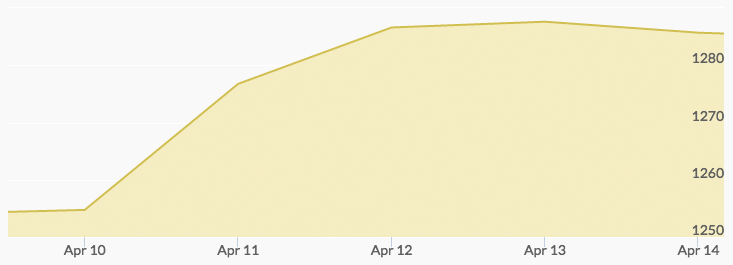

Following President Trump’s comments about an overly strong U.S. dollar, gold led the way in an outstanding week for precious metals. The Monday opening of $1,250 fast became a fleeting memory as steady buying brought price increases until Friday’s close at $1,287.65. As the volume increased from Monday’s close of $1,256.09, the Tuesday high was not hit until closing, with a solid two-day increase of $20 at $1,276.18, reported the spot gold price chart. Wednesday saw some early profit taking around a narrow range, but continued buying pushed the close to an impressive five-month high of $1,287.23. This strong showing was followed on Thursday and Friday with some profit taking in a narrow range due to indications of a slightly recovering dollar. However, new gold buyers were quick to pick up offered sales. The short Easter week brought the market a breather at $1,287.65 after a hefty $37 increase in the price of gold. 1

This week’s strength seemed to spur a number of gold buyers off the sidelines, as global economic and political issues reentered the headlines. For example, it was reported that a leading portfolio manager at Black Rock was putting his funds into safe haven investments. The manager of the $40 billion fund, Russ Koesterich, noted, “There is a little political risk creeping back into investors’ awareness…” in explaining his reallocation to gold and Treasuries. Other major speculators were also seen as increasing their long positions in gold and silver. 2

The French economy is one of those “known unknowns” that is getting closer scrutiny, especially with the coming election. With its economy called by some “the sick man of Europe,” France is coming to one of the most important elections of the century, and the potential outcome on April 23 has many holding their breath. 3

The current situation is only one of several testing investor appetite for risk, and it will only take one more global crisis to increase the rush to safe haven assets. Other than China’s GDP data, there is limited economic and political news scheduled for the coming week. Barring any U.S. political action or further activity in Syria, the market will be closely watching the follow-up to last week’s heavy gold buying.