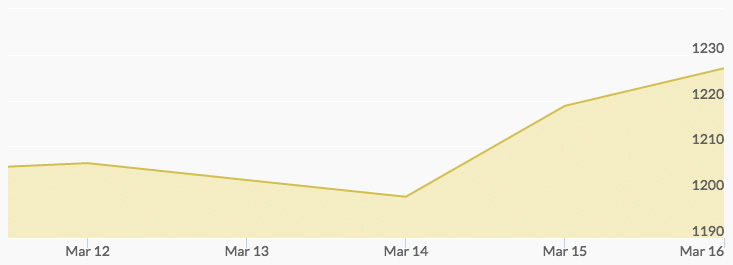

The beginning of last week in the markets was largely shaped by investor and speculator anticipation of the Federal Reserve’s announcement of whether or not they would raise interest rates again. Despite anxious market sentiment, the price of gold chart reported that the yellow metal was selling above the closely watched $1,200 mark on Monday. Gold prices dipped just below the $1,200 mark by the close of Tuesday, but after-hours trading brought some new buying and upward pressure.

Trading momentum picked up on Wednesday after the release of the Fed’s announcement to raise interest rates, with the price of gold closing at $1,219. By the opening bell on Thursday, gold prices were at $1,228.24. Profit taking and short covering further fueled the market on Friday, and gold prices were up by nearly $25 at the close of the week.

While the strong performance of precious metals after the interest rate increase surprised some, many analysts asserted that the market had properly read early FOMC signals and priced the hike in. In fact, long-term gold investors do not view the current rate hikes as a threat to yields. With confirmation of a 2 percent or greater inflation level, the forecast of a 3 percent target for Fed rates by 2019 means that savers continue to loose net value in their paper assets. 1

The other factor helping gold prices during the week was a weakening dollar relative to other currencies. Market observers are closely watching the U.S. Dollar Index as it hovers around 100. 2 As the market digests the latest government reports and FOMC minutes, the coming week will be sensitive to the direction of the dollar. Historically, long-term buyers have used the strong dollar as a chance to add to their holdings at a lower price. Likewise, a weaker dollar will see some profit taking and speculators moving to cover their positions as the price of gold moves upward.

The coming week has few economic reports expected, but there will be several closely watched speeches from Federal Reserve officials, including Chairwoman Janet Yellen and the presidents of the Chicago, New York, Minneapolis and Dallas Fed. 3

The key to many traders is looking to see if there is sufficient support to keep the price of gold above that pivotal $1,200 mark.