As gold continues to barrel toward $4,000 per ounce, investors are wondering what the long-term horizon looks like for the yellow metal. In the face of all-time peaks, institutional and international investors send a clear buy signal to the American people.

In this week’s The Gold Spot, Scottsdale Bullion & Coins Founder Eric Sepanek and Sr. Precious Metals Advisor Steve Rand discuss why banks are raising their price forecasts as gold enters uncharted territory, how a spike in Indian demand reflects global gold consumption, and why silver is looking bullish, too.

BMO Raises Gold Price Prediction

Recently, BMO Capital Markets elevated its gold price forecast for H4 2025 by 8%. Now, the Canadian bank expects the yellow metal to hover around $3,900/oz for the final three months of the year. Its 2026 gold price prediction is even more bullish, with analysts calling for $4,400/oz. BMO pointed to the US government shutdown and the surging national debt as key symptoms of a dysfunctional financial system — a key factor increasing gold’s appeal.

This optimistic gold price forecast for 2026 is part of a broader trend of financial institutions and experts raising their gold price expectations as the rally continues to grow relentlessly. With spot gold prices sitting comfortably around $3,800/oz, many people are saying $4,000/oz gold is within reach. Some are even projecting that $5,000/oz gold is coming faster than investors may think.

Gold’s parabolic expansion is erasing projections quicker than they can be made. Increasingly, earlier predictions that seemed overly optimistic are looking more and more plausible. For example, Steve Hanke, Economics Professor at Johns Hopkins University, recently floated the possibility of $6,000/oz, and Forbes contributor and U.S. Global Investors CEO Frank Holmes even tossed their gold-bug hat into the ring with a $7,000/oz call. Robert Kiyosaki, known for his confident gold and silver forecasts, is pulling for gold prices at $25,000/oz!

“A lot of this may seem unrealistic, but we're hearing about a potential gold reevaluation, which could make gold prices go to much higher numbers than anyone can really comprehend in the scheme of what we normally see.”

Silver Follows Closely Behind

Analysts at BMO have adjusted their silver price forecasts to the upside as well. They suggest the shiny metal could average around $50/oz in 2026, representing a considerable 57% jump from their previous silver price prediction. BMO isn’t the only bank expecting silver to surpass $50. UBS has also boosted their silver price target to $55/oz. While gold’s momentum is a major tailwind for silver prices, the banks emphasize strong industrial and investment demand as key drivers for the metal’s anticipated rise.

Diwali Will Fuel Gold Demand

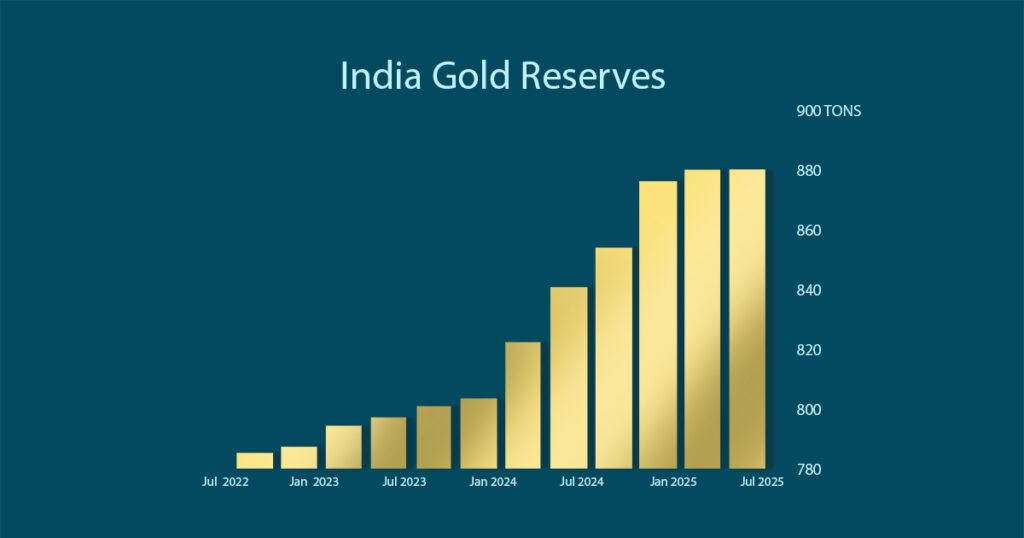

India’s gold consumption is making headlines, which isn’t anything new. The powerhouse BRICS member has been accumulating gold bullion at an accelerating rate, increasing its physical reserves to around 900 tons.

However, the country’s central bank isn’t the only source of gold buying. India boasts one of the largest jewelry markets in the world, alongside China. The upcoming Diwali festival is closely tied to this heightened gold frenzy, as the metal is an important spiritual and cultural symbol of blessings and good fortune.

Unlike other holidays that might make a blip on the radar, Diwali gold purchases have a measurable impact on gold prices. One study found that, in the months following the festival, gold prices rose more than half the time. In those instances, gold prices jumped by an average of 10%, with some swings reaching as high as 31%. Retail buyers consume about 20% of their country’s total annual gold demand during this celebration alone.

While impressive in and of itself, this spike in demand comes with two crucial outcomes. First and foremost, global demand remains high despite elevated premiums in other parts of the world. Secondly, the availability of physical gold is becoming a concern among US investors who have remained on the sidelines compared to international investors.

“In this country, it's not the general public that's buying gold. Once the United States recognizes how big the problems are, that's when you're going to see premiums surge and lack of availability.”

The Shrinking Gold to Silver Ratio

Gold-to-Silver Ratio Chart Source: TradingView.com

A few months ago, our advisors highlighted the expanded gold-to-silver ratio, which was nearing 110:1. While not a record high, we argued the increasing spread signaled a potential breakout for silver. Since then, silver prices have surged to a 14-year high and continue to rise at a steady pace.

The relative value between gold and silver has shrunk significantly but remains stretched compared to historic norms. Some people will point to the 15:1 government-mandated ratio from over a hundred years ago, but that number is unrealistic given the free market’s controls over the precious metals markets.

In the pandemic era, the gold-to-silver ratio expanded to 126:1. At the beginning of this year, it was closer to 90:1, and now sits around 80:1. Gold’s growth is being mirrored nearly tit-for-tat by the shiny precious metal as it nears an all-time high around $50/oz. Many argue it’s silver’s time to shine.

“Silver is going to break the all-time high, just below $50/oz. We are going to exceed that and might be off to the races at that point.”

Don’t Miss Out on the Gold and Silver Surge

Even at all-time highs, gold remains inexpensive. Everything from a deteriorating financial landscape and domestic political gridlock to rising expert forecasts and steady global demand, gold’s outlook is extremely bullish. Silver is following in the yellow metal’s footsteps without missing a beat, signaling equal strength.

The question remains whether Americans will heed the proverbial writing on the wall and join their international precious metals investors in protecting their wealth from the rapidly changing global economy. If you’re looking to get the most out of your gold and silver investments, get our FREE Gold & Silver Coins Report Today!

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields