Markets are shaking, the dollar is slipping, and gold is stealing the spotlight. From historic volatility to a global financial realignment, 2025 is anything but business as usual.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisor Joe Elkjer and Sr. Precious Metals Advisor Damian White discuss economy-wide uncertainty, the transformation of the global financial system, and rising gold demand.

Volatility is the Theme

Volatility has defined markets for most of 2025, as reflected in alarming indicators such as:

- 🚨 Stock markets kicking off their worst 100-day start in a year in over five decades.

- 🚨 Recession risks rising sharply, climbing by more than 56%, per a CNBC Fed Survey.

- 🚨 Consumer outlook for the future falling to its lowest point in 12 years.

While it’s difficult to predict exactly how long this volatility will last, recent surveys offer some insight. In the most recent Global Risks Report, 84% of respondents anticipate ongoing instability or worse over the next two years. Almost two-thirds project a “stormy” or “turbulent” decade ahead.

A Reshuffling of the Global Financial System

Amid mounting volatility, the global financial landscape is undergoing a major transformation, marked by the following seismic changes:

Loss of Dollar Supremacy

The dollar’s long-standing position as the world’s reserve currency is under attack at home and abroad. Domestically, skyrocketing national debt and frequent weaponization have tarnished the greenback’s reputation. On the international front, de-dollarization has picked up steam.

Since the beginning of the year, the US Dollar Index (DXY), which tracks USD strength against a basket of foreign currencies, has fallen by 8.4%. In early April 2025, 10-year Treasury yields jumped from under 4% to 4.5%, reflecting a confidence crisis in US fiscal stability.

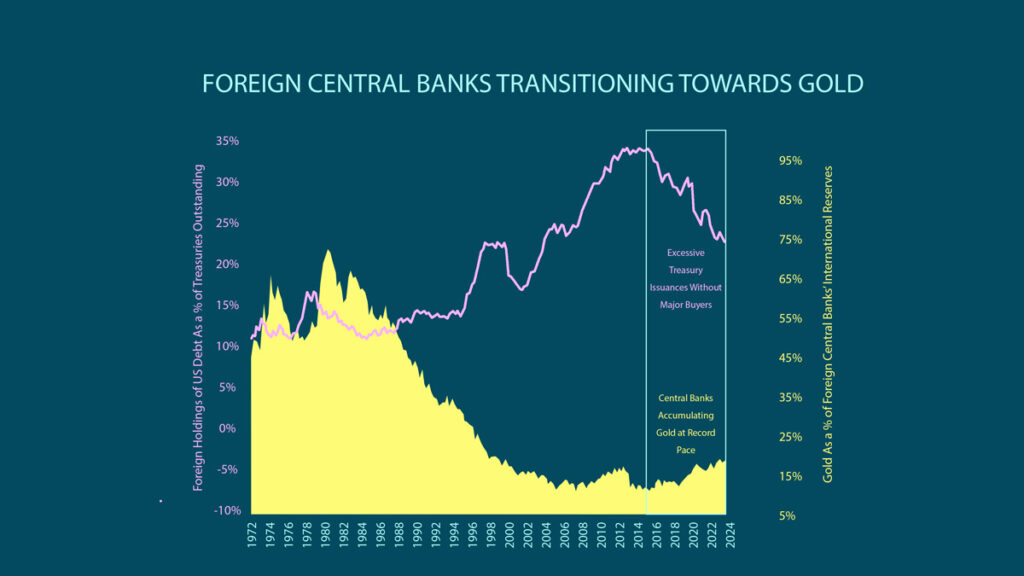

Deutsche Bank cautions that the dollar is already losing its safe-haven status. Governments have been dumping dollars en masse in favor of gold for a while.

Trade Realignment

The Trump administration’s sweeping tariff policy has significantly disrupted the existing global trade framework, adding pressure to already fragile supply chains, and raising questions about the long-standing perception of the US as a reliable investment haven.

While the stated goal was to boost domestic manufacturing and narrow the trade deficit, the broader consequences have been difficult to ignore. Many countries are now forging new trade partnerships, and a growing share of global commerce is shifting away from reliance on the US dollar.

Even if President Trump can land 180+ trade deals within his self-imposed 90-day window, the fallout from the trade disruptions could be unavoidable. Ray Dalio, the Founder of Bridgewater Associates, warns1:

Whatever happens with tariffs, these problems won’t go away. It’s already too late.

Gold’s Rising Status

As the dollar’s dominance falters and worldwide trade realigns, physical gold has emerged as the cornerstone of the burgeoning global financial system. Countries have been steadily offloading dollar-linked assets while adding to their gold bullion reserves at historic rates.

