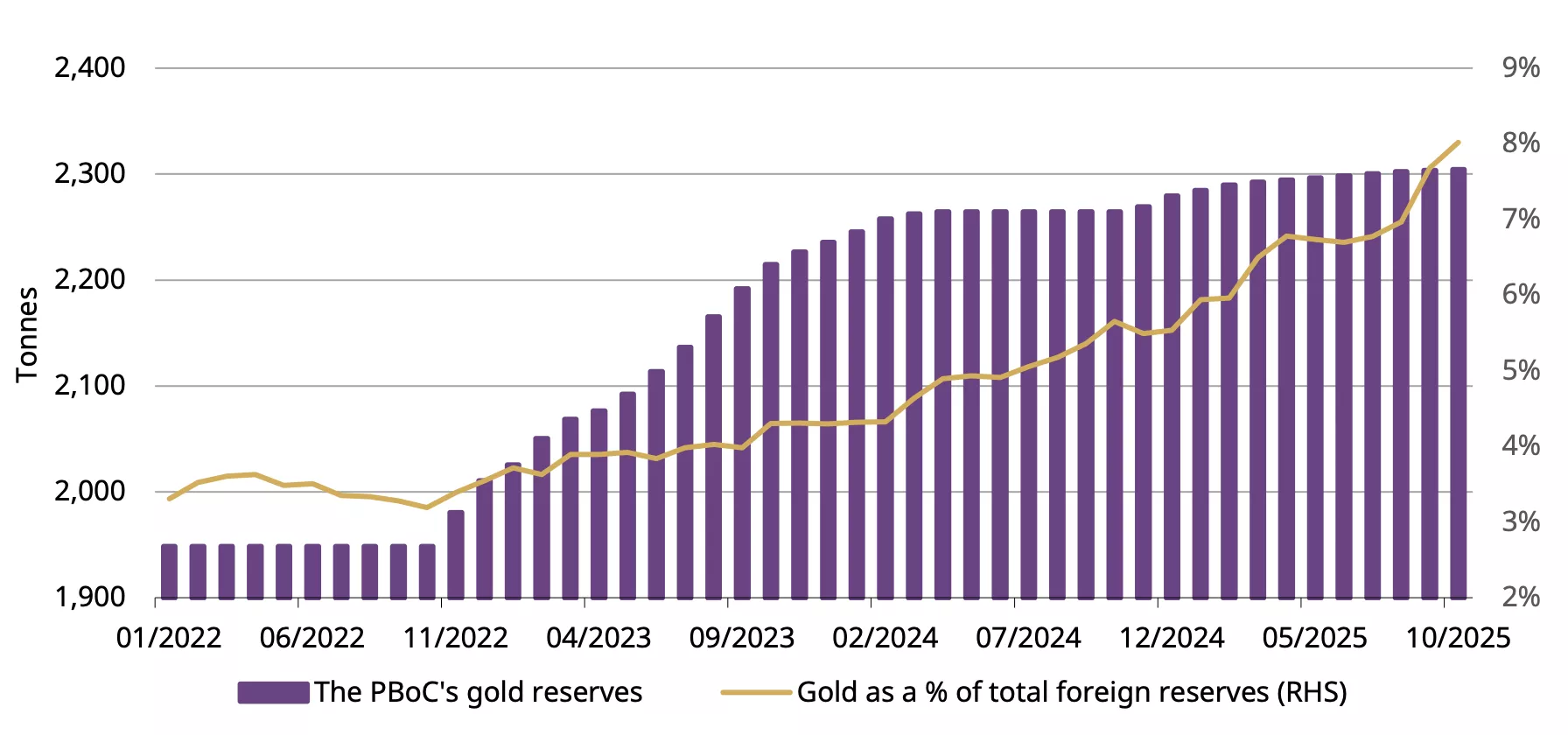

China has a well-earned reputation as a highly private yet exceptionally impactful geopolitical rival. One of the country’s most deceptively influential weapons is its highly secretive gold reserves. Over the past few years, the People’s Bank of China has been one of the most consistent and largest buyers of tangible gold, with purchases rising for an entire year.

The PBoC’s reported gold holdings and their share of total foreign exchange reserves. Chart source: World Gold Council

However, the Chinese central bank has made suspiciously small purchases over the past few months, compared to its momentous gold demand over the past few years. Analysts overwhelmingly believe China is buying far more than official figures indicate, for very strategic purposes.

How Much Gold Does China Own?

China’s official estimates are widely reviewed as unreliable and underreported. There’s a broad consensus that the PBOC is buying more physical gold each year and holding more in its reserves than is reported on paper. However, experts also widely agree that the precise tonnage is virtually impossible to know, given China’s immense wealth and its dominant 10% control of the gold mining market.

