Silver is grabbing headlines, but gold is telling the real story. Beneath the rallies and record highs, the foundations of the financial system are shifting fast.

In this week’s The Gold Spot, listen to Scottsdale Bullion & Coin’s Precious Metals Advisors Tim Murphy and Todd Graf unpack the deeper forces behind the silver surge and explain why gold’s structural fundamentals remain the stronger long-term asset.

Precious Metals Barrel Into 2026

Following record-setting performances in 2025, gold and silver are wasting no time capitalizing on their historic gains. Roughly three weeks into 2026, both metals have set several fresh all-time highs.

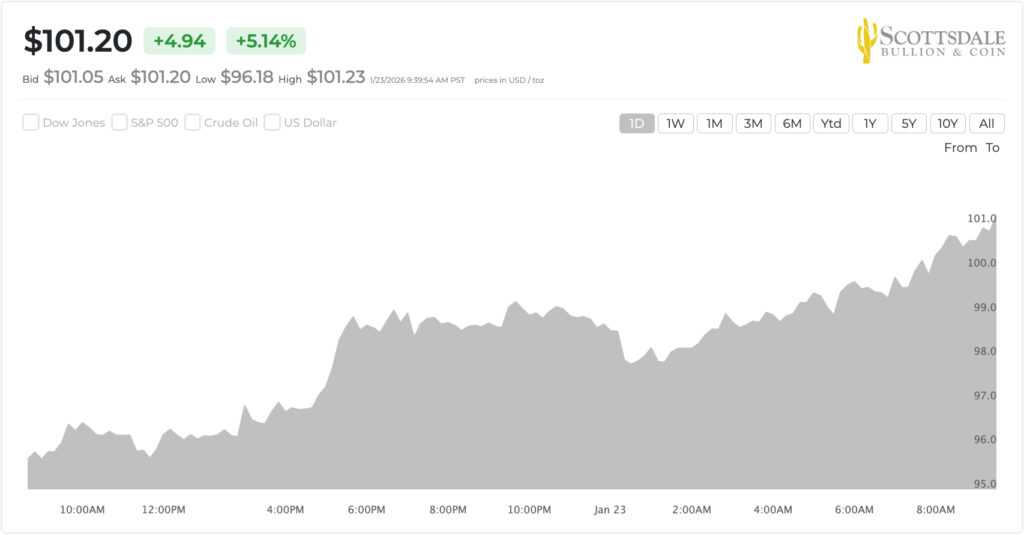

Silver Steals the Spotlight

Silver spot prices break past $100/oz on January 23, 2026

Silver prices have stolen the show with a thumping +40% surge, spiking from $71/oz to over $100/oz. For perspective, the shiny metal has already achieved half of gold’s value growth from the entirety of 2025. Understandably, this booming growth has stolen the precious metals show.

Google searches for “silver” have spiked, reaching unprecedented volume1. In the past month, retail investors have poured $69.2 million into iShares Silver Trust — the most widely traded silver exchange-traded fund. This influx marked the second-highest movement into silver from retail participants ever recorded.

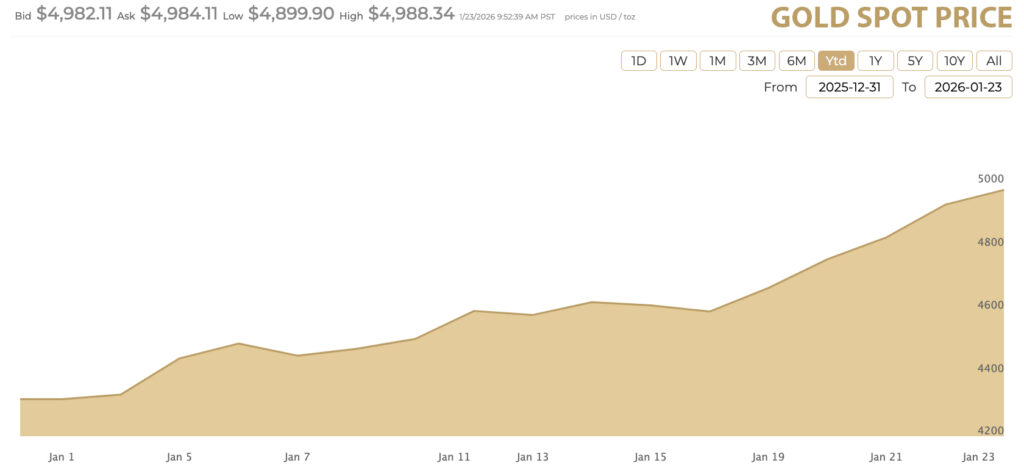

Gold’s Behind-the-Scenes Strength

During the same three-week period, gold staged its own mini-rally, topping off 2025’s surge with a 15% rise. The yellow metal leapt from $4,350/oz to $4,988/oz. Similar to other precious metals bull markets, the sheer strength of gold prices holds the public’s interest until silver starts outrunning its larger cousin.

With gold knocking on the door of $5,000/oz and the fundamentals remaining unchanged, the metal’s strength remains undeniable. Focusing too much on silver, investors run the risk of missing out on the yellow metal’s own investment merits.

Why Investors Shouldn’t Lose Sight of Gold

1. Wealth Insurance vs Speculative Growth

Gold is the quintessential hedge against market volatility, uncertainty, and depreciation due to its proven ability to keep pace with inflation. This inherent value and built-in resilience exhibits itself in steady upward momentum and reliable growth.

On the other hand, silver is notoriously volatile, known for rapid movements in either direction. In reality, gold’s 15% growth versus silver’s +40% surge — along with their disparate returns in 2025 — is the perfect illustration of this difference.

At the moment, the shiny metal’s skyrocketing value is captivating and distracting. Long-term investors focused on building and protecting wealth across decades recognize this temptation and keep their sights set on gold.

“Gold is a dollar hedge. That fundamental case hasn’t changed. It’s only gotten stronger.”

2. National Debt Protection

Standing at $38.6 trillion, the U.S. national debt is a towering representation of the country’s decades-long fiscal irresponsibility. For perspective, the debt bubble doubled in size since 2015, when it was only $18 trillion.

Every day, the federal government is digging the debt hole another $6 billion deeper. That’s $255 million per hour. At its current pace, the national debt is predicted to hit $39 trillion by April and an eye-watering $138 trillion by 2055, according to the Congressional Budget Office.

“When the dollar's buying power is being systematically eroded, you need an anchor.”

3. Debt as a Political Football

The national debt time bomb is ticking, and no political party or politician wants to be left holding it. The result is a never-ending game of hot potato in which the existential budget issue is passed to the subsequent administration. The pace of growth is remarkable, and only picks up speed.

Within the first calendar year of the second Trump administration, around $2 trillion has been added to the debt. Furthermore, the president is pushing to increase defense spending by 50% within a year, which would add $1.5 trillion to the U.S. deficit.

4. Burdensome Interest Payments

While budget hawks justifiably focus on the non-discretionary spending — such as Social Security, Medicare, and Medicaid, which comprise 60% of the annual federal budget — investors shouldn’t lose track of rising interest payments. Every year, the U.S. spends nearly $1 trillion on interest payments to simply service the debt.

In 2025, that amount was $970 billion. For reference, that represents nearly 14% of all federal spending for that calendar year. Current interest payments eclipse defense spending, underscoring this growing financial burden.

5. Booming Debt-to-GDP Ratio

Another way to understand the foundational economic risk posed by the colossal debt burden is how it stacks up against the country’s gross domestic product (GDP). Right now, the debt-to-GDP ratio stands at an alarming 124%.

For reference, this important metric only reached 106% at its height during World War II, when spending was arguably unavoidable, rather than discretionary. Over time, the U.S. government has proven to spend more than the economy can create, negating the argument that the country can simply “outgrow” the problem.

Gold as the New Financial Anchor

When debt grows faster than economic output, interest payments eclipse some of a country’s largest budget items, and no political path to resolution is available, the fiat currency at the foundation of that system rapidly loses value, trust, and legitimacy.

That’s precisely what’s happening right now, as risk becomes structural rather than cyclical. Over the past few years, gold has risen as the new foundation upon which countries and institutions trust to build their financial futures.

Silver’s Surge vs. Gold’s Structural Case

Silver’s monumental rally is exciting, historic, and financially beneficial. There’s no question about the shiny metal’s hard returns and further growth potential. However, this mind-boggling growth risks distracting from a more foundational and consequential story: The U.S. is on an unsustainable, unchallenged fiscal path that will lead to foundational economic challenges.

The systemic obstacles that have undergirded gold’s years-long rally, such as central bank demand, global de-dollarization, and the national debt crisis, very much remain active. Many of these factors are even getting worse. Savvy investors who have been through various market cycles understand that silver’s gains shouldn’t distract from gold’s foundational investment value.

It’s quickly becoming more important than ever to learn how to protect your wealth from the dollar-squeezing policies of the federal government and the subsequent erosion of the current economic order.

Claim a FREE COPY of our popular Rookie Mistakes Guide to learn how to avoid the 22 common blunders precious metals investors make. Ensure your investments optimize your wealth and financial goals.

2026 Precious Metals Forecasts & Predictions

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

SUGGESTED READING

SUGGESTED READING

Questions or Comments?

"*" indicates required fields