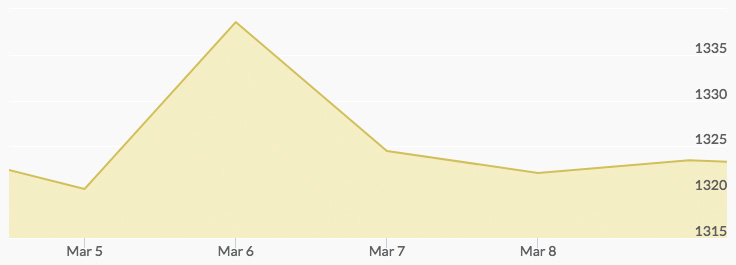

Gold had a big rally midweek, pulled back, and then rallied again to end the week up, reported the historical price of gold chart. On Monday morning, the price of gold opened slightly off from the previous Friday’s close at $1,321.90 and slipped to close at $1,319.55. The yellow metal took off in afterhours trading, however, and Tuesday’s open surged to $1,328.12. The gold rally kept going to close at $1,333.76 for a gain of a full 1.08 percent over Monday’s close. Markets hit a high of $1,339.06 for the week in Tuesday’s afterhours trading, and then cooled to open Wednesday with gold prices at $1,331.58. Gold pulled back to $1,325.12 by the close. Thursday opened slightly off at $1,324.99 and slipped to $1,322.22 by the close. The price of gold opened on Friday at $1,316.27 before rallying almost $7.00 to close the week up at $1,323.93.

Stock market participants were on edge last week over the prospect of a trade war between the U.S. and its trading partners. 1 Early in the week, the European Union (EU) threatened targeted tariffs on products from states that are part of the GOP heartland, such as bourbon, Harley Davidsons, jeans, and agricultural products. 2 Later in the week, it was revealed that EU officials were also seeking to negotiate exclusions from the new tariffs, while National Economic Advisor Gary Cohn organized a White House summit of U.S. executives from companies that purchase steel and aluminum to try and change the president’s mind on the tariffs. 3 4 By Thursday, however, Mr. Cohn had stepped down as top economic adviser, and the president signed the official proclamations levying tariffs of 25 percent on steel imports and 10 percent on aluminum imports but that excluded Canada and Mexico, two of our top suppliers of imported steel. 5 6

Midweek a little-noticed story quietly surfaced that piqued the interest of savvy gold investors. British real estate giant Knight Frank issued their annual wealth report for 2018, which shows that the global population with assets above $5 million and those with assets above $50 million are growing at a record pace. 7 More wealth typically means more gold buying, so the story is another bullish factor for gold in the months and years to come.