As silver’s history-making rally continues above $90/oz, a new wave of slick, high-volume commentary is sweeping across social media. A sudden new presence in the precious metals conversation is raising questions about how narratives emerge during market stress, what qualifies as reliable investment insight, and how quickly investor interest in silver is expanding.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor John Karow analyze the YouTube phenomenon known as “The Asian Guy,” how this investment guidance lines up with more established voices, and what the channel’s rise in popularity says about the silver market moving forward.

The Emergence of “The Asian Guy”

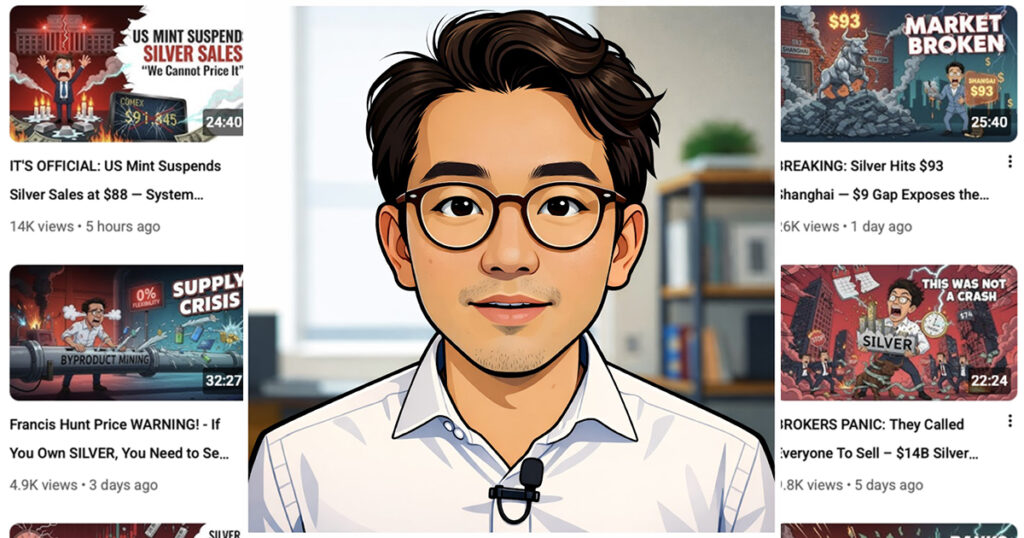

Over the past few weeks, a single digital persona has gone from obscure to unavoidable in the online silver conversation. “The Asian Guy” is only one of over a dozen YouTube channels using similar artificial intelligence avatars, automated voiceovers, and still images to pump out silver-related videos several times per day.

The production is slick, the output is relentless, and the claims range from familiar market mechanics to assertions that are much harder to pin down. The undeniable impact of this new virtual voice has forced retail investors and trusted voices in the precious metals arena to raise important questions about accuracy and motive.

What Can Be Verified

Many question marks are swirling around this digital sensation, as nobody truly knows the individual or organization behind the videos. However, the information that can be gleaned from merely browsing the channel provides some clues as to what’s going on behind the scenes. So far, it can be established that:

- “The Asian Guy” is a repeated digital persona appearing across more than a dozen YouTube channels, rather than a single, identifiable creator.

- The presenter is a clearly AI-generated avatar, with an identical appearance, facial movement patterns, and scripted narration style across all videos.

- Collectively, the related channels have accumulated millions of views, with many individual channels showing several thousand to more than 10,000 subscribers.

- Video output across these channels is continuous and high-volume, often exceeding one video per day per channel, with content that is generally long-form and detailed.

- Most of the related channels focus primarily on silver, while a smaller number also cover broader macroeconomic or financial topics.

- The silver-focused content across these social channels appeared nearly simultaneously in December 2025, coinciding with a sharp acceleration in silver prices and elevated market volatility.

- The channels did not exhibit a long, gradual buildup of audience or content before this sudden visibility.

Familiar Claims, Repackaged at Scale

If you’ve been following the silver market for more than a few years, as the audience of The Gold Spot has, you’ll recognize that most of the topics covered by “The Asian Guy” and related channels are familiar.

The content repeatedly returns to a well-known set of silver-market themes, including:

- COMEX futures leverage and positioning.

- Large bullion bank exposure, including JPMorgan.

- Chinese demand and policy-related dynamics.

- Rising industrial use of silver.

- Short squeeze mechanics and physical availability.

Many of these ideas have circulated within precious metals circles for years and are now being repackaged and presented as breaking developments to grab attention, generate interest, and even, perhaps, encourage certain trading actions.

“For anyone who's been following the silver market for more than a decade knows that a lot of this information is not new. It looks like an AI collection of past information that came from either fact, fiction, opinion, speculation, or sometimes conspiracy.”

Who Could Be Behind It?

With no disclosed creator identity and a level of coordination uncommon for retail content, the origins of these channels have become a point of active debate within the precious metals community.

- Chinese institutional interests, including state-linked or policy-adjacent market participants.

- Government or regulatory entities attempting to shape market narratives or investor behavior.

- Bullion banks or large financial institutions with meaningful silver exposure.

- A well-resourced private content operation with access to market data and advanced production capabilities.

- An internal whistleblower or informed insider deliberately masks their identity.

- A combination of these forces, rather than a single identifiable source.

Where Verification Becomes Challenging

While much of the commentary revisits familiar themes, some specific assertions are delivered with a level of confidence that makes independent verification challenging.

Several claims referenced across these videos rely on unnamed sources, private meetings, or internal actions that do not appear in publicly available data or mainstream financial reporting. When information cannot be corroborated through transparent sources, investors are left with fewer tools to distinguish confirmed developments from interpretation or extrapolation.

Where the Analysis Falls Short: The LBMA Context

If a channel presents itself as explaining the full silver market, omitting wholesale settlement dynamics leaves a meaningful gap. Notably, several LBMA-related developments that materially impact the silver market today remain largely absent from much of the recent high-volume commentary:

- London physical settlement: The LBMA governs large-scale silver settlement and signals whether supply stress is isolated or systemic.

- Unallocated and leased silver: Institutional exposure is dominated by unallocated accounts and leasing structures that shape liquidity and risk under strain.

- Wholesale stress transmission: Disruptions in London can spill into futures markets, influencing spreads, deliveries, and volatility beyond positioning data.

Leaving these dynamics out does not invalidate the broader discussions around silver, but the limited scope does call the channel’s broader motivation into question.

Why This Matters for Investors

On The Gold Spot, we rarely address social media trends or personalities because markets are driven by structure, capital flows, and fundamentals, not online narratives. In most cases, social media reacts to the market, not the other way around.

The only notable exception was the legendary GameStop short squeeze when a random guy by the name of Roaring Kitty was able to generate enough organic retail participation that institutional positions were forced to cover their shorts.

“If we learn one thing from the GameStop short squeeze that you don't want to underestimate the power that the public has in driving the markets once it gets involved. It's yet another major money injection into the silver market.”

“The Asian Guy” represents a similar social media and retail investment phenomenon in a different market. The virality and engagement surrounding this content suggest retail participation is on the cusp of a major influx. That move poses considerable upward pressure for silver prices, which have so far been primarily driven by institutional and industrial demand. Silver has already reached record levels without meaningful retail inflows.

If broader participation follows, history suggests it would add momentum to an already explosive rally, putting already bullish 2026 silver price predictions into perspective.

For a deeper look at silver market fundamentals beyond headlines, claim a FREE copy of our Silver Investor Report.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free ReportQuestion or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields