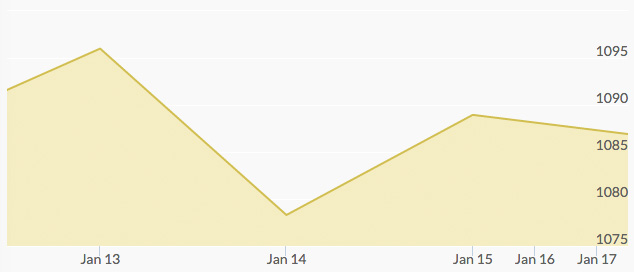

After gold’s rally last week, the yellow metal struggled within a trading range of $1,080 and $1,100 this week. Monday started out the week strong, as investor worries regarding China’s flailing economy spurred traders back to gold as a safe haven fund. After a weakened yuan last week, China shares fell again this week. The aftereffects of the devaluation of the yuan and continuing Saudi Arabia-Iran tensions lent support to the price of gold, reaching $1,095.

Anxieties eased on Tuesday, and China’s stock index was up, thereby bringing gold down. By mid-week, gold was struggling against a strong U.S. stock market and improving European economy, and slipped down to just above $1,080 on Wednesday morning.

The tides turned again for gold by Wednesday afternoon, as a dollar rally faltered and stocks slid. The World Gold Council also reported that central banks had added 55 tons of gold to their reserves during November, an increase of 29 tons since October, which is an implicitly good sign for gold prices. It means there’s less gold on the market, thereby decreasing supply, which raises prices, and also that world leaders increasingly value gold. Furthermore, later in the week the Financial Times reported that gold supply from mining is expected to decrease in the coming years, which would signal higher prices in the market with a decreased supply.

Thursday saw gold retreat from its gains against a strong equity market. The energy sector exhibited signs of strength, while oil prices rebounded from 12-year lows. U.S. stock indexes rose 2% and the dollar lifted, as well. Relatedly, news from the Federal Reserve shows indications that they won’t be as aggressive in continuing interest rate hikes over the year, due to worries about the oil situation. A Reuters poll showed that analysts believe the Fed will raise rates only three times in 2016.