In this week’s The Gold Spot, Scottdale Bullion & Coin’s Precious Metals Advisors Brian Conneely and Todd Graf draw parallels between gold’s cup-and-handle breakout and silver’s current price action. They explain how shiny metal mirrors major gains in 2011 and the advantageous risk-to-reward ratio that makes silver appealing compared to other assets.

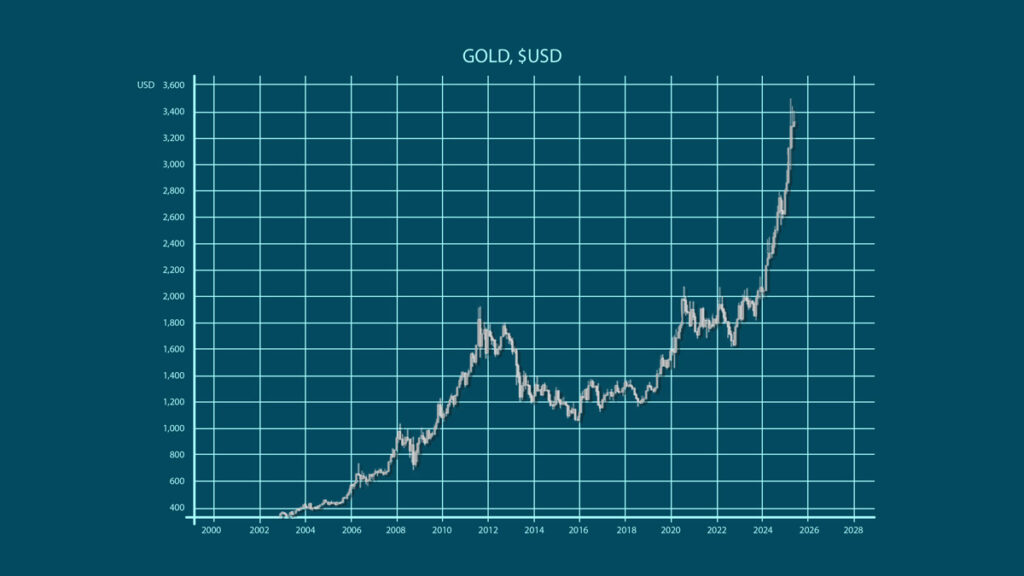

Gold’s Cup-and-Handle-Breakout Recap

Gold’s soaring price increase has been undeniable over the past few years, capturing the attention of retail investors worldwide. In fact, nearly one-fourth of investors globally cite gold as the top long-term investment, up significantly from prior years.

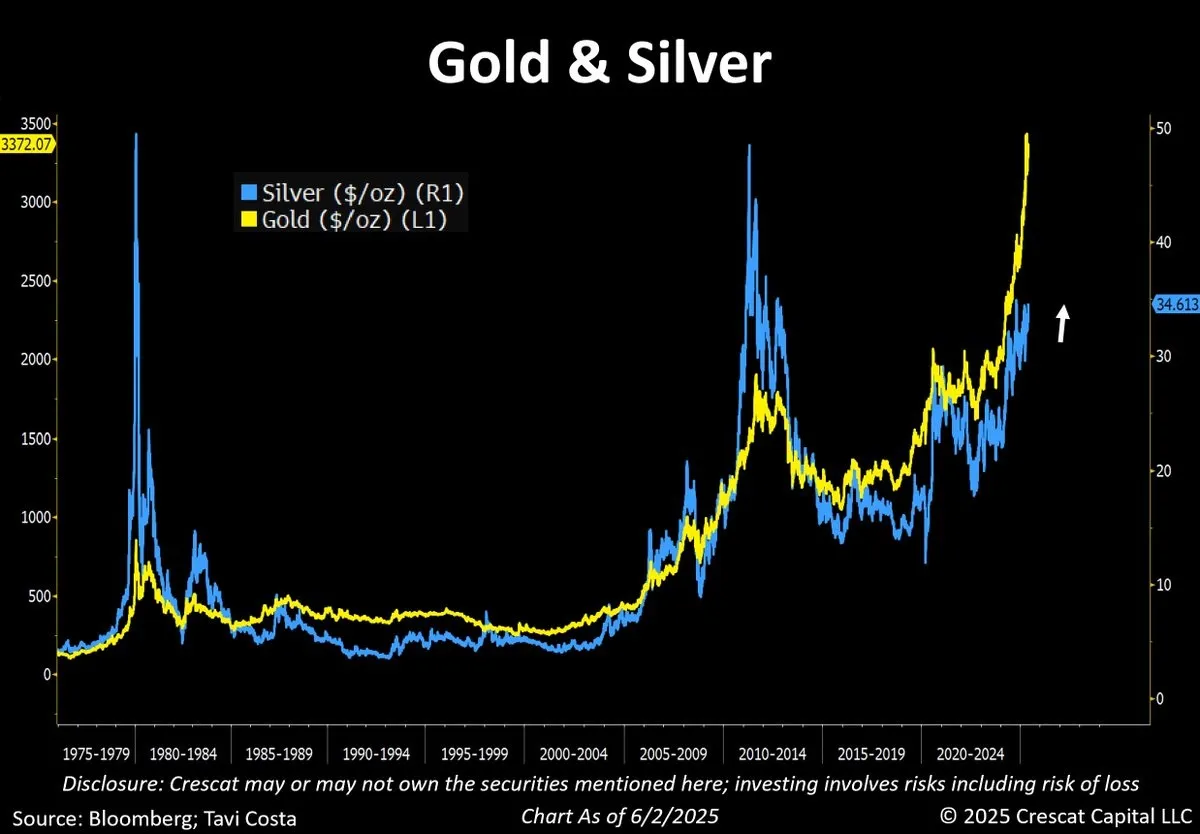

When charting gold’s price action over the past few years, a clear cup-and-handle pattern emerges. This extremely bullish indicator develops as an asset steadily recovers, consolidates, and gains buying pressure before breaking out to new highs.

