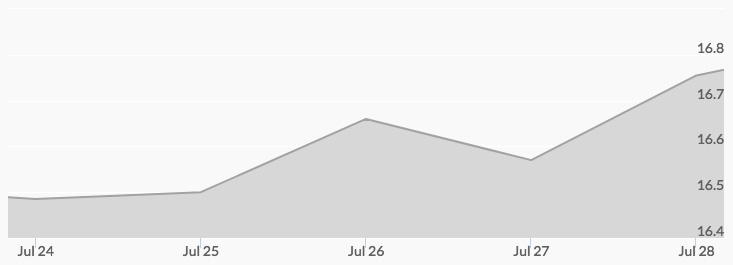

The historic silver price chart indicated that the white metal opened at $16.54 last Monday and closed at $16.49 due to light day trading. The opening bid for Tuesday was 30 cents higher at $16.60, but profit taking resulted in a close for the day of $16.48. Wednesday’s opening bid was essentially unaffected by aftermarket selling at $16.47. Steady buying set in until midafternoon saw a high trade of $16.66 before silver prices moved to a slightly lower close of $16.64. Continued activity caused a jump to $16.79 on the Thursday open, but more selling saved off some of that gain for a final bid of $16.58. Once again, the Friday open was helped by premarket buying, resulting in an early bid of $16.69. Interest continued to generate more buying until the final price for the week closed up nearly a quarter at $16.76.

While the market produced an attractive return for silver during the month of July, silver moves into August this week with investors and traders still seeking firm direction. Traders who watch the Gold Silver Ratio note the indicator has been giving signals to buy silver, and this may generate more interest in the coming days. 1

Factors that are also bullish for silver include the struggling U.S. dollar and ongoing concerns about the economic recovery. Production continues to decline at the mine level, and this creates a major upward pressure as demand keeps growing. 2

Limited news is scheduled to provide much market insight in the coming days. ADP will produce its report on the latest job data, and the Australian Central Bank will announce its decision concerning interest rates, currently at 1.5 percent.

Speculators covering shorts and looking to higher prices in futures indicate many buyers believe the current momentum is bullish for silver prices. Meanwhile investors are seeking opportunities to buy silver at current prices.