Bitcoin’s stellar price performance has been dominating the news lately, making many investors wonder if they should go all in on the cryptocurrency. You might’ve even heard some people singing Bitcoin’s praises by calling it “digital gold.”[1]

Such comparisons have led steadfast gold bugs to ask questions like, “Should you cash in your gold for Bitcoin before there’s another massive price increase?” or “Will this digital form of currency outperform traditional assets?”

Before you buy a single Bitcoin, get the facts straight. Here, we’ll take a deeper look at how Bitcoin compares to gold, so that you can make an informed decision about investing in the cryptocurrency.

Is Bitcoin Digital Gold?

Although the claims of Bitcoin being “digital gold” were partly sensationalist, there’s some rationale behind this comparison.[2]

Here are a few ways in which Bitcoin and gold are similar from an investing standpoint.

Bitcoin and Gold Are Alternative Assets

Bonds, certificates, stocks, and similar assets are considered mainstream investment instruments. As these have become viewed as standard, anything that falls outside of this group is known as an alternative asset, a category into which both Bitcoin and precious metals fall.[3]

Investors typically use these alternative assets to diversify their portfolios and protect their nest eggs because such assets can have an inverse relationship to stocks and bonds.[4] Thus, when the stock market’s down, gold could be up or at least stable.

Some think Bitcoin could help hedge against stock market volatility too, though the cryptocurrency has its own volatility issues to consider (keep reading for more on this below).[5]

Bitcoin and Gold Are Scarce

Both gold and the leading cryptocurrency are rare assets.

The Earth’s resources are limited, and there is a finite amount of gold. The U.S. Geological Survey estimates there is only about 50,000 tons of gold reserves left underground to mine. And with mining output falling in recent years, rumors that we’ve reached peak gold are swirling around the industry.[6]

When it comes to Bitcoin, its creators decided to put a cap on the amount that could be digitally mined. The limit is 21 million Bitcoin, and protocols ensure that all of this cryptocurrency won’t be out until 2140.5 So, there is a finite amount of Bitcoin too—as long as its creators don’t change their mind.

Bitcoin and Gold Are Both Liquid Assets

Another commonality between gold and Bitcoin is liquidity. Both assets exist in highly liquid markets in which investors can easily exchange them for fiat currency.5 In other words, it’s typically easy to exchange Bitcoin and gold for U.S. dollars. This can make your investments more flexible and dynamic.

How Is Bitcoin Different from Gold?

Even with some similarities, Bitcoin and gold are not the same. There are some critical differences investors must know in order to make wise decisions regarding these two investments.

Bitcoin vs. Gold: Demand

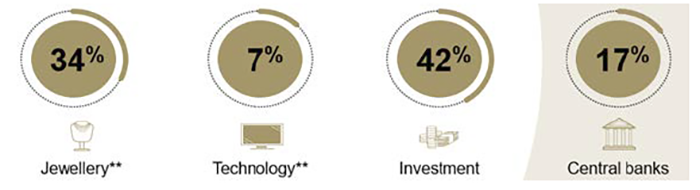

It’s no secret that supply and demand can influence the price of an asset. Compared to Bitcoin, gold has more demand drivers: 34% of the world’s gold is melted and shaped into ornamental jewelry; 7% is used by the technology sector; 17% can be found in central bank vaults; and 42% helps diversify the portfolios of private investors. Hence the price of gold’s steady ascent.

Investors are the sole source of demand for Bitcoin. When investor sentiment sways, Bitcoin prices swing.[7]

Gold’s Diverse Demand

Figure 1: Gold’s demand is linked to investment and consumption

Composition of average annual net demand*

*Based on 10-year average annual net demand estimates ending in 2020. It excludes over-the-counter demand.

**Net jewellry and technology demand computed assuming 90% of annual recycling comes from jewellry and 10% from technology. Source: World Gold Council

Bitcoin vs. Gold: Risk

Cryptocurrencies, including Bitcoin, have led to improved performance in investors’ portfolios. However, this increase in value has been associated with an increase in risk.7

To make matters worse, there have been horror stories of investors losing millions of dollars-worth of Bitcoin either due to lost passwords or theft.[8][9]

👉 Suggested Reading: ‘Dr. Doom’ economist Nouriel Roubini breaks down why bitcoin is neither a currency nor an asset – and is instead a giant bubble

In contrast, gold has consistently been seen as a reliable store of value, especially during times of economic uncertainty, like we’ve been seeing during the pandemic.[10]

Bitcoin vs. Gold: Regulations

Regulatory burdens are an important consideration for investors and another significant difference between gold and Bitcoin.

