The silver price rebounded on Monday after last week’s 8% losses, as technical buyers entered the market. The Federal Reserve is giving strong indication that a rate hike will occur in December, which is bearish for both gold and silver. The dollar hit a two-month high last week, pushing both metals down.

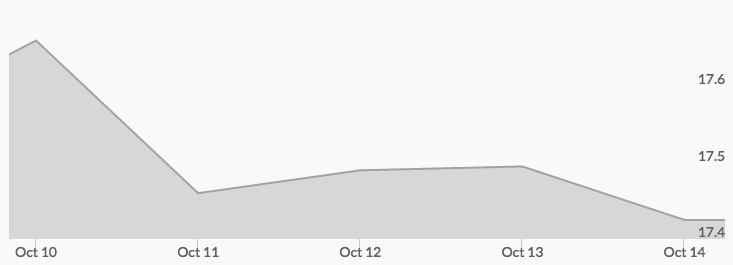

The price of silver opened around $17.60 per ounce, and bounced up to $17.75 on Tuesday before falling the rest of the week. The dollar dropped lower on Thursday, along with bond rates, but silver stayed low. The U.S. jobless data was stronger than expected this week.

Silver trading this week was choppy, similar to gold. Both metals, along with the dollar, seemed to be caught in a gray area of support and resistance, making time. A December rate hike is largely expected and could be the next major impetus for precious metals price movement; the presidential election could also spur a price direction. Silver closed the week around $17.40 per ounce.