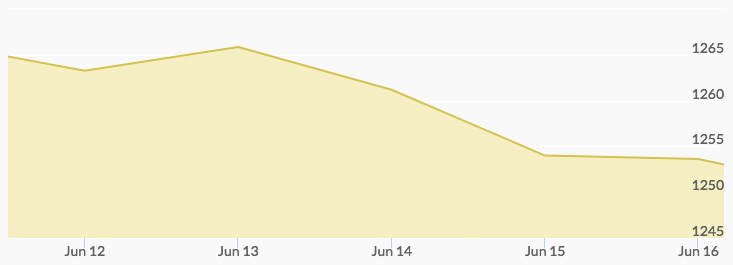

The gold market opened on Monday at $1,267.36, and sellers and buyers matched each other in a narrow range of quotes before the close of $1,265.51. Aftermarket activity resulted in a lower opening, shaving off three dollars to $1,262.01. More buying improved this price, rising steadily to $1,267.16 before closing pennies lower at $1,266.42. Another strong opening on Wednesday at $1,275.38 was followed shortly after by the high of the week, $1,277.79. However, news of the Fed minutes and quarter percentage point bump in the interest rate it charges banks caused gold prices to pull back to $1,263.07. 1 The price of gold stayed slightly above $1,250 for the remainder of the week, hitting $1,254 on Thursday and closing at 1,253.63 on Friday.

While the week marked a bearish reaction to the interest rate increase, the dip in price was relatively minor compared to previous such announcements. When interest rates increase, the markets expect to see movement away from the yellow metal since it does not pay dividends or generate interest income. However, gold and precious metals have continued to buck that normal trend, and prices have shown an intriguing resilience. The gold price history chart indicates that gold’s price is still holding at the 200-day moving average of $1,250.

In fact, there is growing sentiment that Fed Chairman Janet Yellen is attempting a bit more bully pulpit messaging even in the face of disappointing U.S. economic news. Concerns about the growing possibility of a recession are driving some market hesitancy, especially in light of the week’s disappointing data on retail sales and inflation. That is the fourth consecutive month retails sales have disappointed the market, and others noted that 10-year Treasury yields are now holding at the lowest level since the November elections.

Data on existing U.S. home sales is expected on Wednesday. As more data comes out that fails to support the Fed’s optimistic stance, the realities of the market could well send more buying signals for gold to the risk-averse segment of investors.