Even with these obstacles, some financial leaders have devised strategies for estimating Beijing’s gold holdings. For example, Société Générale estimates China’s year-to-date purchases at 250 tons, 10 times greater than the country’s official purchases. Bruce Ikemizu of the Japan Bullion Market Association thinks the PBOC’s overall reserves stand around 5,000 tons, which would be double what’s reported.

Why Is It Hard to Track?

As one of the world’s largest economies, the question marks surrounding China’s gold reserves are puzzling for many investors. In reality, monitoring the gold holdings of various countries is extremely challenging. Unlike other tightly controlled commodities, the gold market is largely opaque.

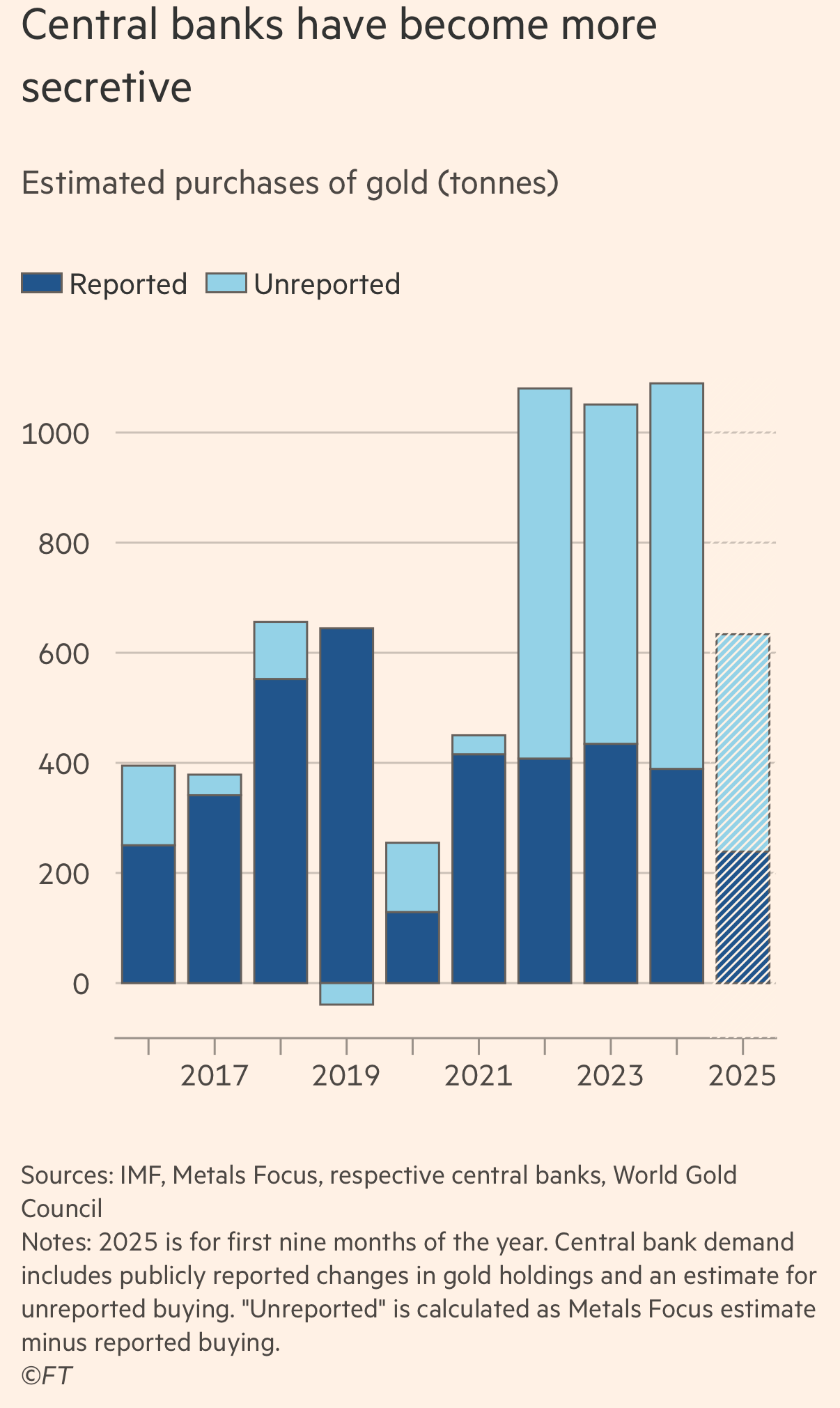

Reporting is voluntary, and central banks are increasingly underreporting for several reasons. The Financial Times estimates that only about one-third of total central bank gold buying is reported publicly, with the other two-thirds happening in the dark. That’s down from 90% transparency only four years ago.

