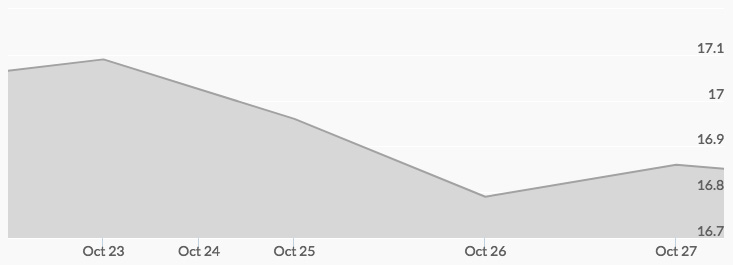

Last week opened with live silver prices at $17.03 in overseas trading and, like gold, moved up and down in a tight range before U.S. markets opened Monday morning. Prices shot up to $17.09 by midday New York time and continued to climb to $17.12 at the end of the day. Tuesday opened with silver prices slightly up at $17.14 before a pullback in the markets resulted in a close of $16.89. Wednesday opened flat at $16.89 and again moved in a tight range until the beginning of U.S. trading, when silver followed the rest of the precious metals on a steady climb to close out the day at $17.00 even. Thursday’s open again saw a fairly narrow range in overseas trading but then the start of the day in the U.S. markets marked a pullback that brought silver markets to a close at $16.78. Friday opened down a penny in overseas trading and fell to $16.64 before the U.S. open, at which point silver bulls drove the price up all day to close out the week at $16.87.

Silver’s price chart again followed in gold’s footsteps. Strength in the dollar and equities markets was one factor influencing prices. Rumors that President Trump seems to be leaning toward Jerome Powell for the new chair of the Federal Reserve served to support both. 1 However, bull markets for silver counteracted pullbacks on Tuesday and Thursday on the other days of the week. Expert opinions on this range from building open interest to technical analysis that suggests that silver is preparing for a breakout. 2

This week will bring important economic data. A statement from Tuesday and Wednesday’s FOMC meeting will be released on the latter day. The Bank of England and the Bank of Japan will also be holding meetings on monetary policy this week. On Friday, the U.S. employment report for October will be issued.