As Donald Trump’s transition team starts laying the foundations for a second term, markets are paying close attention. Nearly every asset class has reacted to the expectations of a disruptive administration. The key question is how markets will perform over the next four years as Trump implements bold economic and geopolitical policies.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisors Todd Graf and Tim Murphy discuss gold’s historical performance under Trump’s first presidency, the fundamentals behind the metal’s rally, and what’s unlikely to change over the next few years.

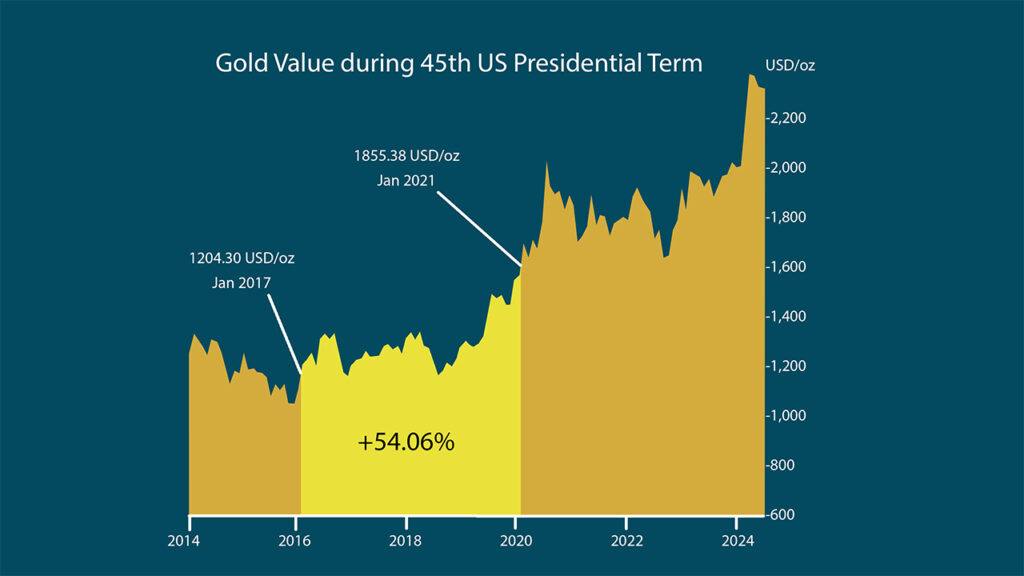

Gold’s Performance During Trump’s First Term

Gold price gains during Trump’s first presidency.

Investors aren’t completely blind to projecting gold’s performance under the Trump administration. Looking at the precious metal’s trajectory throughout the first term can shed some light on what can be expected moving forward. Right after the heated 2016 election, gold prices fell between 9% and 11%. This dip quickly reversed into a sustained rally throughout Trump’s tenure. At the end of those four years, gold prices had risen an astounding 54%, nearly keeping pace with the stock market’s record-setting gain of 67.8%.

Many experts are drawing parallels between this historical trend and gold’s current movements. In the frenzy of the post-election market, gold has retreated more than 8% from an all-time high of $2,786.44 an ounce. However, the metal has already regained most of those losses on the back of deteriorating geopolitical stability and rising economic uncertainty. Additionally, experts are maintaining their already higher gold price predictions for 2025 and beyond.

Reasons to Own Physical Gold

The spot price charts aren’t the only indicator suggesting tailwinds for gold. Short-term movements might be influenced by characteristic post-election volatility, but the broader story is still dictated by more foundational economic and geopolitical issues.

Recently, the US national debt pierced $36 trillion! At the same time, interest payments on the national debt have surged to over $1 trillion per year, making it harder for the country to manage its excessive borrowing. This has triggered a global de-dollarization push as countries seek to limit their reliance on the debt-burdened greenback.

“The reasons to own physical gold right now are more serious than ever. The problems with our debt and the dollar aren’t going away.”

Fiscal Changes NOT Incoming

Some of Trump’s cabinet picks have generated harsh opposition from both sides of the aisle. One of the most troubling from an economic standpoint is Scott Bessent who has been tapped as Treasury Secretary. Unlike many of the next admins’ picks, Bessent seems to represent the old guard of fiscal policies that have led the country to exploding debt and irresponsible spending. For example, he was the Chief Investment Officer for the Soros Fund Management.

That’s not the only bump in the road to much-needed economic healing investors have suffered. Earlier this month, Trump floated the idea of ousting Federal Reserve Chair Jerome Powell–the architect behind the government’s years-high interest rates–who claimed such an action was “not permitted under the law.” This collision comes as inflation numbers creep higher, indicating tough economic headwinds.

A lot of the same characters that got us into this situation are still going to be in charge of everything.–

The Golden Lining

With a decades-long debt crisis and an unchanging financial elite, the country’s economic challenges are unlikely to disappear over the next four years. One of the sole benefits of this trajectory is a positive outlook for gold prices. Following a steep and sustained climb throughout most of 2024, the yellow metal entered a slight correction which some experts are calling just a blip before the next rally.

If you’re able to add to your holdings, this current slump could be an opportunity to buy the dip as many big-name banks are telling investors. Investors not in a position to scoop up more gold should consider holding the line to avoid the risk of selling before a reversal to the upside. Have any questions about the current market or investing in precious metals? The Precious Metals Advisors at Scottsdale Bullion & Coin would be happy to help. Give us a call toll-free at 1-888-812-9892 or using our live chat function.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields