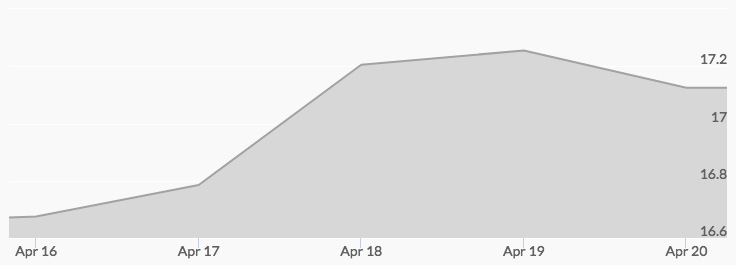

Silver opened the week in a buyer’s market with a price of $16.64 per ounce. After a mild rally midday, the white metal closed at $16.65. Tuesday saw live silver prices open at $16.64 again before dipping to the week low of $16.55. By day’s end, the price had risen again to $16.71. On Wednesday, the price of silver opened at $16.72 before soaring up to $17.23 at midday. The price of silver ended the day at $17.21. Thursday opened with silver prices at $17.20 before reaching the week high of $17.31. The day closed at $17.15. Those who missed lower prices earlier in the week got an opportunity to buy on Friday as the metal opened at $17.16 and dipped to $17.05 in the early morning hours. After a brief midday rally, the price of silver closed at $17.10.

On Monday, Russian firm Polymetal acquired a 45 percent stake in the Prognoz silver deposit. The company says that it foresees achieving a full production run-rate by 2024. On Tuesday, palladium prices dropped from their one-and-a-half-month high; this buying opportunity may have been responsible for fairly flat prices in silver.[1]

An overheated stock market due to corporate earnings on Wednesday encouraged some investors to take profits and protect them by getting into safer havens before the inevitable correction.[2] Friday’s slight easing in silver prices may have been related to the same factors that drove a dip in the price of gold.[3] There are signs that global tensions may ease, which can often make investors more confident. However, with situations in Syria and Russia far from resolved, there are strong indications that metals will continue their climb.