With the 2024 presidential race in the rearview, Americans are focused on how their economic situation will look, entering into a new political reality. There’s a lot of excitement, uncertainty, and questions about what the future holds. In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisor John Karow and Founder Eric Sepanek explain how markets responded to the election results and where gold could be headed with the new presidency.

Donald J. Trump Set to Become 47th U.S. President

The much-anticipated 2024 presidential race results are in: Donald J. Trump will once again step into the Oval Office as the 47th U.S. President, securing both the popular vote and the Electoral College. This historic win makes him only the second president in U.S. history to serve non-consecutive terms, underscoring the enduring impact of his message with a significant portion of the American electorate. Alongside Trump’s victory, Republicans have reclaimed the Senate and are poised to retain control of the House, signaling one of the most significant red waves in recent memory.

Uncertainty Prevails

Following Trump’s landslide victory, the broader market experienced a major bump, reflecting the perception among Americans that the Republican candidate is a boon to the economy. The DOW shot up 1,500 points in a single day, marking the largest intraday extension since 2022; Bitcoin climbed nearly 8%, and the dollar rose strongly. However, this hopium-fueled surge from Wall Street to cryptocurrency doesn’t change the harsh economic realities. The $36 trillion national debt is speeding up, and countries worldwide are embracing a de-dollarization shift.

“I think what we’re going to see is a lot of chaotic investment behavior over the next few weeks as people and nations sort this out”

The Spending Problem

Although voters are hopeful, many wonder if Trump will cut the U.S. debt meaningfully, as both parties have proven their addiction to printing and spending. During his first term, Trump added $7.8 trillion to the federal debt. Biden isn’t far behind, with $4.8 trillion contributed thus far in this presidency.

“If we continue on this path of spending, the real bubble that we need to be concerned about is the dollar and bond bubble.”

The cycle of spending and printing seems endless in an economy built on fiat currency with no physical backing. Without internal guardrails to curb reckless fiscal policies, the economy risks veering off a cliff if the unchecked excesses of Modern Monetary Theory (MMT) – the prevailing fiscal approach – aren’t controlled.

Where is gold headed under Trump?

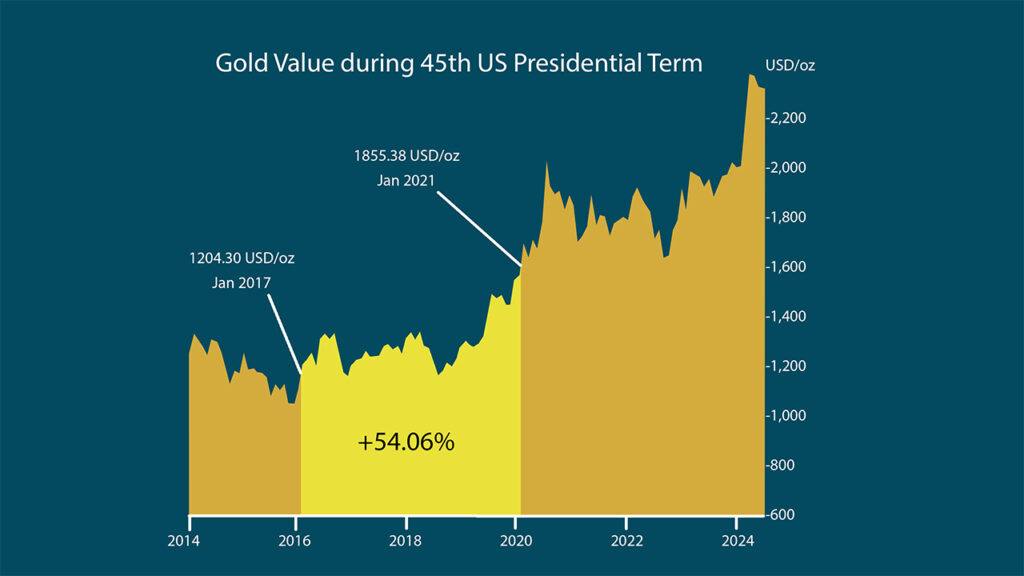

Post-election night, gold prices retreated slightly by 2%, mirroring the gains in dollar-backed assets. Experts anticipate a slight correction for gold, partly as a pause after its recent historic rally and partly due to the broader economy’s Trump-fueled surge. However, historical data suggests that gold is likely to perform well under a Trump presidency. During his first term, the yellow metal shot up over 54% from just over $1,200 to more than $1,885.

Gold prices jumped +54% during President Trump’s first term.

At the same time, the core drivers of gold’s rally throughout 2024 are still in play. After posting records in the first half and third quarter of 2024, central banks are expected to continue stacking gold. This is especially true for the BRICS nations, which have been disproportionately adding to their gold reserves as a hedge against dollar weaponization and a foundation for their domestic fiat currencies. Regardless of who is in power, many experts still predict gold to hit $3,000 next year.

Veterans Charity Spotlight

In light of Veterans Day, we’d like to take this opportunity to highlight a charity close to our hearts: American Service Animal Society (ASAS).

This incredible nonprofit is dedicated to helping veterans regain independence by pairing them with highly trained service dogs. Through personalized training and continuous support, ASAS empowers veterans to overcome daily challenges with confidence and resilience. We encourage you to learn more about their amazing work and see how they’re making a lasting impact in veterans’ lives.

To learn more about the ASAS or to donate, visit: https://dogs4vets.org/

Veteran’s Day Offer

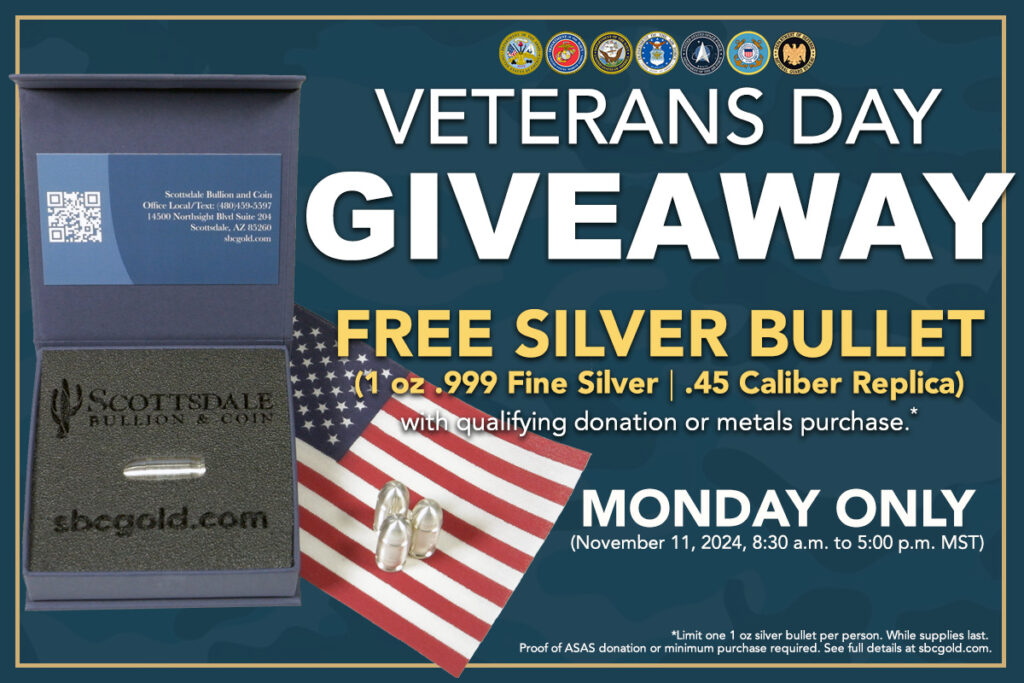

To honor Veterans Day, Scottsdale Bullion & Coin is excited to offer a special promotion on Monday, November 11th. We’re giving away a 1 oz .999 Fine Silver Bullet (.45 caliber replica)* to the first 50 people who:

Donate a minimum of $250 to the ASAS on 11/11/2024 (just provide a donation receipt.)

Or, purchase $5,000 or more with Scottsdale Bullion & Coin on 11/11/2024.

This limited-time giveaway includes only 50 bullets, one for each star on the American flag, and is limited to one bullet per person. It is available for one day only, November 11th. Don’t miss out!

*Offer only valid on Monday, November 11, 2024. While supplies last (only 50 silver bullets available.) Limit one 1 oz silver bullet per person. Proof of $250 donation to ASAS or minimum metals purchase required. Call for full details and availability: 1-888-812-9892.

Thank You For Your Service

This Veterans Day, we want to express our deepest gratitude to the incredible veterans in our SBC family. THANK YOU, John Karow, Kathem Martin, Wally Gordon, and Richard Otto, for your courage, dedication, and service. Your sacrifices have helped protect the freedoms we enjoy daily, and we’re honored to have you on our team.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields