Silver just reached its highest price since 2011, driven by rising market volatility, trade tensions, and global uncertainty. With gold holding near all-time highs, many investors are asking whether silver’s jump is just a temporary spike or the start of a longer-term rally.

In this week’s episode of The Gold Spot, Scottdale Bullion & Coin’s Precious Metals Advisors Joe Elkjer and Tim Murphy break down the key drivers behind silver’s recent surge, how ongoing supply deficits could trigger a silver squeeze, what past price movements suggest about future trends, and how investors can take advantage of the metal’s momentum.

Silver Soars to Highest Price Since 2011

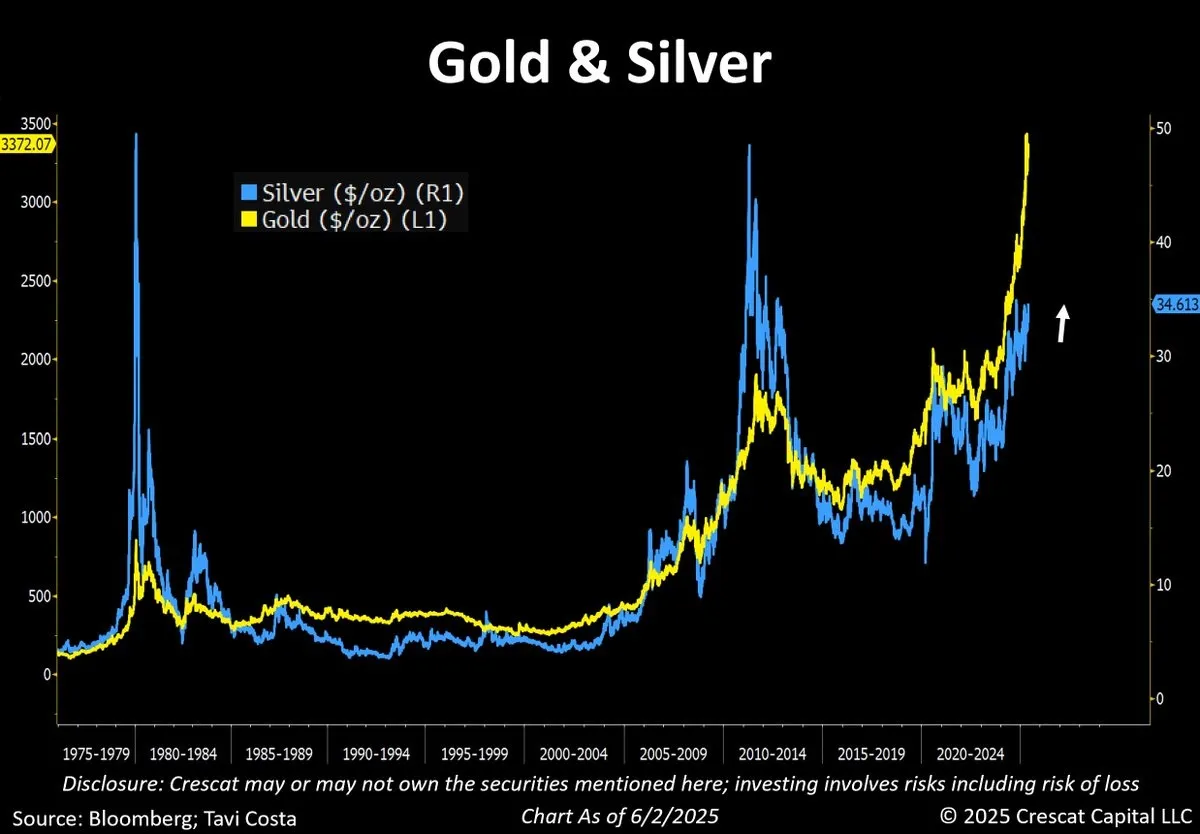

Silver spot prices surged to $39 an ounce last week, climbing nearly 3% in a single trading day. That’s the highest spot price the metal has reached since September 2011. This milestone follows another major move just weeks earlier, when silver pushed past a long-standing resistance level at $35 an ounce.

These consecutive 14-year highs represent silver’s tendency to climb rapidly following a decisive breakout. On the charts, silver is completing a classic cup-and-handle pattern. This formation typically signals growing buying pressure and the potential for rapid upward movement. We covered a similar setup with gold earlier this year, which was followed by a gain of more than 25%.

Demand & Supply Tensions Boost Silver

This sharp spike in silver prices is partly the result of growing tension between supply and demand. Inventories at major commodity exchanges—such as the London Bullion Market Association (LBMA) and New York’s COMEX—have been steadily depleted and are struggling to keep up with the surge in demand.

In a departure from typical behavior, many major buyers are taking physical delivery of futures contracts—agreements to buy a specific amount of silver at a set price and date. Typically, these contracts are closed out before expiration, allowing traders to profit from price movements without requiring physical delivery. As more contracts are being settled in actual metal, pressure on already limited supplies is increasing.

Long-Term Shortfall = Ongoing Price Pressure

While today’s supply-demand tension is making headlines, the imbalance has been building for years. Silver demand has outpaced production for four consecutive years, with deficits averaging 169.6 million ounces annually. The Silver Institute projects that 2025 will mark the fifth straight year of shortfalls, highlighting a persistent, structural issue in the market.

This reflects long-term challenges in scaling silver supply to meet rising industrial and investment demand. Analysts estimate it could take five to ten years for the market to reach equilibrium, let alone shift into a surplus, suggesting this fundamental pressure on the silver market is likely to remain for the foreseeable future.

Can silver break through all-time highs?

With silver breaking through multiple key highs, analysts are already eyeing new milestones. The next major target is $50, a level silver approached yet fell short of in both 1980 and 2011. Now, with gold hitting record highs, mounting economic and geopolitical stress, and a bullish cup-and-handle pattern forming, silver appears well-positioned to potentially break this long-standing resistance.

“The cup-and-handle formation is telling us silver prices are going through $50 like a hot knife through butter. We’re going to $60 and $70 pretty quickly and much higher prices.”

This bullish forecast is shared by author Peter Krauth, who expects $50 silver in 2025 before a long-term spike to $300. Many experts have already revised their 2025 silver price forecasts to the upside, reflecting the shift in sentiment as the shiny metal glistens.

Low Risk & High Reward

Along with gold and platinum, silver boasts one of the strongest performances in the first half of 2025, outpacing the broader stock market and several other commodities. With prices near relative peaks, some wonder if the rally is overheating.

In reality, the silver market is in a low-risk, high-reward position. Plus, dealer premiums remain advantageously low as most retail investors remain on the sidelines.

Based on supply and demand, what the dollar is doing, and other factors, silver’s downside is practically zero and the upside is enormous.–

Prices remain well below inflation-adjusted highs, and macroeconomic drivers persist. The best way for investors to capitalize on this bullish outlook is to buy physical silver.

If you’re looking to optimize your portfolio for the potential silver breakout, check out our FREE Silver Investor report.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields