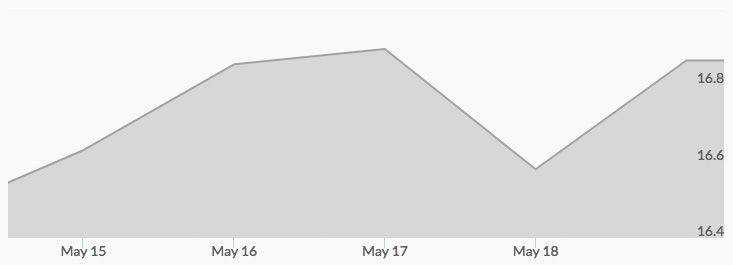

The spot silver price chart reported that the week opened at $16.72. Light trading kept prices for the white metal in a narrow range before closing up at $16.66. Afterhours trading saw more buying, which resulted in an opening of $16.72. Steady buying sent the price of silver to $16.94 on Tuesday, and the Wednesday opening moved higher to $16.98. The week’s high of $17.03 followed by early morning, and then profit taking took the quote per ounce to $16.93 at the close. That trend continued after the markets closed, and the pressure delivered a Thursday open of $16.73. The buyers jumped in at $16.58 and moved the silver price back to $16.67 at the close. This set the stage for a strong Friday, opening up at $16.83 with enough momentum to deliver a solid $16.87 close, marking a slightly up week.

Analysts saw the week’s movement supported by some short covering in the gold and silver futures market, spurred by continuing turmoil in the U.S. political scene. This followed a lessening of concerns after the French election, but the risk aversion undercurrent continues to positively influence precious metal prices.

This was underlined by movement is the U.S. dollar index, which notched a six-month low early in the week. Other geopolitical risks continue to affect market pricing, including the North Korea missile testing and the global-wide ransomware attack.

The release of the May FOMC meeting minutes will occur this Wednesday, and they are not expected to provide any new impact on the market other than hints about the timing of future rate increases. The U.S. political drama, including the possible appearance before Congress of former FBI Director Comey, has the potential to create short-term market movements.

In addition to U.S. political and economic news, a big focus for the markets this week will be the 172nd OPEC meeting. The production cuts will likely be extended into 2018, and this action will produce more firming in oil supplies and prices. Some analysts see the current oil price activity as a short-term support for gold and silver, and no major changes in OPEC policies are expected.