Following a strong first half in 2025, the precious metals market is setting up for another surge in the latter part of the year. Gold, silver, platinum, and palladium boasted impressive individual gains, but collectively these physical assets outpaced the industrious metals market and the entire energy sector. According to UBS, the commodities mark is entering a supercycle, which could propel gold to fresh highs.

Following a strong first half in 2025, the precious metals market is setting up for another surge in the latter part of the year. Gold, silver, platinum, and palladium boasted impressive individual gains, but collectively these physical assets outpaced the industrious metals market and the entire energy sector. According to UBS, the commodities mark is entering a supercycle, which could propel gold to fresh highs.

Precious Metals Shine Bright

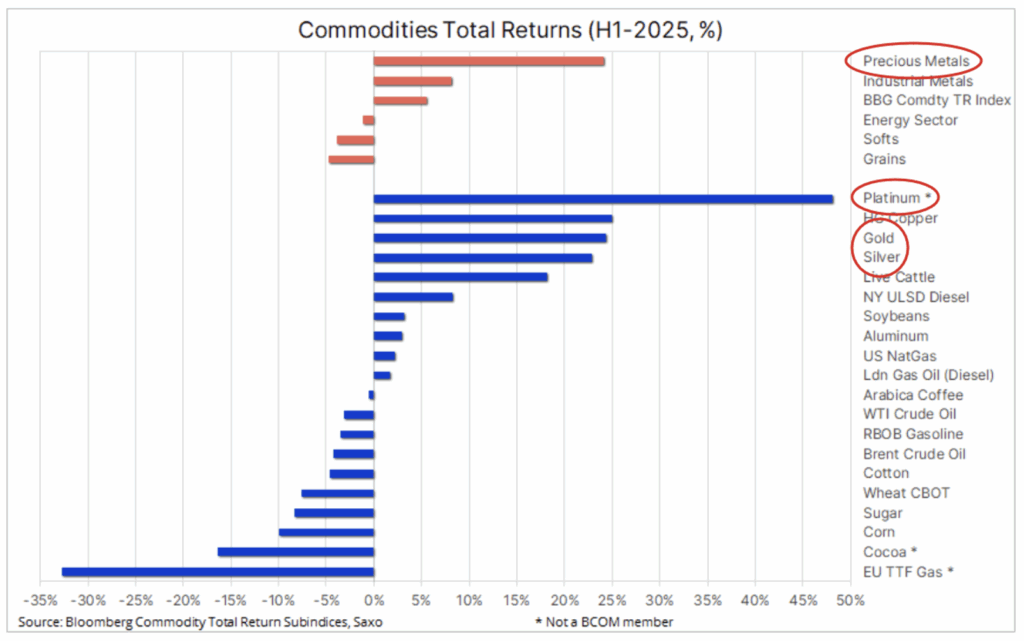

The precious metals sector posted an impressive performance in the first half of 2025, with all four major metals logging double-digit gains amid a weaker dollar, geopolitical tension, and renewed central bank demand. Individually, each metal contributed significantly to the rally:

When accounting for each metal’s relative market size and value, the entire precious metals space returned an impressive 25%. In comparison, the energy sector contracted by 1%, while softs and grains fell by nearly 5% each.

Even compared to major stock indices (usually among the top-performing assets), precious metals outperformed. The S&P 500 returned just 5.5% and the Dow Jones only 3.6% in the first half of 2025, meaning precious metals pulled ahead by a factor of five to eight times.

Incoming Commodities Supercycle

Despite their impressive gains in the first half of 2025, precious metals are poised for continued strength as a broader commodities supercycle gains momentum. According to UBS, a range of macroeconomic, structural, and geopolitical forces “continue to lay the groundwork for a potential commodity bull market.”

The last time commodities entered a supercycle, during China’s rapid industrialization from 2000 to 2008, gold and silver prices each surged more than 200%. Specifically within the precious metals space, the following factors are poised to have the most outsized impact:

Fiscal Sustainability Concerns

As the national debt surpasses $37 trillion and a Republican-led Congress greenlights trillions more in spending, economists are sounding the alarm over the country’s unsustainable fiscal trajectory. Moody’s, the last of the three major credit rating agencies to hold out, downgraded the US’s fiscal rating, signaling deepening concerns about the long-term credibility of the dollar.

Tariff-Induced Supply Shocks

Trump’s unpredictable, on-again off-again tariff policy has created widespread uncertainty, leaving the economy stuck in a holding pattern as businesses delay investment and hiring decisions. This erratic approach to trade has also disrupted global supply chains, often tightening the availability of precious metals, adding volatility to the market, and spiking prices.

Ongoing Dollar Weakness

A combination of a combative trade policies, federal overspending, and debt accumulation is weighing heavily on the dollar’s reputation as the world’s reserve currency. Once the uncontested cornerstone of the global financial system, the USD is losing ground to both gold and the euro as a portion of official reserves.

Fed Policy Reversal

The convergence of these macroeconomic and geopolitical variables are expected to force a sharper-than-expected reversal by the Federal Reserve. A potentially rapid drop in interest rates may attract an equally steep rise in precious metals demand as opportunity cost of owning non-yielding assets wanes.

Where are gold and silver headed?

Beyond merely highlighting the macroeconomic and geopolitical tailwinds behind the precious metals rally, UBS is putting bold numbers to its forecast. The Swiss bank projects gold could reach $4,000 within the next year.

If that target is met and the gold-to-silver ratio normalizes to 80:1, silver prices would likely surge to $50 per ounce, returning to their 2011 highs.