Between 1933 and 1974, the government only allowed citizens to own gold bullion with a license. Ever since these regulations were lifted in 1975, however, investors have been free to hold gold without any restrictions.

American investors may find the regulations governing Bitcoin confusing because both the Commodity Futures Trading Commission (CFTC) and the Internal Revenue Service (IRS) oversee the cryptocurrency, and they classify it differently: the CFTC considers Bitcoin a commodity, while the IRS evaluates it like property.

“The problem is a technical one. It’s not possible to calculate your cryptocurrency tax liability without sophisticated software,” explained Perry Woodin, CEO of Node40, a Software-as-a-Service (SaaS) company for cryptocurrency tax reporting.[11]

Bitcoin vs. Gold: History

To determine the reliability and efficacy of an asset, investors can look at their past performance. Through this lens, gold has a significant advantage over Bitcoin. While gold has been consistently exchanged and used as a store of value for over 2,000 years, Bitcoin has a more inconsistent and much shorter history.[7][12] Furthermore, gold is used both by retail and institutional investors.

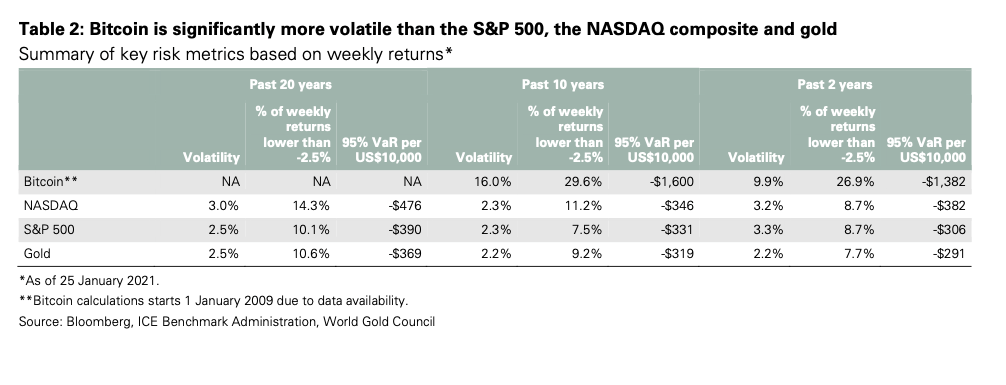

Bitcoin vs. Gold: Volatility

Investors tend to avoid assets with too much volatility, an area where Bitcoin falls short when compared to gold. Even though the leading cryptocurrency has reached record highs lately, it still undergoes considerable fluctuations. In 2018, Bitcoin fell from nearly $20,000 all the way down to $4,000. Then, in 2020, there was a 300% upswing.

Gold prices can experience some volatility but, as analysts at JP Morgan assert, far less than Bitcoin.

“In our opinion, unless Bitcoin volatility subsides quickly from here, its current price … looks unsustainable,” said the analysts.[13]

Bitcoin Is More Volatile than Stocks and Gold

Source: Gold.org (PDF)

Is It Better to Invest in Gold or Bitcoin?

Is Bitcoin a good investment? It depends on what you’re trying to do. Diversification isn’t about going all in on any one asset. Instead, it’s about investing in a number of different assets—both traditional and alternative—in order to limit your risk and increase your potential yield.

Although Bitcoin has experienced a meteoric rise in value over the past few years, it’s a riskier investment than gold.

It’s important to keep in mind that diversification isn’t a get-rich-quick scheme. Instead, it’s a long-term investment strategy designed to protect your wealth through market fluctuations and other economic uncertainties.

👉 Suggested Reading: Jim Cramer: “You Need Some Gold” to Protect Against Inflation & Economic Chaos

Wise investing starts with educating yourself about the rewards and risks associated with each type of asset in your portfolio. If you’re ready to discover more about how gold and silver can help you diversify your portfolio, Request the FREE Precious Metals Investment Guide today.