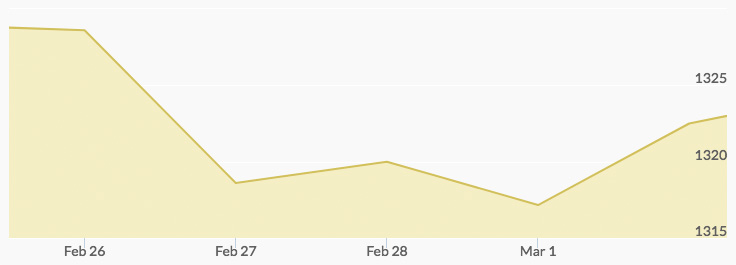

After closing out the previous week at $1,328.66, the yellow metal exploded in pre-market trading Monday to a high of $1,339.65 before opening up at $1,332.32, and then trading up slightly to close at $1,332.38, reported the gold price chart. Tuesday opened with gold prices near to Monday’s close at $1,332.41 but pulled back to end the day at $1,318.49. Wednesday’s open rose to $1,320.23, but the price of gold slipped to $1,317.72 by the close of trading. Thursday’s open pulled back to $1,306.66 but rebounded to close at $1,315.17. On Friday morning, gold prices pushed up $6.70 to $1,321.87, traded in a broad range throughout the day, and then closed up at $1,322.75 for the week.

The week’s trading opened in anticipation of the first meeting of the Federal Reserve Board of Governors under its new chair, Jerome Powell. Mr. Powell presented an upbeat view of the economy, so much so that markets panicked at the prospect of higher-than-expected interest rate hikes in 2018. 1 The Dow fell 299 points (1.2 percent) to close at 25,410; the Nasdaq dropped 91 points (1.2 percent) to end at 7,300; the S&P 500 lost 35 points (1.3 percent) to hit 2,744; and yields on the all-important 10-year Treasury surged to 2.90 percent. 2 Mr. Powell made it clear that he is unfazed by the short-term swings of financial markets, stating that while the markets are important for businesses raising capital, his focus is on the economy.

The news of the week took a dramatic turn on Thursday when President Trump announced sweeping new tariffs on imports of steel and aluminum. The announcement was in fact an unofficial precursor, with the formal announcement set to be made this week, but the administration made clear the plan is to impose a 25 percent duty on steel imports and 10 percent on aluminum imports. As of Monday, Trump said he would not back down on the planned tariffs, despite backlash from fellow Republicans. 3 As the world’s largest steel importer, the move by the U.S. is likely to impact many countries around the world, in particular our top steel suppliers: Canada (16 percent), Brazil (13 percent), South Korea (10 percent), Mexico (9 percent), and Russia (9 percent). 4 Canada is also our top supplier of imported aluminum. 5 The move sparked fears of a trade war and sent equities markets tumbling, 1.7 percent for the Dow and 1.3 percent for the S&P.