Gold has been developing this formation since 2012, when it fell from $1,800/oz to just over $1,000/oz. The yellow metal consolidated for a handful of years before retesting the $1,800 barrier. Following a strong breakout in September 2023, prices have skyrocketed by 86%, hitting $3,400 by April of 2025.

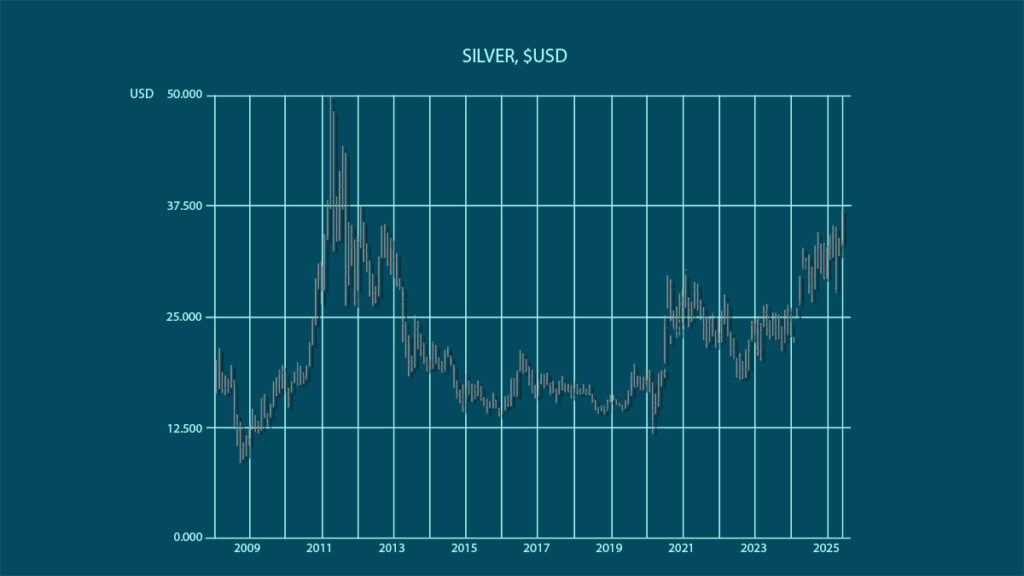

Silver’s Cup-and-Handle & 2011 Gains

Over the past few years, silver has followed quietly in gold’s shadow, but the shiny metal is poised to outpace its golden counterpart. Silver prices have jumped from $20/oz to $39/oz, inching closer to the key $40 level.

This recent breakout above a 14-year high mirrors the market’s surge from $11.30/oz to $49.89/oz between 2009 and 2011. Right now, silver appears to be in a breakout from its “handle” phase of its own cup-and-handle formation, suggesting significant gains ahead.

Silver Lagging Behind Gold…Until Now

Historically, silver tends to lag behind gold during major bull markets. When gold makes a significant move, silver often follows with a delay of about 15 to 18 months. This pattern has repeated across multiple cycles, as gold usually reacts first to macroeconomic shifts while silver plays catch-up once momentum builds.

Gold began its latest breakout in early 2024, surging past prior highs and gaining strength throughout 2025. That puts silver right on schedule for its breakout. If the historical timeline holds, this delay strengthens the bullish case for silver heading into the next several months.

The strength of gold and silver now is inevitable.–

Macros Add Momentum

On top of bullish technical charts and historical precedence, silver is also poised for major gains due to various macroeconomic factors, including:

Market Manipulation

For decades, the silver market has been manipulated by institutional investors who artificially suppress prices to enhance their profits. However, the shiny metal’s sheer momentum and rising demand threaten to blow the lid off this forced price cap.

Inflation

Following multiple years of high inflation (on top of the Federal Reserve’s baseline target of 2% annually), the days of buying silver for cheap are long gone. Ongoing fiscal instability and poor federal oversight have eroded the dollar’s purchasing power, particularly in relation to hard assets, driving prices higher.

Debt

The US national debt recently barreled through the $37 trillion mark with no signs of slowing down. The GOP’s One Big Beautiful Bill Act is estimated to add trillions more over the next few years, and neither political party seems committed to solving the fiscal burden. With a debt crisis looming, more investors are turning to hard assets, such as silver, which is furthering the rally.

Silver’s Asymmetrical Upside

Silver has maintained its value for thousands of years, and with strong investment and industrial demand, it’s safe to say it will never reach zero. Few assets offer such historical reliability.

Combine that with a structurally bullish setup, both technically and macroeconomically, and silver presents one of the most attractive risk-to-reward profiles in the market today.

Its downside is limited, but its upside potential is massive. That’s a rare equation in any asset class due to widespread volatility, uncertainty, and weakness. This growth potential is reflected in silver forecasts for 2025, which keep getting revised to the upside as the shiny metal rises steadily.

“Silver’s upside potential is huge–many multiples of where the price is now. For investors looking for something safe that can also grow quite a bit right now, silver is one of the best assets to be looking at.”

Is your portfolio ready for silver’s surge?

From a technical and macroeconomic perspective, it’s clear that silver’s breakout is gaining steam. With a potentially historic rally on the horizon and a rare risk-to-reward profile, savvy investors are positioning their portfolios for success now. The most immediate way to benefit from this potential surge is to buy physical silver bars and coins.

Before silver stretches to new all-time highs, learn how the shiny metal can bolster your portfolio as a hedge against inflationary pressures and security against geopolitical turmoil.

To put yourself in the best position to succeed, check out our FREE Silver Investor report.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields