“For many, many months [gold] has been trying to break out, and today it’s broken out. Keep a close eye out this week. If we finish strong, if the levels hold, it could be off to the races: $3,000 gold.”— Tim Murphy, Scottsdale Bullion & Coin Precious Metals Advisor

As of Wednesday, November 10, 2021, the CPI numbers are in, and they are the highest they’ve been in a long time.

The Consumer Price Index (CPI) was up 6.2% this October compared to last October, the largest increase since December 1990. Core CPI was up 4.6% year-over-year, the largest increase since August 1991.

What does all this mean? Inflation is clearing rising, as we have been talking about in previous videos, and now we’re seeing some MAJOR movement for gold and silver prices.

Watch the video above to hear from Precious Metals Advisors Joe Elkjer and Tim Murphy about why now is a very exciting time for gold and silver.

Gold Moving Toward $3,000/Oz?

CPI hit a three-decade high in October.

Let’s not mince those words.

With all the questionable reassurances coming from the Fed around inflation, which we’ve discussed before, this news proves what we’ve been saying all along: Inflation is rising and it’s not just “temporary.”

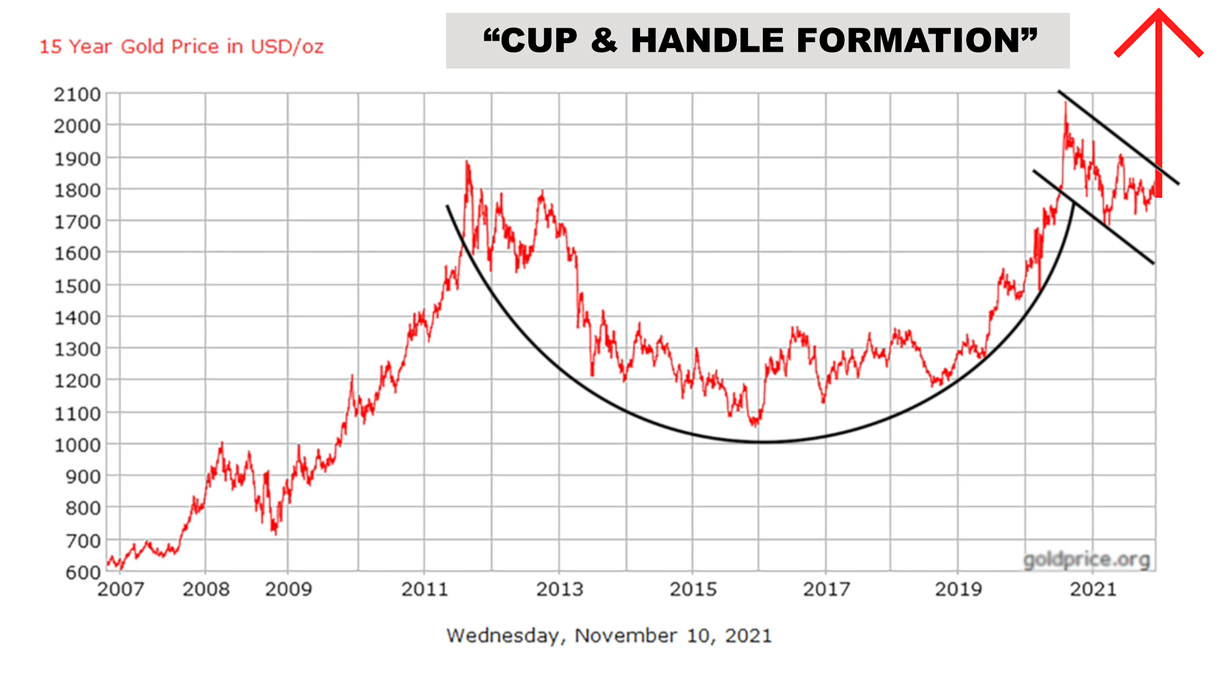

Recently, we’ve seen gold hit a five-month high and break through the $1,840/oz barrier. Let’s take a look at what’s going on in the charts. If this pattern holds, we could be seeing $3,000/oz gold soon enough.

Gold hit a high of $1,896 in 2011 and then broke through to another high of $2,058 in 2020 ten years later. If you look at the formation of these numbers on the chart, it’s what we call a “cup and handle.”

If prices hold steady for the next week or so, we think we could be seeing gold break through $3,000/oz.

Don’t Wait…Invest in Gold Now

If you haven’t already invested in physical gold and silver, it’s not too late to take advantage of the price increases we’ll likely be seeing very soon.