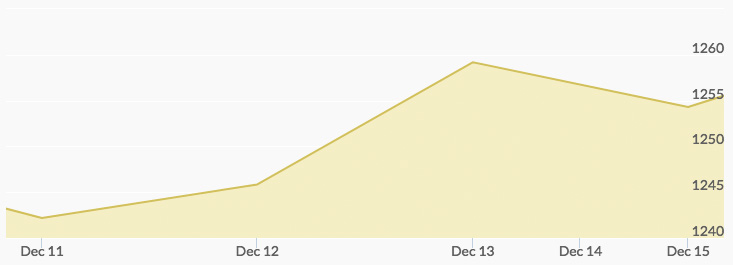

The gold price history chart reported that last Monday opened at $1,247.58 and continued to pullback to close the day out at $1,242.97. Tuesday opened at the low for the week of $1,237.23, but that was the end of the pullback, as the day closed up at $1,243.41. Wednesday’s open continued the rally, starting the day up at $1,245.95 and surging to close out at $1,254.12. Thursday slipped ever so slightly to open at $1,253.43 and closed up at $1,253.54 after trading in a tight range all day. Friday opened up at $1,254.75 and pushed up to $1,256.44 for nearly a $10 gain on the week.

Markets opened on Monday with the news that the first day of Bitcoin futures trading had resulted in a surge of 19 percent in the price of the futures contract and two trading halts due to overly rapid price movements, which only served to add froth to the already inflated market for the cryptocurrency. 1 Market observers have pointed out that the pure cash settlement feature of the futures, rather than the commodity settlement that is a key element to the stability of most futures contracts, brings to mind the cash settlement of another famous future: the Dutch tulip bulb mania of 1637. 2 3

By midweek, the markets had shifted focus to the quarterly meeting of the Federal Reserve, at which the policy committee raised its target Fed Funds rate to 1.25-1.50 percent and maintained its forecast for three more rate hikes in 2018. 4 Popular wisdom states that higher interest rates push down gold prices, but an analysis of the historical data does not support this thesis and recent history has shown the opposite. 5

The week closed out on the news that Brexit negotiations are not going well. The atypical unity among the 27 remaining European Union countries that characterized discussions over the first six months of the talks is showing signs of breaking down, a dynamic that promises to make already challenging talks even more difficult. If the UK’s exit from the EU is mishandled, the results could have a material impact on the pound and dollar rates, a key benchmark for the dollar and therefore for precious metals. 6