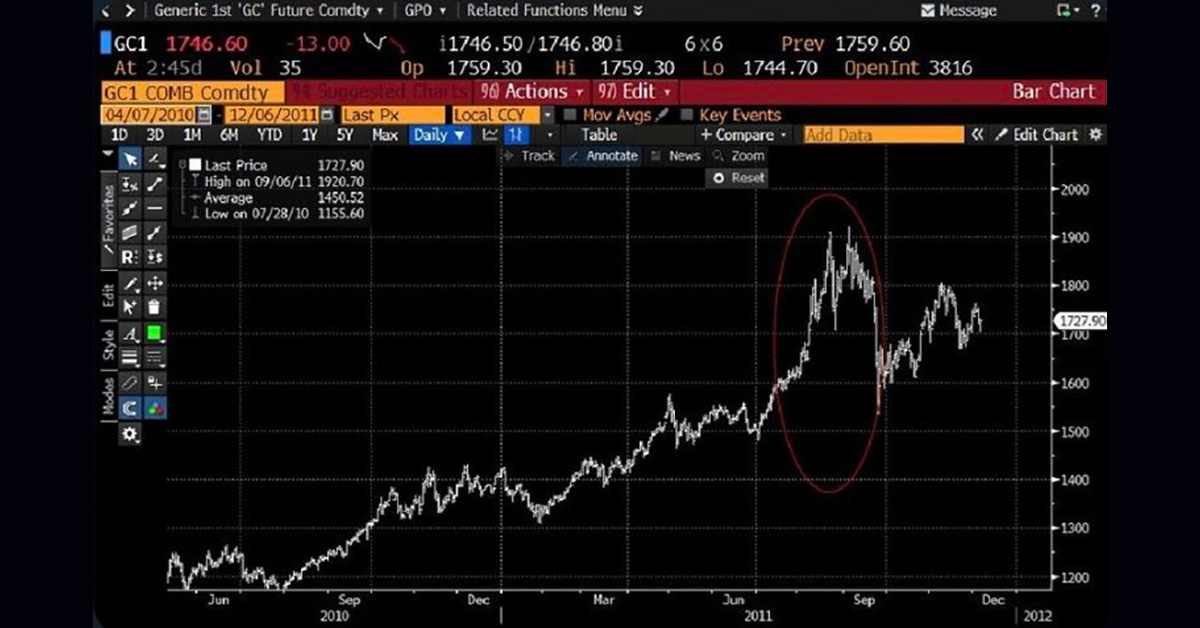

“Back in 2011, #Gold rallied hard as the debt limit battle got this intense,” Tweeted Michael Burry1, the contrarian investor whose billion-dollar bet against the U.S. housing bubble was made famous in the movie “The Big Short” and who inadvertently set off the GameStop short squeeze that triggered the Silver Squeeze.

De-ja Vu?

Worse. Waaay worse. But we’ll let Burry tell you…

“So, @federalreserve, are you lying to us, or are you lying to us?”2 Because Fed Chairman Jerome Powell recently cited one of the central bank’s more flattering inflation gauges. -> Recall the Fed’s been predicting inflation will be “transitory.” For nearly a year now.

“This is the knife’s edge, BECAUSE we are at 5:1. It may go to 100:1. Or become -5:-1. But parabolas don’t resolve sideways.” Because the stock market’s so overvalued, it’s been rising $5 for every $1 invested in it, according to a research report Burry cited.

***Burry, notorious for Tweeting & deleting, has since removed these.***

“Heady Days for Gold”

Then there’s his Tweet about gold and the debt ceiling…

The difference now? The national debt is 2x higher than in 2011: $28 trillion now versus $14 trillion then.

So… what does that mean for these “heady days for gold”? Should the precious metal rally again?

Are you really going to wait and see?

See how to secure your portfolio with gold and silver now. Order your FREE Precious Metals Investment Guide. Before bargain gold prices vanish with Burry’s sage Tweet.