Shakespeare delivered this week’s soliloquy for gold in Henry VI: “Now thou art come to a feast of death.” Gold prices remain in the dumps after enduring the worst trading session in five years, the signature poor performance of a poor commodities market. Some economists believe it to be temporary, but others have yet more Draconian predictions for precious metals investing.

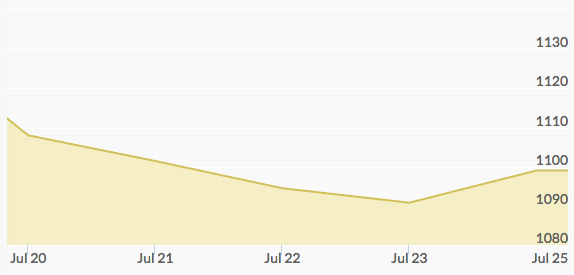

Monday experienced less than an hour of gold trading above the $1,100 threshold. Gold dropped like a rock after the first trading hours and just barely came back up to close out the day at $1,097. Marketwatch claimed that gold fell into a “perfect storm” where less demand coupled with less inflation and less risk in currencies has slashed the price of gold and precious metal commodities. Silver fell by 1.5%.

Tuesday repeated the pattern with greater dramatic flair, ratcheting up to a weekly high of just under $1,105 before plummeting to a weekly low of $1,090. Morgan Stanley thought the climate so unappealing that they released a report claiming that gold could fall as far as $800 per ounce, the lowest price since 2008.

Wednesday saw a period of null growth that kept gold firmly in the basement. Silver prices had a worse day, dropping by half a percentage point overall. Platinum had its worst day of the week, hitting $920 per ounce.

Gold made even more headlines on Thursday by remaining in a slump for ten consecutive days, which CNN reported as headline news for the worst performance of the metal in two decades.

Friday saw stabilization at $1,095 with 125,000 contracts traded in sum. Gold ended the week having dropped by three percentage points overall.