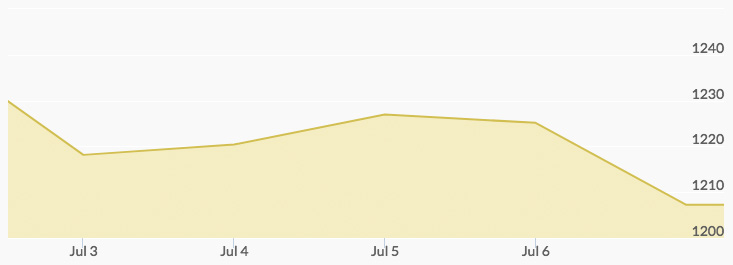

Gold prices opened at $1,228.12 on Monday, and a period of selling took them to $1,220.10 before buying brought them back up to $1,222.47 by the close. While that buying continued in afterhours trading, selling just before the Tuesday open on the global markets saw the bid hit $1,222.74. Light activity did little to change that number until a small jump in trading just before closing took the price to $1,225.04. U.S. markets were closed on Tuesday for the Fourth of July holiday. Wednesday’s opening price of $1,220.34 reflected afterhours selling, but bargain hunters stepped in to move the close for the day to $1,227.59. Thursday brought an initial quote of $1,225.71 and a close of $1,225.04. Aftermarket activity resulted in a Friday opening of $1,215.24. The day closed with the price of gold at $1,213.09.

Gold and silver traders suspect surges in afterhours trading may be behind recent swings in precious metals prices. Last Thursday’s pullback in silver prices was related to an instantaneous trade of more than 25 million ounces around 7 a.m. in Singapore. This followed the movement last week that saw 1.8 million ounces of gold traded in New York in mere seconds at 4 a.m.

Many market participants believe some of these unusually large trades were made in error. Technical traders assert that the effect on their analysis is quite damaging. Bill O’Neill, a partner at Logic Advisors notes, ‘This type of activity is not good for a fair playing field.’ Whether such trades are done on purpose or by accident, they affect key buying and selling signals. For example, the gold price history chart indicates the yellow metal dipped below the 200-day moving average, and some traders think programmed selling may be to blame.

Long-term traders are noting this may be an excellent opportunity to average down on current holdings as the market returns to its expected pricing on both gold and silver. In fact, some traders are adding significant new positions in futures contracts to play the current leverage.

Two pieces of economic news will be watched closely this week. On Thursday, China will provide trade data that will be analyzed for indications of economic conditions there and globally. On Friday, the U.S. Consumer Price Index data will offer guidance on the rate of inflation, a factor that will have major influence on any further actions by the Fed.