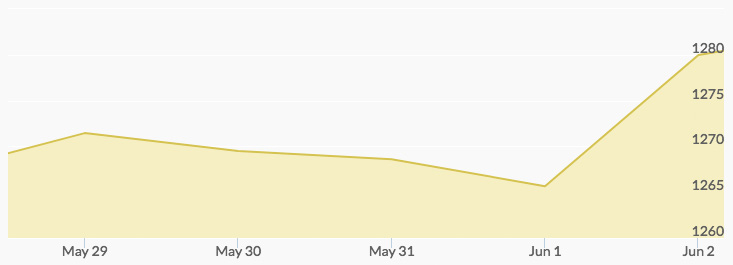

Spot gold prices had a good run last week. The yellow metal opened at $1,265.84 an ounce on Monday and closed at $1,267.13. By Tuesday morning, the spot price of gold pulled back to $1,263.79, and light trading shaved off just under two dollars to close at $1,261.95. That and more was recovered after the markets closed, producing a Wednesday opening quote of $1,265.35. The momentum continued, creating a close of $1,268.82. Gold prices dipped on Thursday, with an opening of $1,264.82 and close of $1,265.87. Friday opened strong at $1,275.11 and closed more than $13 up for the week at $1,279.18 an ounce.

Multiple factors influenced the strong performance of gold. The failure of oil to see any major rebound after production cut agreements and the weaker-than-expected U.S. jobs data pushed the U.S. dollar to recent lows, adding strength to gold’s position in the market. May trading showed significant support for gold, and some analysts are seeing the potential for more gold price increases in the coming weeks.

Internationally, the general election in the UK on June 8 will provide some insight into the Brexit negotiations and, in turn, the trend in euro prices. At home, the U.S. ISM Non-Manufacturing Index data on Monday will be watched more closely than normal as a gauge of the strength of the U.S. economy. 1