The global financial system is being reshuffled, with trade, geopolitics, and monetary systems.–

Systemic Uncertainty Prompts Gold Rush

Gold demand has picked up from nearly every source of demand, from the biggest national players down to average investors, highlighting gold’s rising status as the preferred safe-haven in a sea of volatility and uncertainty:

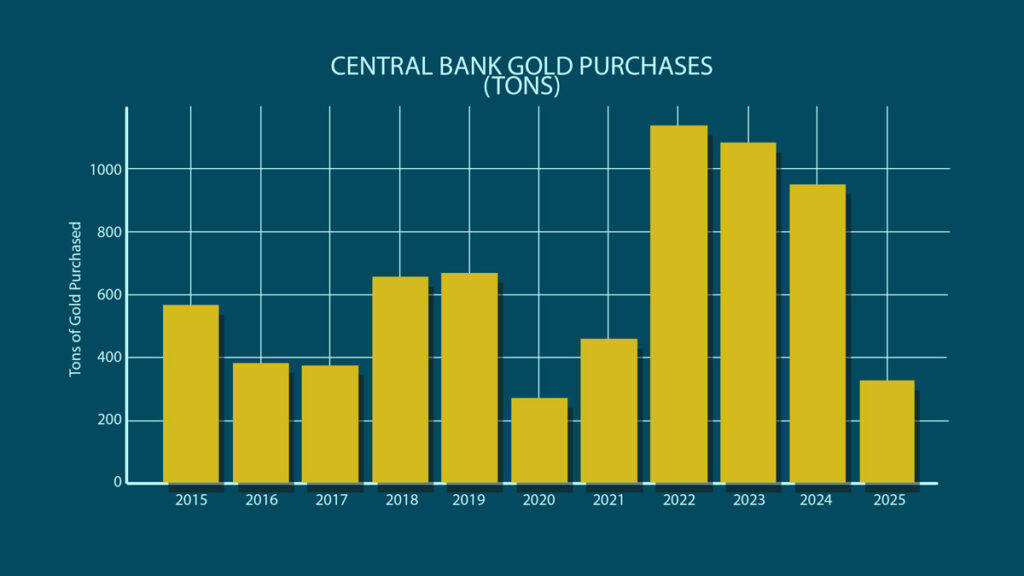

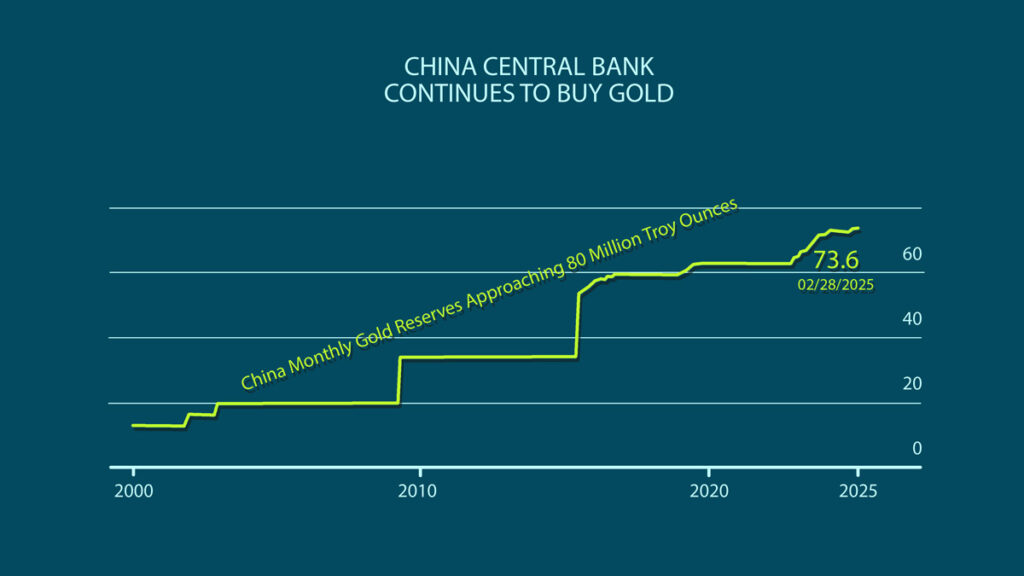

- Central Bank: Governments have purchased more than 1,000 metric tons of gold for the past three consecutive years, with emerging markets such as China leading the way.

- Institutional: Major institutional investors have upped their traditional gold allocations from 2–5% to upwards of 8–12%.

- Retail: Gold exchange-traded fund (ETF) inflows, a popular metric of retail demand, reached a three-year high in Q1 of 2025, while remaining below 2020 levels.

“Gold seems to be the ultimate global asset right now for safety and the store of value, the store of wealth.”

An ‘80s Rally Repeat?

Some experts are comparing gold’s current surge to the record-setting rally posted in the 1980s. Amid nearly a decade of stagflation, the yellow metal spiked over 1,500%. If those same gains played out today, prices would explode to over $30,000 an ounce.

That might seem far-fetched now, but many analysts are raising their gold price predictions for 2025 and beyond. A growing number of experts are putting $4,000/oz on the table in the next year, signaling an increasingly bullish outlook.

Don’t Wait to Buy Gold, Buy Gold & Wait

Gold has a tendency to reward patience, not hesitation. Although prices remain near all-time highs, the general consensus is that the upsurge is far from over. As uncertainty, volatility, and weakness pervade traditional markets, gold shines as a stable foundation.

When there’s nowhere else to park your money that’s safe, you really need to get on board.–

As interest in both gold and silver continues to grow, now’s a great time to learn more. If you’re wondering how precious metals could help fortify your wealth, claim your FREE COPY of our Gold & Silver Report.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields