Despite short-term bearish sentiment and price stagnation, gold could still hit $4,000 within the next 12 months. Bank of America’s bullish outlook comes as its annual Fund Manager’s Survey highlights gold as the most crowded trade.

In the long term, analysts expect surging national debt, stubborn inflation, and a struggling dollar to support new all-time highs in the gold market, extending the rally through a temporary rough patch.

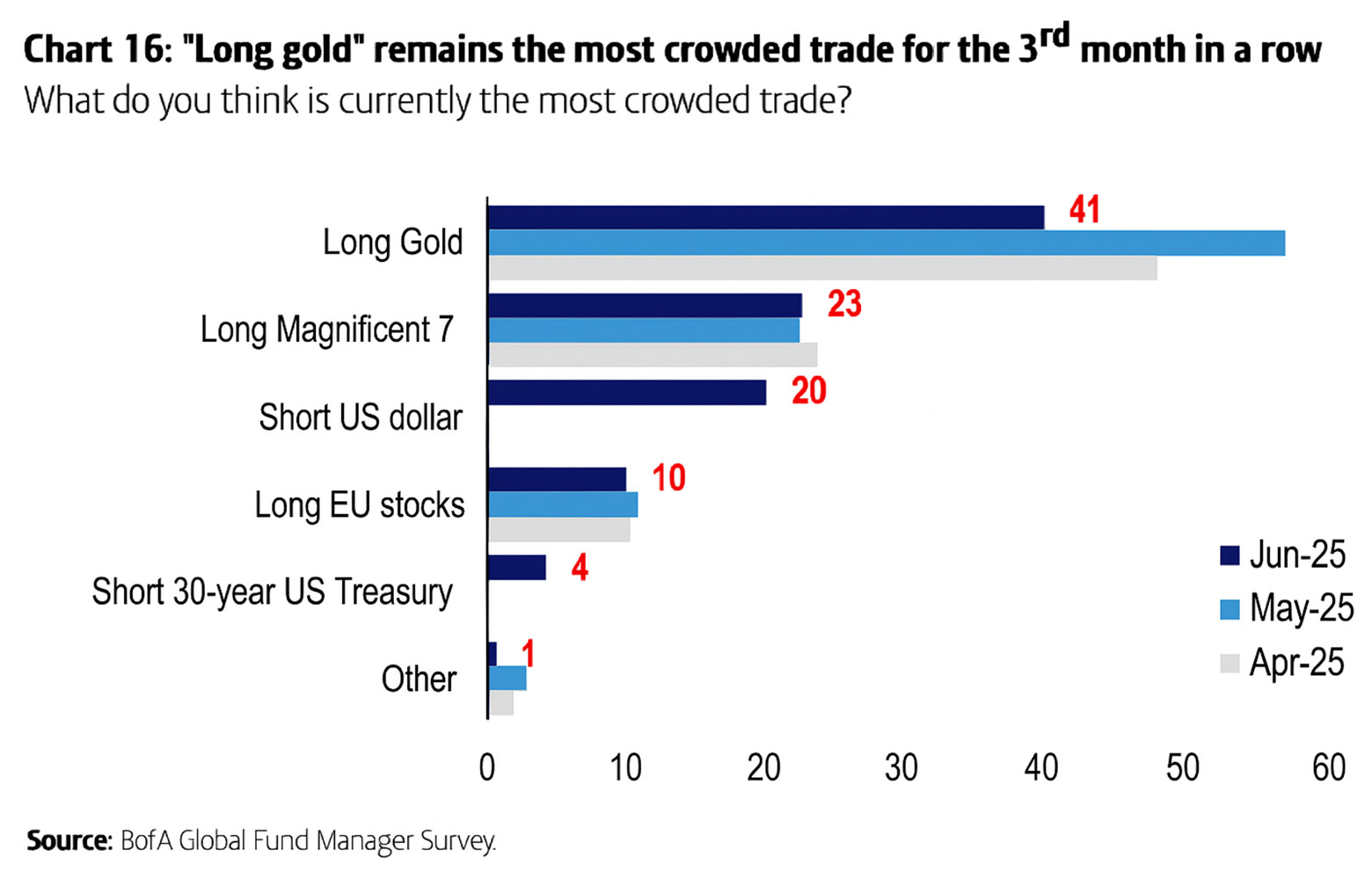

Gold is the “Most Crowded Trade” for Third Straight Month

Each month, Bank of America surveys hundreds of mutual fund, institutional, and hedge fund managers who collectively manage hundreds of billions of dollars. This survey helps the bank track the pulse of a rapidly evolving market sentiment.

A key takeaway from the June survey is that “long gold” remains the most crowded trade in the market. Specifically, 41% of respondents said holding the yellow metal for the long term is one of the most popular investment positions.

This marks the third consecutive month that gold has been the top consensus trade. However, the percentage of managers calling it crowded has declined since relative highs in April and an annual peak in May.

Dollar Optimism Drops to Two-Decade Low

As crowds of investors flock to gold, confidence surrounding the dollar has fallen to a multi-decade low. According to the survey, the percentage of fund managers overweight in the dollar fell to its lowest point in 20 years.

This suggests institutional money is shying away from holding wealth in the greenback due to expectations of short-term volatility and even long-term devaluation. This sentiment reflects current dollar weakness as the USD struggles to recover from a near 10% drop from earlier in the year, sitting near multi-year lows.

The Gold Rally Hasn’t Topped: Here’s Why…

Some investors get skittish with gold being labeled a “crowded” trade, but in market terms, that simply means it’s a popular bet with heavy demand. In 2025, the percentage of fund managers calling gold “crowded” has closely tracked its price rise, peaking in April and May before dipping slightly in June.

A crowded trade doesn’t necessarily mean gold is overbought or due for a crash. It does suggest the market is heavily positioned one way, which could raise short-term risks if sentiment suddenly shifts.

However, BofA sees gold prices being supported in the long term for a few key reasons:

Fiscal Unsustainability

After acknowledging some potential headwinds for gold, BofA analysts suggest that “market concerns over fiscal sustainability are unlikely to fade regardless.”

Persistent concerns about the skyrocketing national debt, widening federal deficits, and slipping global dollar demand are pushing investors to gold, in an attempt to hedge against potential inflation and monetary debasement.

Official Demand

Historic levels of central bank demand remain a central pillar of gold’s ongoing rally. Total official gold consumption has remained above 1,000 tons since 2022–a trend expected to continue in 2025. Societe Generale underscores China’s central role in sustaining official demand with the PBOC accumulating more than 700 tons for the past two years alone.

Dollar Weakness and Fed Support

Bank of America expects gold to remain strong amid a declining dollar and growing market instability.

They noted that “rate volatility and a weaker USD should keep gold supported, especially if the US Treasury or the Fed is ultimately forced to step in and support markets.”

Potential intervention adds to gold’s appeal as a stable hedge.

Gold’s Path to $4,000

In the face of stagnant price action and a crowded gold market, BofA is confidently maintaining a positive outlook on gold. While the bank’s official forecast remains at $3,500/oz for 2025, analysts indicate the yellow metal could surge to $4,000 within the next calendar year.

Citing market fears, fiscal woes, and dollar weakness, BofA says, “We see a path for gold to rally to $4,000/oz over the next 12 months.” Analysts are even encouraging investors to view the metal’s current dip as a buy-the-dip opportunity.