Source: Mohamed A. El-Erian on X

Some leaders seek to avoid confrontation with the US as gold purchases are seen as a rebuke of the dollar. Others fear reports of a large sale or purchase could manipulate gold prices to their disadvantage. Others, like China, appear to operate in the shadows for strategic purposes.

Inside China’s “Gold Corridor”

The mystery surrounding Beijing’s gold strategy doesn’t remain within the PBOC’s vaults or China’s borders. Reports are breaking about China’s so-called “gold corridor” and the implications for the Western-led financial system. At the behest of Xi Jinping, a parallel gold market is emerging to directly challenge the US’s dominant status quo.

“China has been a leader in gold buying. They're basically leveraging their vast gold reserves to back the yuan and strategically challenge the global dominance of the US dollar by creating the gold corridor.”

The “gold corridor” refers to a series of physical vaults, clearing systems, settlement infrastructure, and other supporting mechanisms spanning the BRICS and Belt & Road countries — groups over which China wields considerable leverage.

The objective is to encourage other nations to store their gold in Chinese or Chinese-aligned vaults, use physical gold bullion as collateral for trading in local currencies, and prop up the Yuan amid biting Western sanctions.

Although Chinese foreign policy is often marked by manipulative deals and outright corruption, countries are willingly signing onto the burgeoning Eastern-led financial infrastructure. At once, foreign governments can throw off the shackles of a weakening, sanction-heavy dollar and prop up their local currencies and economies.

“The real objective is to get away from the dollar.”

Gold’s Demand Signals the US Dollar’s Demise

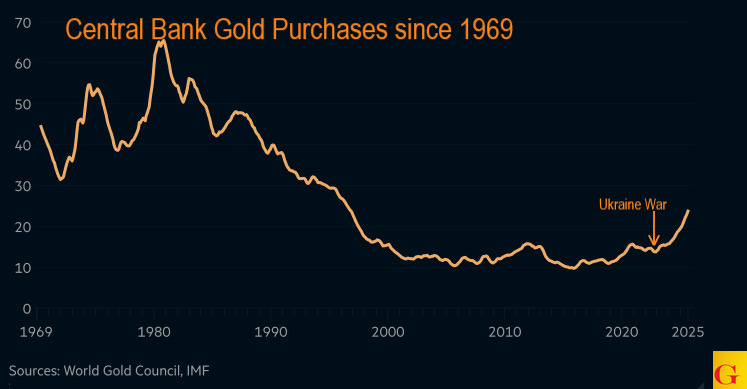

Gold has become a key pillar in the Chinese-led economic war against the dollar-dominated global financial order. The de-dollarization effort has been decades in the making, but the Western-led sanctions against Russia following its invasion of Ukraine have rapidly accelerated the process.

Chart source: GoldFix Substack

This behind-the-scenes demand threatens to undermine US economic interests by offering foreign countries a viable alternative to the current global financial system, where the dollar is the reserve currency. Gold is quickly replacing the USD as the foundation of a new economic order, defined by various spheres of influence and fractured trading hubs.

This supplanting of the US dollar by gold is reflected in the yellow metal’s record move above $4,300 and the dollar’s mighty $38 trillion debt burden. Recently, gold replaced the Euro as the second most widely held reserve asset, inching closer to the dollar.

“As this transition gains momentum, the pressure on the dollar will also increase, and that will solidify gold's hold as a reliable sanction-proof asset.”

What Investors Should Be Watching

For decades, the anti-dollar movement was largely defined by political theater without any tangible changes to match the heated rhetoric. Now, that script has been flipped as countries put on a friendly face while quietly undermining the dollar’s strength.

Central banks are deliberately underreporting their gold purchases, and China — the US’s only true economic rival— is building an alternative financial system. Gold is quickly rising as the new foundation of a multi-polar economic order, and the US dollar is falling from global to regional importance.

The worst thing investors can do now is ignore this foundational change. There’s a reason central banks are offloading the dollar in favor of gold, and retail investors are starting to take notice. Learn how to position yourself before the shift accelerates with our FREE Precious Metals Investment Guide, and avoid the 22 most critical investor mistakes.

Everything you need to know to get started in Precious Metals

Learn how precious metals can strengthen your portfolio, protect your assets and leverage inflation.

Request the Free GuideQuestion or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

SUGGESTED READING

SUGGESTED READING

Questions or Comments?

"*" indicates required fields