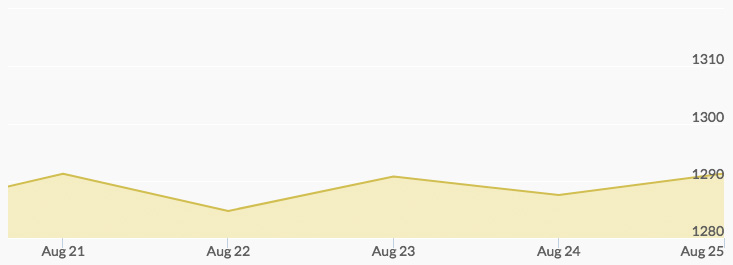

The price of gold saw a strong opening on Monday of $1,292.04. Bidding was up nearly a dollar by noon, but light selling produced a Monday closing quote of $1,290.76. The gold price chart reported a Tuesday opening of $1,285.93, which light selling took to $1,284.02 by the close. However, steady buying in the aftermarket took the price to $1,289 before the opening bid of $1,287.42 on Wednesday morning. More support moved that price to a close for the day of $1,290.78. The Thursday opening came in just pennies off at $1,289.17 and light trading during the day took the close to $1,285.98. Aftermarket selling produced a lower opening of $1,280.87 on Friday, but steady support took the price back to a close for the week of $1,291.20, off less than a dollar for the five days of trading.

The market showed support last week for the yellow metal despite a minor tapering off of purchases while participants awaited the Fed symposium and speeches in Jackson Hole, Wyoming. 1 This reflected long-term interest in gold while short-term speculators continued to wait and watch for more definitive market indicators.

However, the early results from that meeting and the speeches from Janet Yellen and Mario Draghi indicate a continued dovish position from the Fed relative to further interest rate increases. That reading caused early additions to bullish positions by major players, and the step-up in volume of trading showed a number of funds were net long in both gold and silver. Some early indications are that gold will hit a high for 2017 in the coming months. The developing hurricane in the Gulf, with its potential impact on energy costs, may also be a market factor.

This week’s U.S. Employment report on Friday will be important for moving short-term sentiments. The details of the non-farm data and several other releases during the week may affect views on the strength of the labor market and inflation.