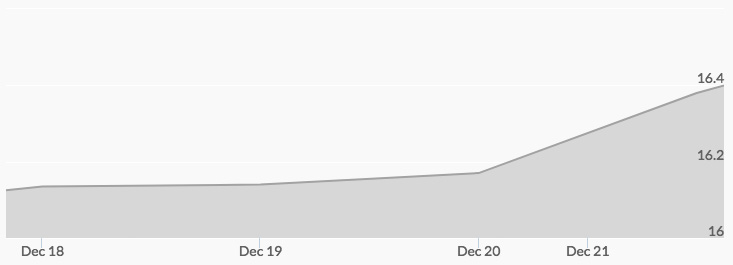

Similar to gold, silver prices trended upward last week. The historic silver price chart indicated that trading opened on Monday at $16.15, $0.09 above the previous week’s close, and then closed the day slightly softer at $16.13. Tuesday opened with silver prices at $16.12, and then closed up on the day at $16.14. Wednesday opened with the price of silver up significantly at $16.22 and traded in this range throughout the day to close at $16.18, still up $0.04 on the previous day’s close. Thursday’s open slipped to $16.13, traded up to $16.20, and then closed back at $16.13. Yet on Friday, silver joined gold in a massive rally by opening up at $16.21, shooting up to $16.40, before finally settling at $16.33 to close out the week.

On Monday news of weakness in Wall Street bonus pools contributed to feelings of malaise in the traditional markets. Interest rate, currency, and equity traders were particularly hard it. 1 Given that Wall Street pays its people just enough to keep them from leaving each year, one may infer from the pay drops that the pros see a stock market correction coming in 2018.

Cryptocurrencies took another hit this week when a founder of litecoin, the world’s fifth biggest cryptocurrency, cashed out of all holdings in his creation. Charlie Lee, the San Francisco-based software engineer who created litecoin in 2011, claimed his action was driven by ethics, stating that ‘I no longer need to tie my financial success to litecoin’s success’ and that the move would allow him to comment on litecoin and other cryptocurrencies without a ‘conflict of interest.’ Savvy market observers however ask themselves if this insider hasn’t seen the writing on the wall, i.e. that the current market is an unsustainable bubble.

While markets focused on President Trump signing the tax bill into law and the passage of the GOP stopgap spending bill, a report from the Bank of International Settlements (BIS) outlined data showing that quantitative easing (QE) has become less effective. 2 3 If QE is now likely to be less effective and the world’s governments are running out of ways to keep the bubble afloat, we can expect the flight to quality to become a major source of demand for precious metals in the months and years ahead.