“We make money the old fashioned way. We print it.”— Art Rolnick, Chief Economist for the Minneapolis Federal Reserve Bank

It’s not just increasingly more banks warning that the market is in a bubble and extremely elevated asset prices are risking a broader market crash: moments ago, the Fed itself has issued the same warning. In the 85-page Federal Reserve Semi-annual Financial Stability Report, published moments after the market close, the Fed warned that as Bloomberg put it, “prices of risky assets keep rising, making them more susceptible to perilous crashes if the economy takes a turn for the worse” adding that “asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall.”

For years we have been reporting about the price manipulation of virtually all markets with stocks and bonds being pushed artificially higher and gold, silver and interest rates being artificially held down. But, as debt and inflation continue to rise, managing market prices will become ever more so difficult. A perfect example is the price manipulation of gold and silver. Even with rising inflation and extremely bullish fundamentals (low supplies and strong demand – at all levels), gold and silver have been trading sideways to lower for 15 months. Every time the metals staged a decent rally, they got knocked down by the bullion banks and “powers to be”. However, since Friday, gold has risen close to $100oz, and that is in the face of massive selling by the bullion banks to the tune of approximately 80,000 futures contracts. Normally selling of this huge magnitude would cause gold to drop $100oz, so maybe the strong physical market has finally caused the bullion banks to hit a wall?

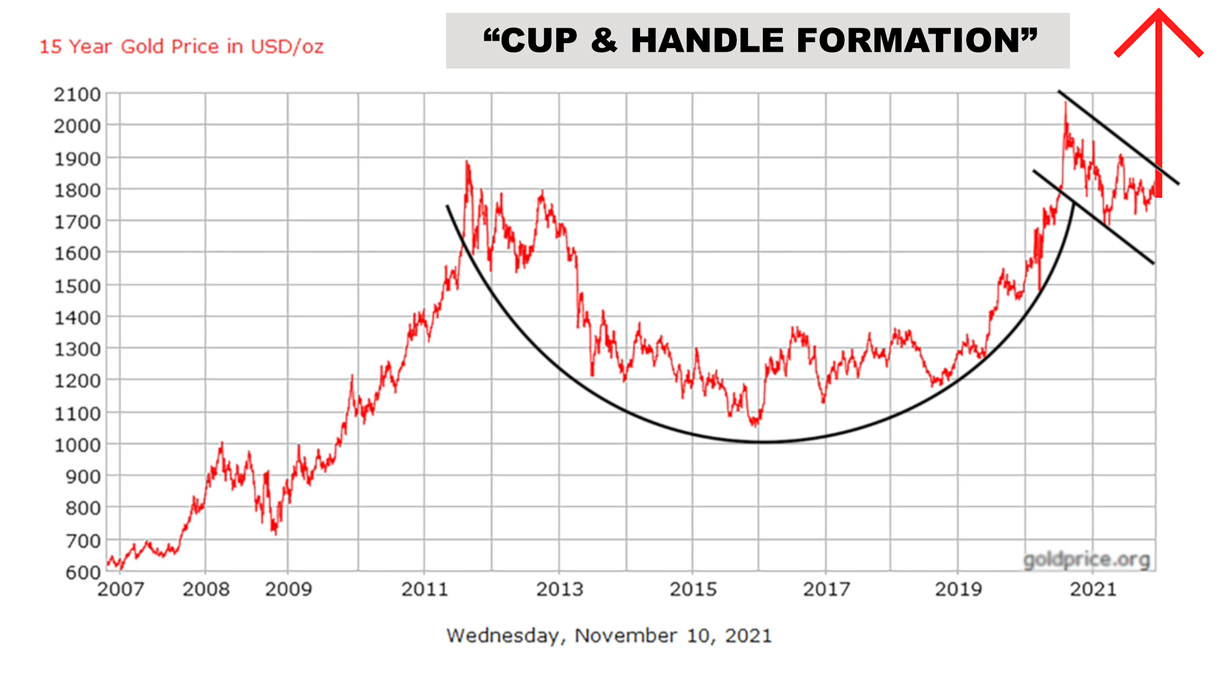

The gold chart below reveals a ten year “cup & handle” formation. This formation is regarded as one of the most powerful technical patterns known to man and this morning, as inflation was yet again reported higher, gold moved higher as well and “broke out” above the key resistance of $1,840oz. If gold can hold above and even pull away from $1,840oz over the next several days or maybe a week, the measured move would put gold eventually at $3,000oz, possibly as early as next year. Of course, the bullion banks will not go down without a fight, but whether gold explodes higher this week, next week, next month or next year, a much higher gold price is in the cards. The Fed has to allow inflation to rise in order to counter the out-of-control debt. (The only other option being a complete default of the debt). The average used car is now costing $28,000 and apartment rent is up 15% across the country. And the all-important energy prices are soaring too, which has the public feeling the pain and starting to take notice.

Relative to how much money has been printed and relative to the rising inflation levels, gold and silver are cheap, especially silver. Gold is real money and ultimately will prove to be the only viable form of protection against higher inflation, a weaker dollar and a stagnant economy. I implore you to own sufficient physical gold and silver while prices are still reasonable AND supplies are still available. Trillions of dollars printed out of thin air will have consequences and contrary to popular opinion, the ever-riskier stock market is not infallible. I implore you to do whatever necessary to protect your wealth and insure a healthy financial future. Also, please encourage anyone that you care about to do the same. Soon, interest rates will take their natural course and rise. And it is higher interest rates that will prove to be the kiss of death for the stock market, bond market and real estate market. Mark my words, as the “cup & handle” breakout gains momentum, only those properly diversified will be assured of a good night’s sleep.