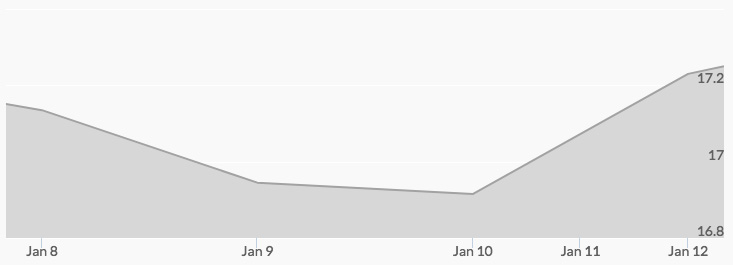

Silver did not continue its four-week rally this week, but didn’t lose much either. Monday opened with live silver prices in the midst of a pullback at $17.14, which dipped as low as $17.06 before closing at $17.12 for the day. Tuesday’s open saw silver prices pull back to $17.03 and intra-day trading dipped below $17.00 briefly before closing out the day exactly at the $17.00 mark. Wednesday opened up at $17.12 then slipped just under the $17.00 mark to close at $16.99 for the day. Thursday opened with the price of silver slightly off at $16.98, traded in a tight range for the day, and closed where it started the day. Friday’s open surged to $17.15, the markets rallied to $17.26 in intra-day, and then closed the week out at $17.21, just under where it closed the previous week.

The early part of the week brought the news that equities all over the world are massively overbought. Bloomberg’s Relative Strength Index showed that the S&P 500, the MSCI Asia Pacific Index, the MSCI World Index, the Nikkei 225, and the MSCI Emerging Markets Index are all significantly overbought, while the Euro Stoxx 600 is approaching overbought territory. 1 As we’ve been saying, the signs of a stock market bubble are getting harder and harder to ignore.

Concerns over disruption of international trade grew as reports surfaced of more difficulties in Nafta negotiations. The Trump administration’s focus on eliminating trade deficits with its Nafta partners is a major driver in the discussions, and as talks continue, concerns are growing that agreement will not be reached. These concerns caused jitters in equities markets but helped drive the end-of-week rally in the precious metals sector. 2

The week closed out with news that China’s 2017 imports of a whole range of commodities set new records. 3 The news was bullish for all of the commodities complex, including precious metals, and helped pull silver up at the end of the week.