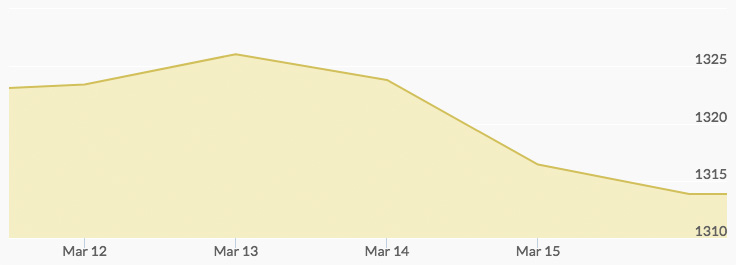

The price of gold opened on Monday at $1,315.78 and surged right from the opening bell to close up at $1,323.33. On Tuesday morning, gold prices slipped to $1,318.85 but again rallied from the open and closed up at $1,325.97. Wednesday opened with the price of gold up at $1,326.40; the yellow metal traded in a tight range for the day before closing slightly off at $1,325.33. Thursday’s open slipped to $1,322.22, and then the market pulled back to $1,316.55 by the close. Friday’s open pushed back up to $1,320.65, but gold prices pulled back again to end the week at $1,314.24.

News in the early part of the week revealed that demand for U.S. treasury bonds is at its lowest since October 2009. Apparently, demand has been shrinking for the past two years, in spite of steadily raising interest rates. Given the recent tax cuts, government spending must be met by borrowing, and so the slack in demand is a concern. 1 In short, no one expects the federal government to not be able to borrow to fund itself, but the shrinking interest in the bonds raises concerns. Any disruption of this kind is not good for the dollar but could be great for gold and precious metals.

Comments made by the latest nominee for the National Economic Advisor position in President Trump’s cabinet left vacant by Gary Cohn may have accounted for the pullback in gold prices late last week. Larry Kudlow, an economist who worked on Wall Street and in the Reagan administration, was tipped as the president’s choice for the most important economic advisory role in the nation. 2 Mr. Kudlow is known for highly opinionated commentary, which he displayed when he stated in an interview concerning his nomination that investors should ‘buy King Dollar and sell gold.’ 3 While gold slipped in the latter part of the week, the dollar moved up only marginally, suggesting that markets don’t buy his logic entirely. When taken into account with the shrinking demand for U.S. treasuries, it’s entirely possible that investors are beginning to believe that the federal government will struggle to keep growth going.