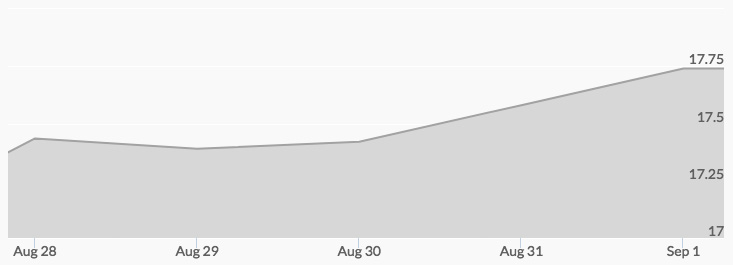

The silver market opened at $17.21 on Monday morning, and strong buying moved the price of silver to $17.50 by the close. Another dime was added to this position in continued aftermarket action for a Tuesday opening of $17.60 before some profit taking finally consolidated around a close for the day of $17.42. Wednesday’s trading stayed in a narrow range after an opening of $17.39 and resulted in a close that was up a couple of pennies at $17.41. Sentiment for silver was in a bullish direction at the Thursday open of $17.46 with ongoing support building to a daily high of $17.62 just before final trades gave the markets a $17.57 closing quote. Opening virtually unchanged Friday at $17.58, more silver buying took the trading to a weekly high of $17.73 by noon, and that would be the bid at the final, producing more than a half-dollar increase for the week.

Prices for the white metal have reached 12-month highs, reports the silver spot price history chart, drawing some larger traders back into the action. The fundamentals of silver supply and demand have been in play for most of 2017, but recent concerns over increasing international risks and geopolitical issues are now affecting prices. The U.S. is grappling with tax cuts, the debt sealing, caution at the Fed, and other issues, such as the recent hurricane. The UK and EU are just now fully facing the challenges presented by Brexit, and the ongoing worries over North Korea all increase interest in risk-averse assets.

The coming week will provide insight into how the U.S. is going to address some of those issues and government reports on prices and construction data will give further indication of the state of the economy. As silver buyers gain more confidence that there is underlying strength in the current bullish trend, it is expected trading volume will pick up and provide additional positive momentum.