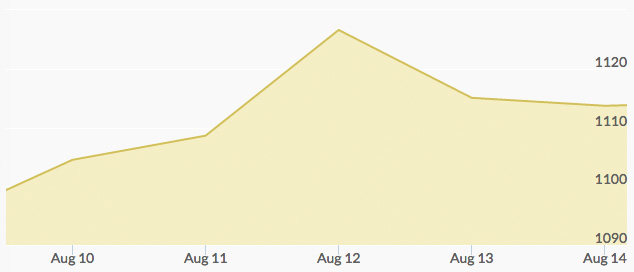

What goes up in the economic world usually comes down, but when one stock goes down, it pushes other investment opportunities up. The relationship between currencies and the price of gold represents one such zero-sum game, a game that currencies have been winning handily through 2015. The beginning of the end may be in sight for the gold bear market, however, as the precious metal climbed above $1,100 per ounce on a steady growth streak through the opening half of August.

Monday would be the high point of the week after gold gained through the previous five consecutive trading days, closing out at nearly $1,125 per ounce. Much of the gains came on the back of the Chinese yuan devaluation, which Yahoo news initially reported as being unable to swing gold. Nervous investors, however, decided to come back to the gold fold as China’s currency tatters at the seams.

Tuesday saw gold dip for the first time in a week, dropping by seven dollars per ounce. Silver prices fell nearly a full one percent, though this news came on the back of the London Silver Market dropping their Silver Fix spot price after over 100 years of operations.

A minor drop overall on Wednesday categorized a trading day without much movement. With only 110,000 contracts for gold futures trading hands, the gold craze appeared to have tempered off. Without currency gains, however, gold remained in the driver’s seat.

Thursday saw gold recover almost all the value lost in the prior two trading days. Like earlier trading sessions, this recovery came on the back of the Shanghai stock market losing big—more than five percent in a single day—and investors looking for a hedge against the yuan’s struggling performance.

Friday closed out the trading week with gold at $1,117, the second consecutive week with gold over $1,100 and a one-month high. With the Fed hike as little as a month away, the conditions appear to be set for a short-term bull gold market with the possibility to extend further if investors aren’t keen on U.S. currency.