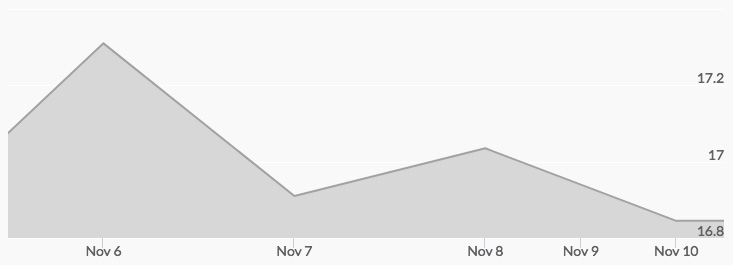

Monday’s open for silver prices came in at $16.89, slightly down from last week’s close of $16.91, but the market quickly took off. Silver bulls took over the day right from the start and at one point the metal hit an intraday high of $17.25, which represented a surge of more than 2 percent in the span of just a few hours. The market later settled at a close of $17.22, just under 2 percent up for the day. The price of silver pulled back on Tuesday, opening at $17.11 and closing at $17.00. Afterhours trading then pushed silver prices back up to open Wednesday morning at $17.03. Live silver prices reached an intraday high of $17.19 before closing at $17.04. The bulls continued to run in afterhours trading and Thursday’s market opened at $17.09, pulled back in early trading, then took back most of the lost ground to close out at $17.02. Friday opened up for the fourth day in a row at $17.04, but after having moved independently of gold throughout much of the week, silver followed the yellow metal, with prices pulling back to $16.88 by the close.

Silver, like the rest of the commodities complex, was led up by oil prices in the wake of news of the Saudi royal shake-up over the weekend. Oil rallied in response to uncertainty stemming from the arrests of scores of current and former senior ministers, Aramco executives, and princes, putting the future of the world’s largest oil producer in question. Pushback on the GOP’s tax plan involving the 20 percent excise tax on foreign sales added to the flight to quality, and increased prices for the majority of the precious metals complex for the week. 1 In an otherwise bullish week, gold pulled the market back on Friday as, on an otherwise light trading day due to the Veteran’s Day holiday, the unwinding of a major short position on COMEX gold resulted in a dip in all precious metals prices.