The world’s central banks have printed $834 million each and every hour of each and every day… for the past 18 months… to keep the global economy up and going.-The Daily Reckoning

There’s a passage in Ernest Hemingway’s novel The Sun Also Rises in which a character named Mike is asked how he went bankrupt. “Two ways,” he answers. “Gradually, then suddenly.”

Two events took place last week that were very positive for gold and silver. First, the all-important Employment/Non-Farm Payroll numbers released were far weaker than expected. As quoted by Alasdair Macleod last Friday, “Gold and silver jumped today on disappointing payroll figures, with only 235,000 jobs added, compared with forecasts of 725,000. That’s a huge miss. Clearly, the US economy is stagnating badly at a time when official price inflation is running at 5.4%. The Fed still maintains that it is transitory, an excuse that’s wearing very thin. But it is the Fed’s worst nightmare: stagflation — by which is meant an economy that has price inflation while activity stagnates.”

The second important event was the Jackson Hole Economic Conference. Again, Macleod via King World News, was quoted as saying, “Remarkably, in a speech on monetary policy given at the Jackson Hole conference last Friday, Jay Powell never mentioned money, money supply, M1 or M2. With money supply expanding at a record pace to fund both QE and intractable budget deficits the omission is extraordinary. The FOMC (the rate setting committee) appears to no longer take the consequences of monetary expansion into account. But the fact is that rising consumer prices caused by monetary expansion have driven real rates sharply negative and are leading to pressure for higher interest rates.”

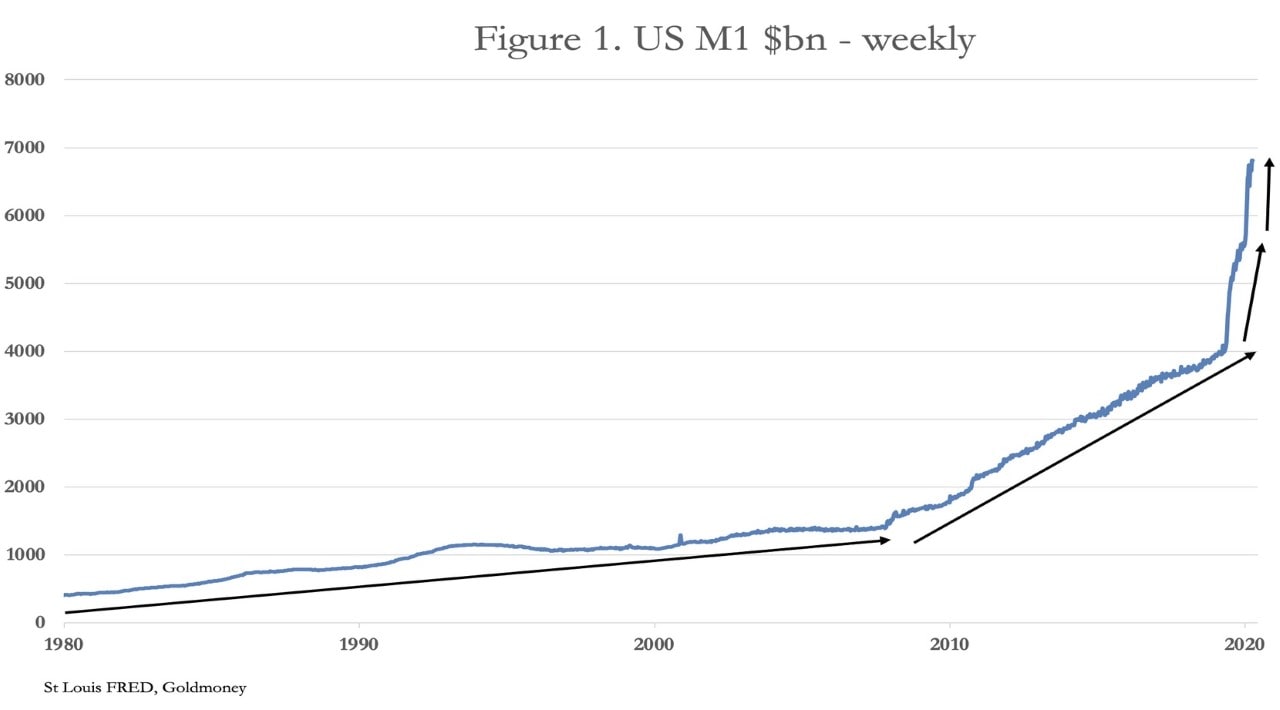

When I learned that Central Banks as a whole were collectively creating out of thin air a total of $834 million every hour for the last 18 months, I almost fell out of my chair. On this matter, Alasdair Macleod had the following to say, “The truth of an emerging situation is that America has changed from a low inflation economy with a gentle erosion of the dollar’s value artificially cheapening US Treasury debt, to a commitment to hyperinflation, the start of which was the rapid expansion of M1 money supply as shown in Figure 1 above .…”

Since I’m on a roll with Macleod, I’m going to finish things out with some more tidbits from his piece in King World News ….

The lessons from history combined with sound economic analysis tell us that markets will reassert themselves over the Fed, and for that matter, over all other central banks which have embarked on similar monetary policies. Gold is the ultimate hedge against these events and their consequences…

We can see that the Fed’s non-monetary approach to monetary policy begs important questions, but there are usually reasons behind it which we must consider. They give us a steer to the Fed’s real mission; its twin objectives of 2% price inflation and full employment having become secondary. It is to keep the Federal government financed by suppressing the interest cost and encouraging the expansion of bank credit to subscribe for government debt.

With the Biden administration unable to reduce its budget deficit, a rising interest rate environment, reflecting price inflation, is bound to result in a funding crisis. These are the debt trap circumstances which not only deters foreign ownership of the currency but persuades foreigners to dump existing currency holdings in increasing amounts.

The combination of Biden’s spending proposals and a stagnating economy is making it impossible for the Fed to continue to suppress interest rates and therefore bond yields. And it is equally impossible to see how the Fed can stop them from rising without sacrificing the dollar. Not only are we going to see a new trend of rising yields established, but very quickly it will be evident there is no visible end to it.

Gold is and will remain the ultimate hedge against failing currencies and their economic consequences, and its importance has never been greater in modern times.