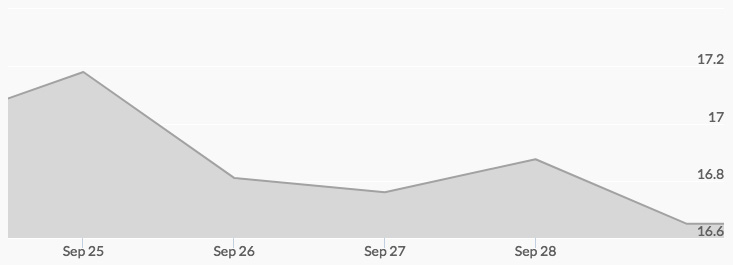

Silver markets opened at $16.89 on Monday, followed by a day of light volume with trading ending with live silver prices up slightly at $17.13 on the final bid. Tuesday’s silver price open of $16.94 came in the face of more light volume, and the final trade was quoted as $16.83. Bargain hunters allowed the Wednesday open to come in at $16.77. Trading for the day was light in a narrow range, and the market closed up one cent at $16.78. Thursday’s direction for silver prices was upward after the $16.79 open, and the close for the day was $16.86. The Friday open at $16.75 was followed with silver buying that took the quote to $16.82 before sellers moved the market to a close of $16.68

Many observers pointed to the week’s light trading as an indication that traders are seeking some solid signs of true market momentum. The market’s movement over the past few weeks comes in the face of a solid run-up in precious metals prices for the year, and many observers are indicating confidence that this mild correction is setting the stage for a strong fourth quarter. 1 Market factors, such as supply and demand, continue to provide confidence for long-term price increases.

As the market waits to see solid indications of where the U.S. economy is heading, the institutional buyers continue to hold a bullish position for the white metal, and some traders who follow the Gold Silver Ratio are also using this indicator as an opportunity to rebalance their positions.