Silver’s status in the US market just shifted in a major way, opening the door to a fundamentally different price outlook. At the same time, Bitcoin is struggling to recover as mainstream adoption brings heavier regulatory oversight to a once-fringe digital currency.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors Todd Graf and Tim Murphy discuss silver’s designation as a critical mineral, what bullish chart pattern is forming, and why Bitcoin may be falling out of favor among investors.

Silver’s Volatility Explained

After surging past $50 for the first time in history about a month ago, prices have experienced characteristic volatility. Shortly after breaching the long-held $50 ceiling, silver prices breached $54 before falling back to $46/oz. So far in November, those losses have been reclaimed with silver prices heading for $55/oz.

This volatility has been characteristic of the silver industry due to decades of heavy short positioning by major financial players. This behind-the-scenes manipulation enabled whales to purchase silver at lower prices. Following the conviction of two J.P. Morgan precious metals traders, many traders hoped for the end of silver market manipulation, but the interference by the big players persists.

In 2020, the underlying shallowness of the silver market resurfaced as official consumption began rising alongside strong central bank demand for gold. Led by India, Russia, and China, this surge in physical silver buying quickly put pressure on inventories at the London Metal Exchange, one of the world’s largest hubs.

The Silver Short Squeeze Sets In

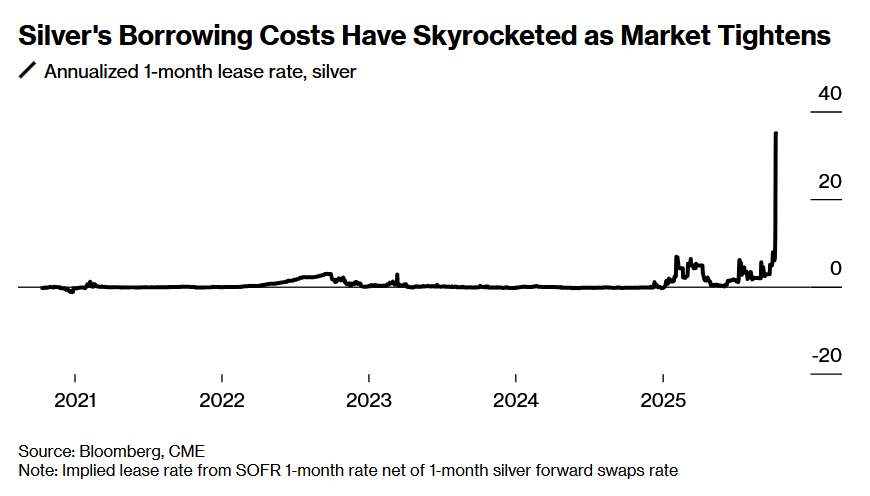

The dwindling silver supply forced the leading financial short sellers to buy back futures contracts, elevating the metal’s spot price. The waning silver supply also hikes borrowing costs—the fee traders pay to borrow physical metal to operate positions. In October 2025, lease rates in the London market soared to over 30%. For reference, these rates usually are around 1% when supplies are robust.

Source: The Bubble Bubble Report

“Silver is in a good old-fashioned short squeeze.”

All of these pressures have culminated in a full-scale short squeeze—a bullish market scenario where rising demand collides with vanishing supply, forcing shorts to buy back silver at any price. The result is often a blow-off top where silver enters price discovery mode, launching to new heights.

Silver Officially Added to Critical Minerals List

The backdrop of shrinking physical availability, ballooning borrowing costs, and widespread geopolitical tension set the stage for government intervention. Earlier in the year, we discussed the prospect of silver being added to the US critical minerals list.

Recently, the federal government confirmed those reports by officially designating silver as a critical mineral, which comes with added protection and potential controls.

This federal oversight of the silver market signals a dramatic shift in US policy and has considerable implications for the metal’s price. Despite the magnitude of this step, the announcement has been largely downplayed in the media, leaving most of the public unaware of its significance.

A Five-Decade Cup & Handle Breakout

Alongside these foundational tailwinds, silver is flashing an extremely optimistic technical signal. Currently, silver’s price action is breaking out of a cup-and-handle pattern that has been 50 years in the making. With its base near $5 and the resistance around $50, silver’s price is forming one of the most bullish formations ever seen in the shiny metal’s history.

50-year silver spot price chart. Chart source: silveprice.org

“This cup and handle…is a 50-year formation…that I've never seen anything like before. It's very, very powerful. $100 an ounce is very real, and it could happen as soon as March of next year. So we're not that far away.”

Bitcoin Slides

Bitcoin price October to November 2025. Chart source: coinmarketcap.com

Bitcoin has been under sharp pressure in recent weeks, falling from roughly $125,000 to below $100,000 as volatility sweeps through the cryptocurrency market. The pullback mirrors the broader instability across digital assets, driven by heavy profit-taking, margin liquidations, and increasingly aggressive activity from large holders.

In particular, an estimated $40 billion worth of long-dormant wallets—some untouched for five to seven years—have begun unloading substantial portions of their holdings, adding to the selling pressure.

Crypto Enters the Mainstream

The recent Bitcoin selloff and the broader softness in the cryptocurrency market reflect a shifting landscape for digital currencies. What was once heralded as the ultimate form of financial privacy has been thrust into the grasp of regulatory control, government oversight, and powerful financial interests.

Some of the largest banks in the world, including Morgan Stanley and J.P. Morgan, are expanding their footprints in the crypto space, bringing the potential for volatility and outright manipulation, which have marred the silver market for decades. At the same time, governments are rolling out central bank digital currencies (CBDCs), adding stablecoins to reserves, and cozying up to crypto elites with a track record of fraud.

“Cryptocurrency, it is changing. I mean, it’s becoming more mainstream. A lot of people are concerned about privacy with this.”

Silver Surges as Crypto Stumbles

The Bitcoin vs precious metals debate is getting quickly resolved as cryptocurrencies fall victim to the same fate as fiat currencies and other heavily regulated assets.

Meanwhile, gold continues to break new records as governments top up their reserves due to the yellow metal’s privacy, inherent value, and lack of control.

At the same time, silver’s classification as a critical mineral and a bullish cup-and-handle formation signal a potential breakout.

To unlock the smartest ways to invest in today’s market and avoid the 22 common rookie mistakes that cost new gold and silver buyers thousands, get your FREE COPY of our popular Silver Investor Report now!

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free ReportQuestion or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields