The concept of asset diversification is so important it won Harry Markowitz the Nobel Peace Prize for Economics in 1990 for his work on the topic. The core message about diversification is that any portfolio should have a variety of different assets that react with different correlations to certain market and economic cycles. The theory is that if one asset decreases in value, the balancing assets will increase in value, minimizing overall risk. 1

Benefits of Diversification

Most of today’s professional financial institutions pay homage to the concept of diversification in some form or another. The basic concepts include such time-proven tendencies as the expectation that equities do well when interest rates rise, and bonds are preferred when the equities markets are on a down cycle.

The idea is to minimize the need to predict the direction of the markets and to make money regardless of its inherent cycles.

Additionally, one important factor diversity is intended to account for is inflation. Cash loses its purchasing power when inflation rises, and certain assets, such as gold and numismatic coins protect value. While the issue of inflation has gained little attention for much of the past decade, it is again in the news. In fact, with most central banks targeting an inflation rate of at least 2 percent, there are indications the rate will be even greater over the near to long term.

Protecting Purchasing Power

Savvy investors are increasingly aware of their exposure to paper currency. Unsustainable levels of government debt and continued deficit spending by governments around the globe ensure that currencies will lose value, or purchasing power. Moreover, these same governments see inflation as one way to “pay down” or at least lessen their debt burdens, paying back current bonds and notes with future, cheaper dollars.

These factors have those same investors looking at rare coins as one way to combat the loss in value in their portfolios. The highly respected and closely followed Knight Frank Luxury Index is just one source that reports on the steadily increasing value of rare and collectible coins. According to Stanley Gibbons Investments, the rare coin market is active and liquid, with four to five billion dollars in coins changing hands in 2015.

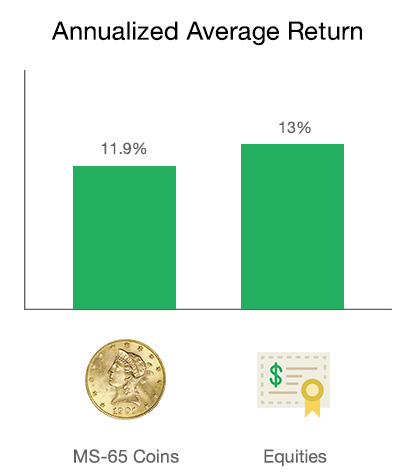

Their record over the past fifty years has been especially impressive. Thanks to uniform coin grading systems it is possible to benchmark the increase of value in comparable coins. According to a study conducted by Penn State University, coins that graded at least 65 on those systems generated an annualized average return of 11.9 percent. That is very close to the 13 percent from equities. Even coins with lower scores increased more than an annualized 10 percent.

Rare Coins: A Wise Investment

These impressive performance numbers show that investment-quality rare coins are an excellent additional diversification option. In the current worldwide economic times, these rare coins are not only showing excellent returns but also they are highly liquid and provide an excellent buffer against the growing threat and erosion of inflation.